Sell Iron Condor

Sell Iron Condor

The iron condor consists of four options: two calls and two puts. A simple way of looking at an iron condor is a position consisting of selling a call spread and a selling a put spread. All four legs of the strategy will have the same expiration date.

The iron condor is designed to profit in two ways, if the market were to trade sideways and the underlying expires between the sold legs of your strategy all options expire worthless and the credit received, being your maximum profit, is kept. The second is from a decline in implied volatility levels, in which case the options may also lose value meaning you can buy back the short condor for less than you sold it for.

This is a neutral strategy that benefits from a minimal movement in the underlying as well as implied volatility levels decreasing.

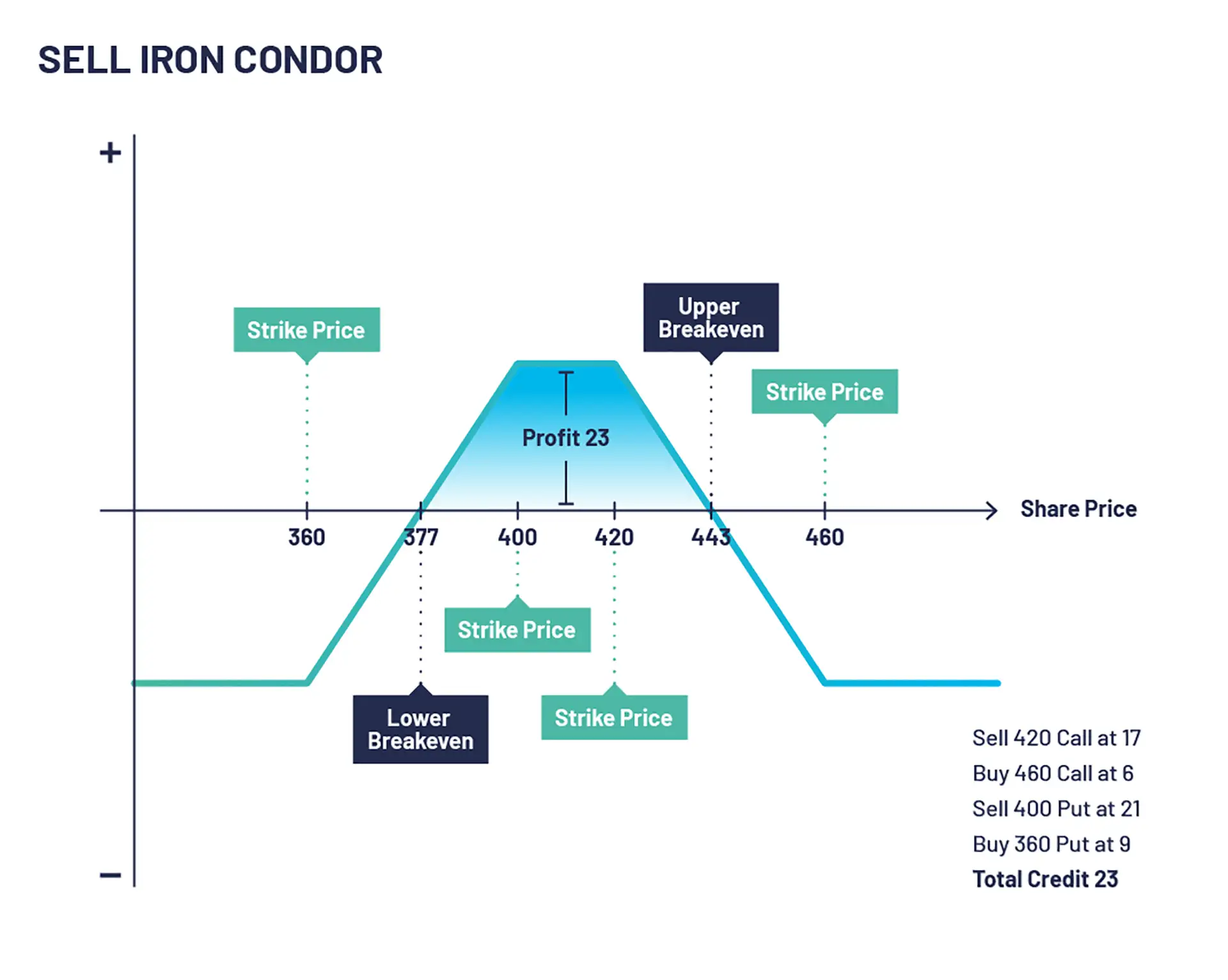

SELL IRON CONDOR EXAMPLE

Let’s look at selling an iron condor example. XYZ is trading at 412.

An options trader executes selling a call spread and selling a put spread. All four legs of the strategy will have the same expiration date.

Sell Call Spread

Sells a 420 call at 17 and buys a 460 call at 6. The net credit received and maximum profit on this trade is 11 (17-6)

Sell Put Spread

Sells a 400 put at 21 and buys a 360 put at 9. The net credit received and maximum profit on this trade is 12 (21-9)

The net credit received and maximum profit is 23 (11+12)

If XYZ PLC stock is between the 420 call and 400 put on expiry of the options the maximum profit on this trade is realised. If XYZ PLC stock rises and is trading above 460 on expiry the maximum loss on this trade is realised. If XYZ PLC stock falls and is trading below 360 on expiry of the options the maximum loss on this trade is realised.

SELL IRON CONDOR SUMMARY

CONFIGURATION:

- Sell a call option

- Buy a call option with higher strike

- Sell a put option

- Buy a put option with a lower strike

- All options to have the same expiry

OUTLOOK:

- Anticipate little to no movement and a decrease in volatility

TARGET:

- The maximum profit is achieved if the underlying stock is between the lower call strike and upper put strike at expiration

PROS

- Defined risk strategy

- Time decay, volatility decreasing

CONS

- Assignment risk on the sold options if American style

- Limited profit potential

Check out our other articles