Understanding the Long Straddle Strategy in Options Trading

What is a Long Straddle?

Options straddles can be split into two different configurations, a long straddle option and a short straddle option. This guide explains the long straddle option strategy and what you need to know if you wanted to employ this strategy.

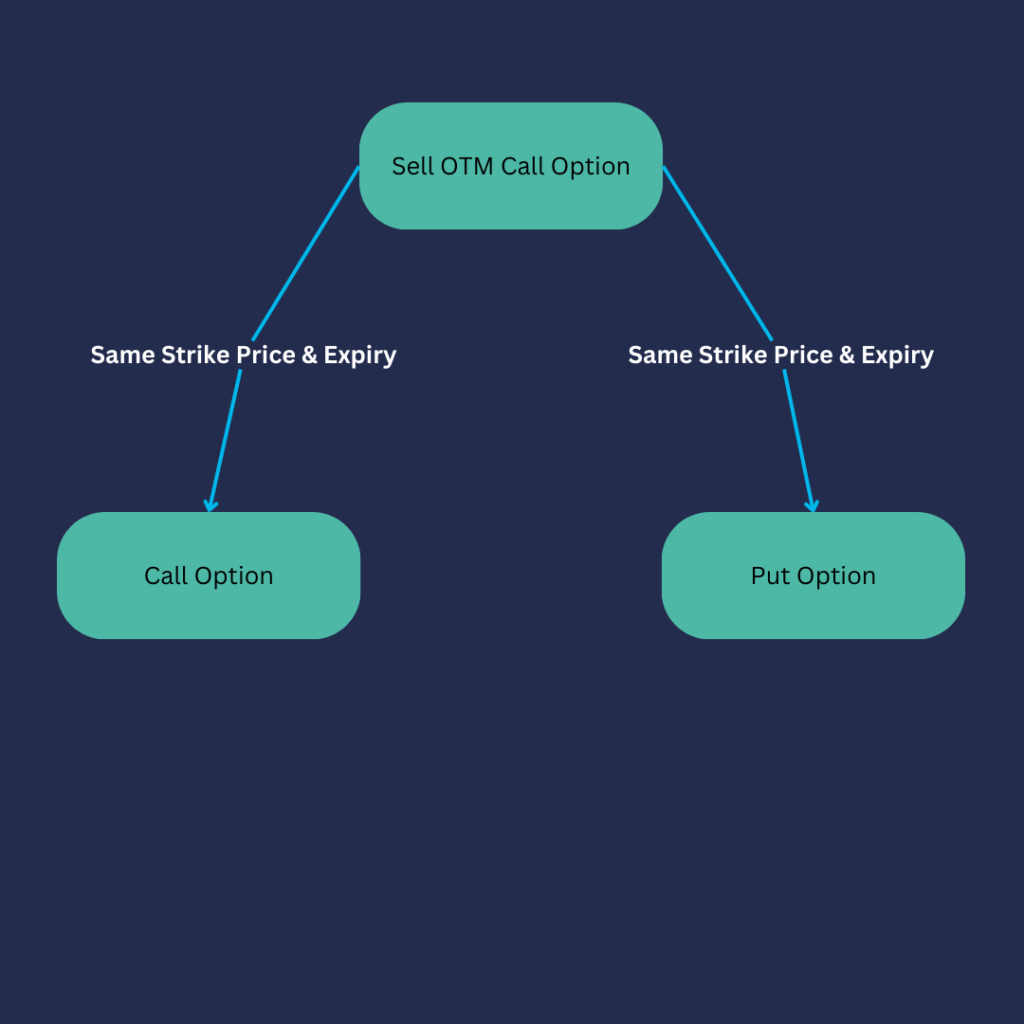

The long straddle strategy is a powerful tool in options trading. It involves purchasing a call and a put option simultaneously, both with the same strike price and expiration date. This non-directional strategy thrives on market volatility, allowing traders to profit regardless of whether the underlying asset’s price rises or falls.

Navigating the vast landscape of options trading can seem daunting, but the long straddle strategy offers an enticing opportunity for investors. Understanding and employing this strategy can pave the way for potential profits in most market environments.

What is the Long Straddle Strategy?

A long straddle is a strategy in which you buy a call option and a put option, typically at the money, both with the same strike price and expiration. Together, they produce a position that will profit if the stock makes a big move either up or down.

