Bull Call Spreads: Learn How to Profit from Bullish Markets

What is a Bull Call Spread?

A bull call spread is an options strategy that is used when an investor expects a moderate rise in the price of the underlying asset. This strategy involves buying a call option and simultaneously selling another call option (with a higher strike price) on the same underlying asset and with the same expiration date.

This is a bullish strategy that benefits from a reduction in cost due to selling the higher strike call option, with the trade-off being you cap your potential profit.

The maximum profit potential of the trade is easily calculated. Simply take the difference between strike prices and subtract the net premium paid for the call spread. The maximum loss is the total premium paid for the call spread.

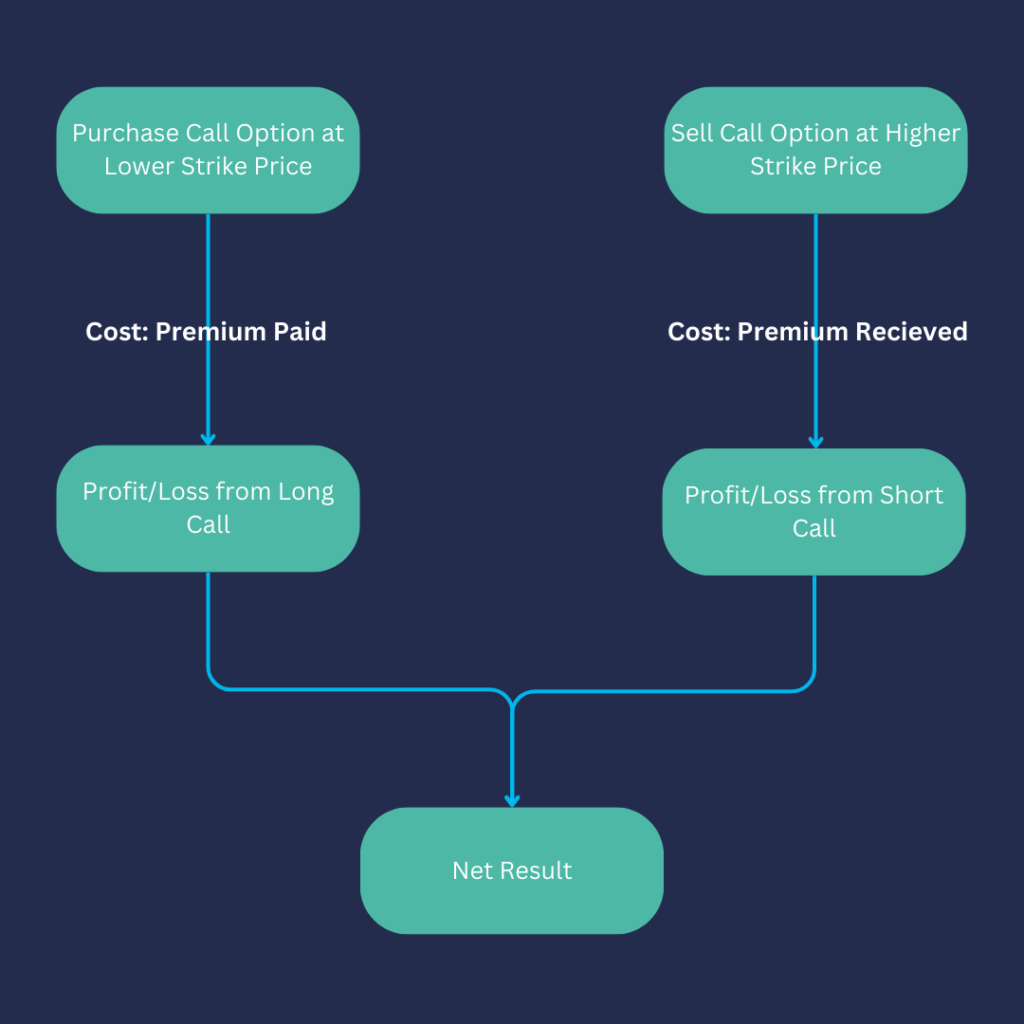

Mechanism of Bull Call Spread

Buying Call Option

The first step involves buying a call option. This is the option with a lower strike price. The investor will profit if the price of the underlying asset goes up.

Selling Call Option

The second step involves selling a call option with a higher strike price. This is done to offset the cost of buying the first call. The premium received from selling this call reduces the overall investment required for the strategy.

Why Use a Bull Call Spread?

You would look to employ this strategy if you think the market has a chance of rising but at the same time have a target in mind for how far the stock will go. In the case that the call option you want to buy is expensive (e.g. because volatility is high, or it’s in the money (ITM) with a lot of intrinsic value already priced in) then selling a call option can lower your cost basis.

This is also a good way to get gearing on a trade as you could afford to buy more call spreads to get greater exposure to the stock.

Advantages of Bull Call Spread

Limited Losses

The maximum loss is restricted to the net premium paid at the time of initiating the trade.

Lower Cost

The premium received from the sale of the higher strike call option helps to offset the cost of buying the lower strike call.

