A Complete Guide to Mastering the Short Strangle

Explore our comprehensive guide to the short strangle to learn about the strategies, risks, and benefits of implementing a short strangle; and to gain valuable insights into maximizing your profits while managing potential losses.

What is a Short Strangle?

A short strangle is an options trading strategy which is profitable when there is low movement in the underlying asset. A short strangle is a neutral strategy, as it profits when the underlying asset price stays between the two strike prices as time passes.

The strategy is designed to take advantage of time decay, as the options lose value over time due to the decreasing time left until expiration. An ideal time to deploy this strategy would be during a high implied volatility environment because the premium received for granting the options will be high, and volatility often reduces after a period of exacerbated price moves.

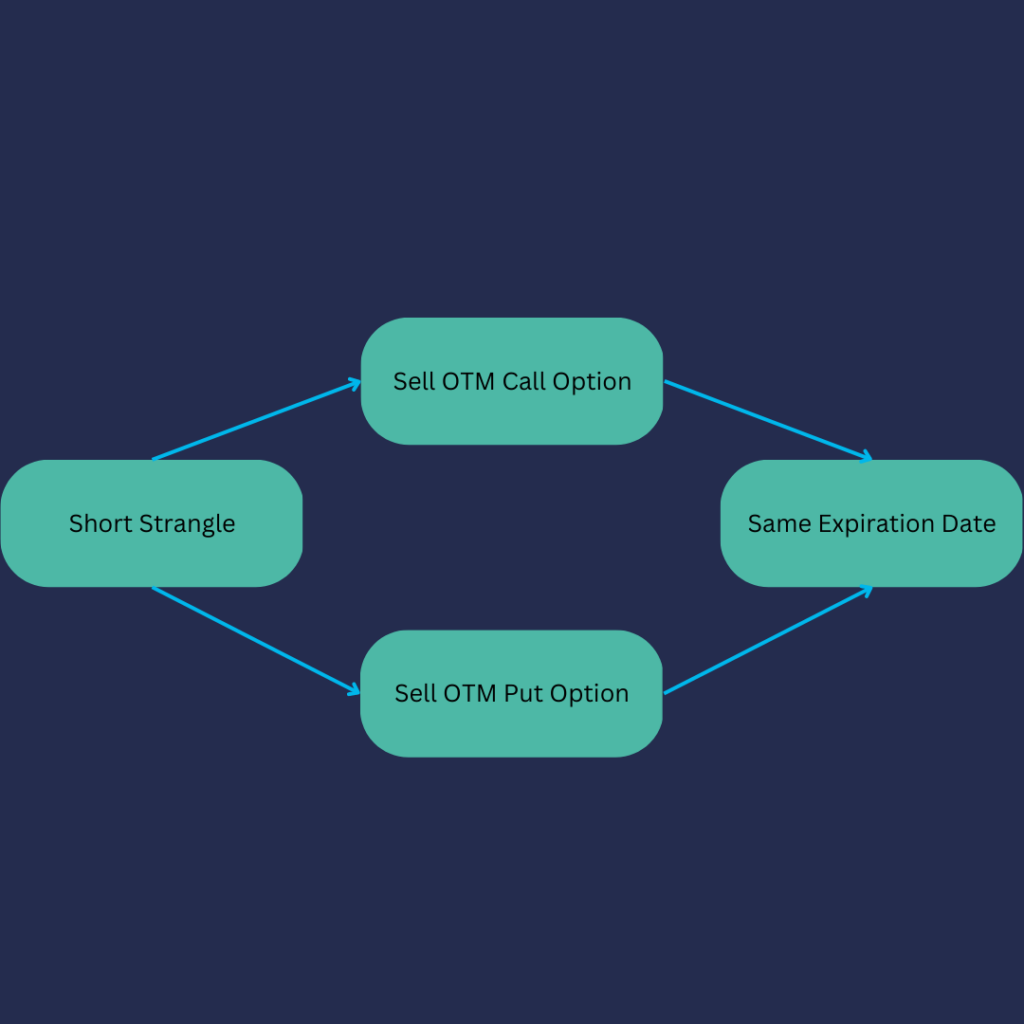

The trader sells both a call option and a put option at different strike prices but with the same expiration date. The strike price of the call option is higher than the current market price of the underlying asset, while the strike price of the put option is lower than the current market price of the underlying asset.

How does a Short Strangle work?

To execute a short strangle, an investor sells an out-of-the-money (OTM) call option and an OTM put option with the same expiration date but different strike prices. The premium received from selling the options creates an initial credit, which represents the maximum potential profit. The strategy profits if the underlying asset’s price remains within the range created by the strike prices of the sold options.

Components of a Short Strangle

- Sell an out-of-the-money call option: Selling an OTM call option generates premium income for the trader. The ideal strike price for the call option is higher than the current market price of the underlying asset.

