Put Options

What Is A Put Option?

Put options are financial derivatives that grant the holder the right, but not the obligation, to sell an underlying asset at a predetermined price (the strike price) within a specified time period. This underlying asset can be a stock, index, commodity, or even a currency. Put options are often used as a form of insurance against potential price declines in the underlying asset.

Buying put options is a way of profiting from a downward move in an asset or protecting a portfolio from any adverse market moves. Puts are directly impacted by changes in the underlying asset and will increase in value as the underlying asset falls in price. Investors who think that the markets will fall may buy put options to take advantage of this move, profiting as it moves down. Investors with existing portfolios also use put options to protect their investment as a type of insurance policy.

Options move in a non-linear correlation with the underlying asset price, so it is important to choose the right strike for your view. The strike price you choose is the price at which the option can be converted to the underlying asset if you decide to exercise your right.

Put Option Example

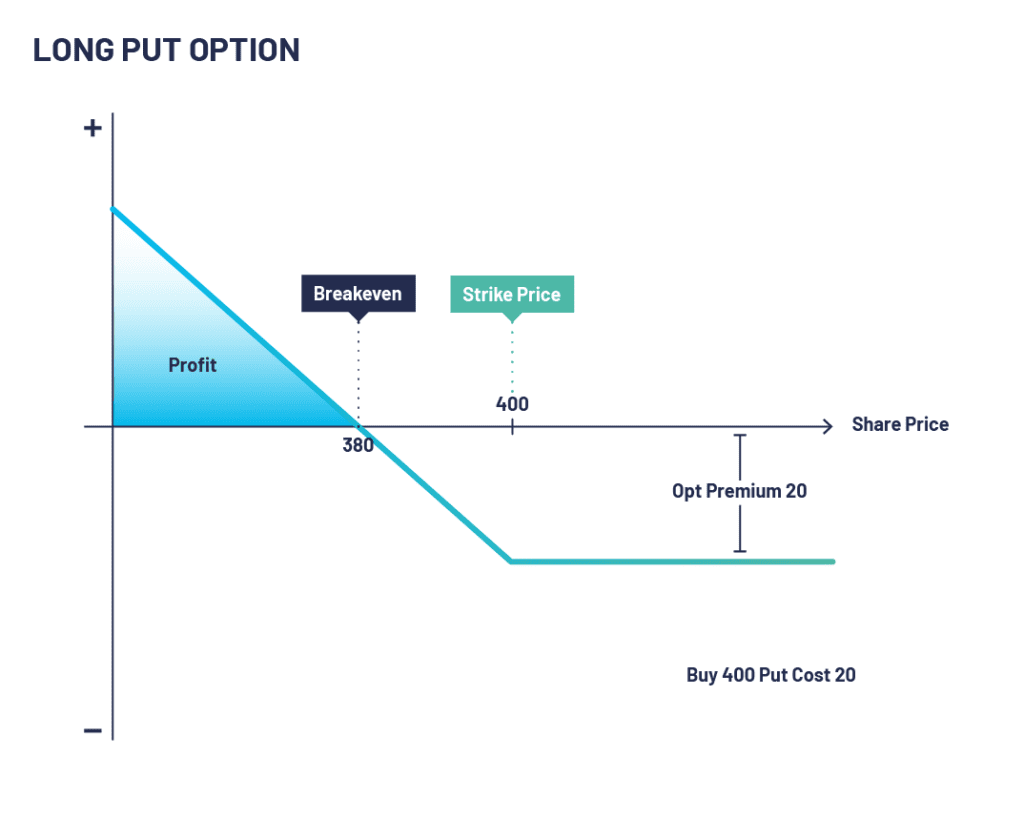

A buyer purchases a 400 put option in XYZ PLC at 20 when the stock was 405. If the stock fell to 350, the buyer would have the right to sell a pre-agreed amount of XYZ stock at 400, giving the option an intrinsic value of 50, up from 20 at the time of purchase.

An investor who has an existing stock position could do the same as a type of hedge but could also exercise their right to sell at the higher value of 400, therefore protecting their position as the market falls. The risk of buying a put is limited to the premium you pay for it but has near-unlimited profit potential.