Disadvantages of Bull Call Spread

Capped Profits

The maximum profit is limited to the difference between the strike prices of the two calls, minus the net premium paid at the start of the trade.

Time Decay

The bull call spread is susceptible to time decay because the time value of options erodes as their expiration date gets closer.

Example of a Bull Call Spread

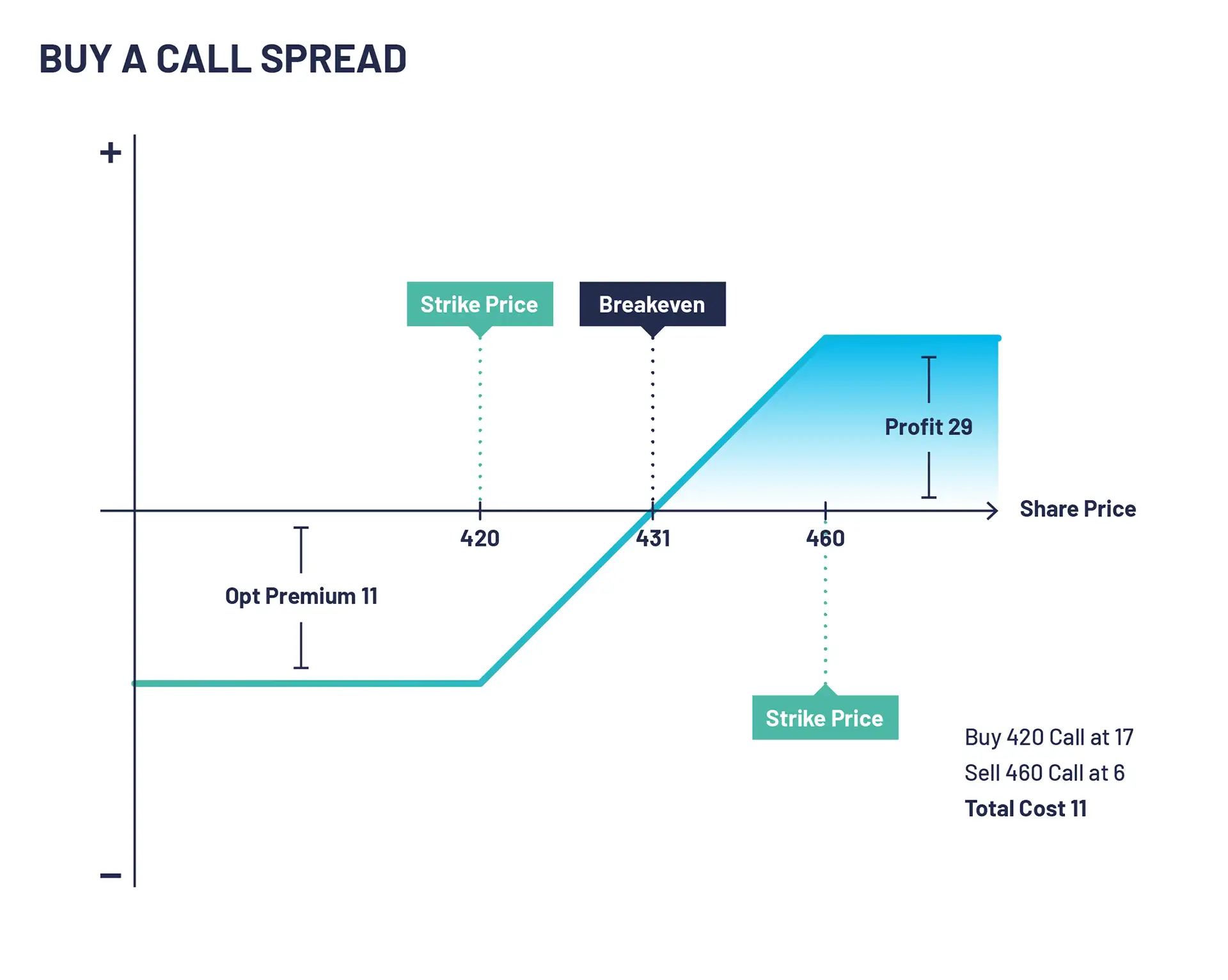

Let’s look at an example of a bull call spread. XYZ is trading at 412. An options trader executes a bull call spread by buying a 420 call at 17 and selling a 460 call at 6. The net debit and maximum loss on this trade is 11 (17-6).

If XYZ PLC stock rises and is trading above 460 on expiry of the option the maximum profit on this trade is realised. The long 420 calls and short 460 calls would be exercised, resulting in you buying the shares at 420 and simultaneously selling them at 460. In practice, you would normally sell your call spread for close to 40 being the difference between the two strike prices.

If the stock closes below 420 both options expire worthless and the initial debit paid is lost.

Key Considerations When Implementing Bull Call Spread

When planning to use this strategy, it’s crucial to consider the following:

Risk Management: As with any investment, it’s essential to evaluate your risk tolerance. Although the bull call spread limits potential losses, investors should be prepared for the possibility of loss up to the net premium paid.