Long Straddle Strategy has more success in volatile markets with prices moving sharply in either direction. The best time to buy a long straddle is during quiet trading periods as you will pay less for the two options as their implied volatility will be lower, but with the expectation that more volatile trading conditions will happen in the future (for example due to an increase in geopolitical tensions).

By having long positions in both call and put options, a long straddle can achieve potential profits regardless of which way the underlying asset price moves, provided the move is strong enough to cover the cost of the options premiums. Given the way that the long straddle is set up, only one of the options will have intrinsic value when it expires, but the investor hopes that the value of that option will be enough to earn a profit on the entire position. This allows for unlimited profit with limited, pre-defined risk.

Breakdown of the Long Straddle Strategy

Let’s delve deeper into the components that constitute the long straddle strategy:

Call Option: The buyer has the right to purchase the underlying asset at a predetermined price, known as the strike price before the contract expires.

Put Option: The buyer has the right to sell the underlying asset at the strike price before the expiration date.

By acquiring these options concurrently, you establish a position that profits from large price movements in either direction.

Executing the Long Straddle Strategy

The execution of the long straddle strategy involves two key steps:

Buy a Call Option: The first step is to purchase a call option. This option grants the right to buy the underlying asset at the strike price before the expiration date.

Buy a Put Option: Simultaneously, a put option is purchased, which grants the right to sell the underlying asset at the strike price before the contract expires.

By combining these steps, you can profit from significant price fluctuations, irrespective of their direction.

Long Straddle Option Example

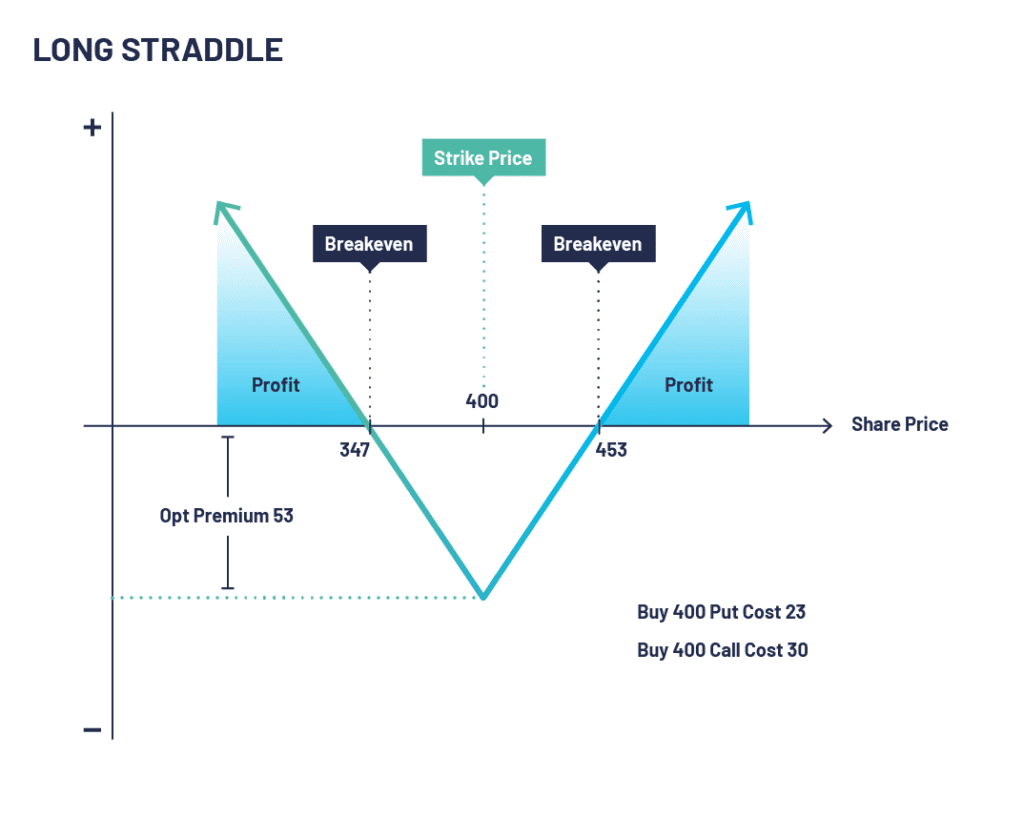

Let’s look at an example of buying straddle options in XYZ Plc with a strike price of 400 and paying a total of 53 in premium for the two options. The worst-case scenario here is if the stock doesn’t move and remains at 400 on expiry meaning the options expire worthless and you lose the 53 per that you paid for the strategy.