If the price of XYZ PLC Company’s stock indeed falls below the strike price before the option’s expiration, the investor can exercise their right to sell the shares at the higher strike price, thus limiting their losses on the shares. On the other hand, if the stock price remains above the strike price or increases, they are not obligated to exercise the put option, and can let it expire without any further action.

Put Options: The Key Elements

To fully comprehend put options, it’s crucial to understand the key components associated with them. These are:

The Put Buyer:

The individual or entity that acquires the put option.

The Put Seller:

The individual or entity that sells, ‘grants’ or ‘writes’ the put option

Strike Price:

The fixed price at which the underlying asset can be sold.

Expiration Date:

The deadline by which the option must be exercised, or it becomes worthless.

Trading Put Options: The Process

Investing in put options involves a multi-step process:

- Choose the Underlying Asset: Identify the asset for which the put option will be purchased.

- Select the Expiration Date and Strike Price: These parameters are essential to determining the premium of the put option.

- Buy or Sell the Put Option: Purchase or sell the option through a broker, paying or receiving the premium.

- Monitor and Manage the Position: Keep track of the market and adjust the strategy as necessary.

Advantages of Put Options

Put options offer several advantages to investors and traders:

- Downside Protection: Put options serve as a safeguard against potential losses in the value of the underlying asset. By securing the right to sell at a predetermined price, investors can mitigate their risk exposure.

- Profit Potential: In addition to protecting against losses, put options also provide an opportunity for profit. If the underlying asset’s price decreases significantly, the value of the put option will increase, allowing the holder to sell at a higher price than the current market value.

- Portfolio Diversification: Put options offer a means to diversify investment portfolios, providing a hedge against downturns in specific assets or sectors. This diversification can help balance overall portfolio risk.

- Flexibility: Put options can be tailored to suit individual investment strategies and risk appetites. With various strike prices and expiration dates available, investors can select options that align with their specific market expectations and timeframes.

Risks Associated with Put Options

While put options can be a valuable tool, it’s important to consider the potential risks involved:

- Limited Timeframe: Put options have an expiration date, meaning the underlying asset’s price must reach the desired level within a specified timeframe. If the expected price decline doesn’t materialise before the option expires, its value may diminish or become worthless.

- Premium Cost: Purchasing put options requires paying a premium upfront. This cost represents the maximum potential loss for the option holder, even if the underlying asset’s price doesn’t decline as anticipated.

- Market Volatility: Put options can be affected by market volatility, impacting their value. Sudden price movements or unexpected events can lead to rapid changes in option prices, making timing crucial for successful trading.

Strategies for Using Put Options

- Protective Puts: Protective puts are used to safeguard an existing investment. By purchasing put options on a stock already held in a portfolio, investors can limit potential losses if the stock price declines.

- Speculative Puts: Speculative puts involve purchasing put options on an asset without owning it. This strategy allows investors to profit from anticipated price declines in the underlying asset, even if they do not currently hold it.

- Options Spreads: Options spreads involve simultaneously buying and selling put options on the same underlying asset but with different strike prices or expiration dates. This strategy can help manage the cost of the options while potentially reducing risk exposure.

- Collar Strategy: The collar strategy combines the purchase of a put option with the sale of a call option on the same underlying asset. This strategy aims to limit both potential losses and gains, effectively creating a price range within which the investor’s position remains protected.

Understanding Option Pricing

Option pricing is influenced by several factors, including the following:

Underlying Asset Price:

The price of the underlying asset has a direct impact on the value of a put option. As the asset price decreases, the put option becomes more valuable.

Strike Price:

The strike price determines the price at which the put option holder can sell the underlying asset. The relationship between the strike price and the current asset price affects the option’s value.

Time to Expiration:

The time remaining until the option’s expiration influences its value. Generally, options with longer expiration periods tend to have higher premiums.

Volatility:

Higher levels of volatility in the market or the underlying asset can increase the value of put options. Greater uncertainty translates into higher expected price declines and, thus, a higher option value.