Market Analysis: Understanding the market and the specific asset you are trading is vital. Make sure to conduct thorough research and analysis to predict potential price movements accurately.

Implied Volatility: High implied volatility can inflate the cost of options. This can reduce the effectiveness of a bull call spread.

Early Assignment Risk: The short call leg has the risk of being assigned before expiration if the option goes in-the-money and is an American Style option. Be prepared to deal with this scenario.

Exit Strategy: Decide on an exit strategy before entering a bull call spread. This could involve closing the spread if a certain percentage of the maximum profit is achieved, or if the underlying asset’s price hits a specific target.

Asset Price and the Purchased Call Option

A rise in the underlying asset’s price boosts the intrinsic value of the call option you’ve purchased. This increase in intrinsic value subsequently raises the premium of the call option. If the underlying asset’s price surpasses the strike price of the bought call option, the option is said to be “in the money,” and its value (and thus its premium) will continue to rise with the asset’s price.

Asset Price and the Written Call Option

On the other hand, the sold call option in a bull call spread works somewhat differently. An increase in the underlying asset’s price will increase this option’s value. However, since you sold this option, the increase in its value translates to a potential liability. In the best-case scenario, the underlying asset’s price remains below the strike price of this sold call, keeping it “out of the money” and preventing it from detracting from the net premium.

How the Underlying Asset Influences a Bull Call Spread’s Premium

The primary force behind the price movement of the options is the price movement of the underlying asset itself. When the underlying asset price increases, the value of call options also generally increases. As a result, a bull call spread will increase in value, enhancing the net premium.

The Role of Implied Volatility

Aside from the direct impact of the underlying asset’s price, its implied volatility also plays a significant role in the premium of a bull call spread. The greater the implied volatility of the underlying asset, the higher the option premiums. This is because implied volatility indicates the market’s anticipation of the asset’s price movement, which influences the risk associated with the option.

In a bull call spread, higher implied volatility could increase the premium of both the purchased and sold call options. However, the net effect on the spread’s premium might not be as significant, given that an increase in the sold call’s premium (which you collect) can offset the increase in the purchased call’s premium (which you pay).

Summary of buying a Call Spread

In conclusion, the bull call spread can be an effective strategy for moderate bullish outlooks. It presents an opportunity for investors to mitigate risk and potentially earn profits, albeit capped. As always, an understanding of the market and your risk tolerance is vital when engaging in any form of trading.

Configuration:

- Buy a call option

- Sell a call option with a higher strike and the same expiry

Outlook:

- Anticipate a moderately bullish move

Target:

- Underlying stock price expires above strike of the sold call option

Pros:

- Defined risk strategy

- Cheaper to execute than buying an outright call so can get higher exposure for the same premium

Cons:

- Your profits are capped at the level of the sold call.

- The net effect of time decay is somewhat neutral. It’s eroding the value of the option you purchased (negative) and the option you sold (positive)

- Assignment risks on the sold call if American style

Bull Call Spread FAQs

What is a Bull Call Spread?

A bull call spread is an options trading strategy used by investors who are bullish on a particular stock or asset. It involves buying a call option at a lower strike price and simultaneously selling a call option at a higher strike price.

How does a Bull Call Spread work?

In a bull call spread, the investor buys a call option with a lower strike price, which gives them the right to purchase the underlying asset at that price. At the same time, they sell a call option with a higher strike price, which obligates them to sell the underlying asset at that price. The premiums received from selling the higher strike call partially offset the cost of buying the lower strike call.

What is the purpose of a Bull Call Spread?

The purpose of a bull call spread is to limit the investor’s downside risk while still allowing them to profit from an expected increase in the price of the underlying asset. It provides a way to participate in a bullish market with a more affordable and risk-controlled strategy.

What are the potential benefits of a Bull Call Spread?

A bull call spread offers several potential benefits, including limited risk exposure compared to outright buying the underlying asset, a defined maximum loss, and potentially higher returns on investment if the price of the underlying asset rises significantly.

What are the risks of a Bull Call Spread?

While a bull call spread can limit downside risk, it also has some potential risks. If the price of the underlying asset does not rise as expected or remains below the higher strike price, the investor may experience a loss. Additionally, the strategy is subject to time decay and changes in implied volatility, which can impact the value of the options.

How is profit or loss determined in a Bull Call Spread?

The maximum profit in a bull call spread is limited to the difference between the strike prices minus the initial cost of establishing the spread. The maximum loss is limited to the initial cost of the spread. Profit or loss is determined by the price of the underlying asset at expiration, considering the premiums paid and received for the options.

When is a Bull Call Spread an appropriate strategy to use?

A bull call spread can be an appropriate strategy when an investor is moderately bullish on a particular stock or asset and wants to limit their downside risk. It is commonly used when the investor expects a moderate increase in the price of the underlying asset.

Can I close my Bull Call Spread before expiration?

Yes, you can close your bull call spread position before expiration by executing offsetting trades to buy back the call options you sold and sell the call options you bought. By closing the position, you can realise any profits or limit potential losses before the options expire.

Check out our other articles