On the other hand, if the stock moves sharply in either direction to say, 290 or 510 then you will make a profit of 57 (if the market is at 290) or 57 (if the market is at 510).

Profiting from the Long Straddle Strategy

The long straddle strategy is most profitable when the underlying asset experiences considerable price movement. This could be due to earnings announcements, economic data releases, or other market news. The larger the price swing, the higher the potential profit.

Risks and Considerations

While the long straddle strategy can yield profits, it is not without risks. The total investment is the sum of the premiums paid for both options. If the underlying asset’s price doesn’t shift significantly, the strategy could result in a loss equivalent to the combined premiums.

How does Volatility Affect a Long Straddle?

Volatility plays a crucial role in the long straddle strategy. The strategy thrives on volatility, as larger price swings can lead to greater profits. It’s worth noting that both implied and historical volatility can significantly influence the outcome of a long straddle trade.

Implied Volatility and Long Straddle

Implied volatility reflects the market’s expected future volatility of an underlying asset. Higher implied volatility increases the cost of options, as the market anticipates larger price swings. Consequently, when you initiate a long straddle, higher implied volatility can inflate the premium costs, requiring a greater price movement to reach profitability.

Long Straddle Summary

The long straddle strategy displays the flexibility and potential profitability of options trading. By simultaneously buying a call and a put option, traders can profit from significant price movements in either direction, making it a versatile strategy in volatile markets.

However, as with all trading strategies, understanding the intricacies of the long straddle is paramount. Attention to factors like volatility, strategic adjustments, and risk management can help maximise profitability and minimise potential losses.

Embracing the long straddle strategy can be a step towards diversifying your trading strategies and potentially unlocking significant profits in the dynamic world of options trading.

CONFIGURATION:

- Buy a put with a strike price (typically at the money)

- Buy a call with the same strike price as the put

- Both options must have the same expiry date

OUTLOOK:

- Anticipates high volatility – You think a move is coming but are not sure which way (For example, you expect a company’s earnings to be materially different than consensus. Target: The underlying price moves strongly in either direction.

TARGET:

- The underlying price moves strongly in either direction

PROS OF THE LONG STRADDLE:

- Defined risk strategy

- Can benefit from a strong move in either direction

CONS OF THE LONG STRADDLE:

- High-time decay in a neutral market

- Premiums can be very high, especially in a volatile market

Long Straddle FAQs

What is a long straddle?

A long straddle is an options trading strategy where an investor simultaneously buys a call option and a put option on the same underlying asset, with the same strike price and expiration date.

How does a long straddle work?

With a long straddle, the investor profits from significant price movements in either direction. If the price of the underlying asset increases, the call option will generate profit, while a decrease in price will result in profit from the put option.

What is the goal of a long straddle strategy?

The goal of a long straddle strategy is to take advantage of volatility or a significant price swing in the underlying asset. The strategy can be profitable if the price moves enough in either direction to cover the premiums paid for both options.

When is a long straddle strategy suitable?

A long straddle strategy is typically used when an investor expects a substantial price movement in the underlying asset but is uncertain about the direction of the movement. It can be employed during periods of anticipated market volatility or around significant news events.

What are the risks associated with a long straddle?

The main risk of a long straddle strategy is the potential loss of the premiums paid for both the call and put options if the price of the underlying asset remains relatively stable. Additionally, time decay will erode the value of the options over time.

How is the profit determined in a long straddle?

The profit from a long straddle is determined by the difference between the market price of the underlying asset at expiration and the strike price, minus the premiums paid for both the call and put options.

What is the breakeven point for a long straddle?

The breakeven point for a long straddle is reached when the market price of the underlying asset at expiration equals the sum of the strike price and the total premiums paid for the call and put options.

Can a long straddle result in unlimited profits?

Yes, a long straddle has the potential for unlimited profits if the price of the underlying asset experiences a significant and sustained move in either direction. In this case the profits from the winning option will heavily outweigh the loss on the losing option.

How can an investor manage risk in a long straddle strategy?

To manage risk in a long straddle strategy, an investor can set stop-loss orders to limit potential losses if the price of the underlying asset does not move as anticipated. Alternatively, they can close out one of the options if it becomes clear that the price is trending in a specific direction.

Are there any alternatives to a long straddle strategy?

Yes, there are alternative options strategies that investors can consider. Some alternatives include the long strangle, which involves buying out-of-the-money call and put options, and the vertical spread, which limits potential profit but also reduces risk by using options with different strike prices.