Put Option Summary

Put options provide investors with a powerful tool for managing risk, protecting investments, and potentially profiting from market downturns. By understanding the mechanics, advantages, and risks associated with put options, you can make informed investment decisions. Remember to assess your risk tolerance, develop a sound strategy, and consider consulting with a financial advisor before engaging in options trading.

Investing involves risks, and it’s crucial to conduct thorough research and stay updated with market trends. Armed with this knowledge, you are now better equipped to navigate the world of put options and make strategic investment choices.

Put Option Summary

Profit:

If the price of the underlying stock goes below your strike, your option is “in the money” (the difference between the strike price and the underlying stock price). If this is greater than the premium paid (20) then your option is in profit. If the underlying price is 350 then your profit is 30 or 7.5% (400-20-350).

Maximum profit = virtually unlimited

Break-Even:

If the price of the underlying stock goes below your break-even price, you are “in profit” and can crystallise your profit either by selling your option or exercising your option depending on whether you own the underlying asset or not.

Break-even Price = Put Option Strike Price – Premium Paid

Exercising allows you to sell the stock at the strike price. As an example, this means if you bought the 400 puts and the stock is now trading at 350, you can sell the stock at 400.

Loss:

If the price of the underlying stock goes above your strike, your option is “out of the money” and at expiry your option is worthless and you only lose the price you paid to hold the put. You bought the 400 put option at 20, this means a loss of 20 which in this case is 5% of the underlying asset price.

Maximum Loss = Limited to the premium paid for the option.

Put Option Overview

Configuration:

- Buying a Put option

Outlook:

- Bearish, volatility rising

Target:

- The underlying asset being lower than the put strike bought – premium paid

Pros of the Put Option:

- Defined risk strategy

- Unlimited profit potential

- Good for hedging exposure on underlying assets

Cons of the Put Option:

- Premiums can erode quickly in a neutral or rising market

- Can be relatively expensive at the outset

- Market timing is very important

Put Option FAQs

What is a Put Option?

A put option is a financial contract that gives an investor the right, but not the obligation, to sell an asset at a specified price within a set time period.

How does a Put Option work?

A put option can serve as an insurance policy for investors. If the price of the underlying asset falls below the strike price before the expiration date, the investor can sell the asset at the strike price, potentially making a profit. If the price of the asset increases, the maximum loss for the investor is the premium paid for the option.

Why would an investor use Put Options?

Put options are versatile and can be used in various investment strategies. They can be used for portfolio protection, generating income, position building, or shorting an asset.

What are the risks associated with Put Options?

The key risks include potential for losses if the market moves unexpectedly, complexity and experience required to understand and use put options, and volatility of option prices.

How can an investor trade Put Options?

Investing in put options involves choosing an underlying asset, selecting the expiration date and strike price, buying or selling the put option through a broker, and monitoring and managing the position.

What is the difference between the Put Buyer and the Put Seller?

The Put Buyer is the investor who purchases the put option, while the Put Seller, ‘granter’ or ‘writer’, is the individual or entity that sells the put option.

What does exercising a Put Option mean?

Exercising a put option means the investor is choosing to utilise their right to sell the underlying asset at the predetermined strike price. This typically happens when the market price of the asset has fallen below the strike price.

What happens if a Put Option is not exercised?

If a put option is not exercised by the expiration date, the option becomes worthless. The investor would lose the premium they paid for the put option.

Can you sell a Put Option before the expiration date?

Yes, an investor can sell a put option to another trader before the expiration date. This may be done to realise a profit or to prevent further losses.

How is the premium of a Put Option determined?

The premium of a put option is determined by several factors including the difference between the current price of the asset and the strike price, the time remaining until expiration, and the volatility of the asset’s price.

What is the strike price in a Put Option?

The strike price in a put Option is the predetermined price at which the underlying asset can be sold if the investor chooses to exercise the option.

What does writing a Put Option mean?

Writing a put option refers to the act of selling a put option. The ‘writer’ of the put option is obligated to buy the underlying asset if the buyer chooses to exercise the option.

What does it mean when a Put Option is in the money?

A put option is in the money when the market price of the underlying asset is below the strike price. In this case, the investor can profit by exercising the option and selling the asset at the higher strike price.