- Sell an out-of-the-money put option: Selling an OTM put option also generates premium income. The ideal strike price for the put option is lower than the current market price of the underlying asset.

- Same expiration date: Both the call and put options should have the same expiration date to ensure that the strategy is implemented correctly.

Benefits of Trading Short Strangles

Profit Potential

Like any trading strategy, there is potential for profit if your market view is correct. It is not necessary to hold a short strangle to expiry. When the expiration date approaches, the extrinsic value of both options decreases, allowing the trader to potentially buy back the options at a lower price, or run the position to expiry in the hope that profit can be maximised should both options expire worthless.

Flexibility

A short strangle allows traders the ability to adjust strike prices and expiration dates of the short strangle to match their market outlook and risk tolerance. By choosing wider strike prices, traders can increase the probability of profit at the expense of lower premium income.

Short Strangle Strategy Example

We explain the different intricacies of the short strangle option strategy with an example below:

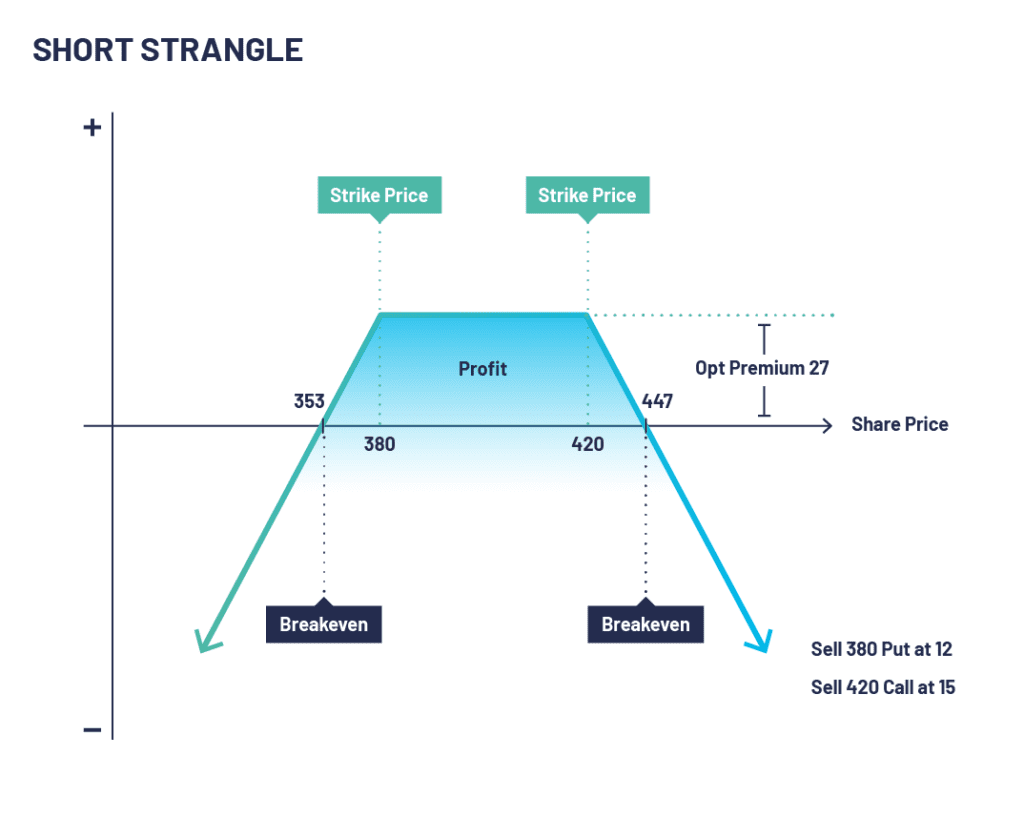

XYZ PLC stock is trading at 405. An options trader executes a short strangle by selling a 380 put at 12 and a 420 call at 15. The net credit taken to enter the trade is the maximum possible profit (27).

If XYZ PLC stock rises and is trading at say 500 on expiry, the 380 puts will expire worthless but the 420 calls expire in-the-money and have an intrinsic value of 80 thus creating a loss of 53 (80-27) The same will happen if, for example, the stock was trading at 300 but with the 380 puts having an intrinsic value of 80.

On expiration, if XYZ stock is trading between 380 and 420, both the 380 put and the 420 call expire worthless and the options trader gains the maximum profit of 27 which is the initial credit they received when opening the strategy.

Short Strangle Diagram

Analysing Profit Potential and Break-Even Points

The maximum profit potential for a short strangle is the combined premium received from selling the call and put options. The break-even points are calculated as follows:

- Upper Break-Even Point: Call strike price + total premium received

- Lower Break-Even Point: Put strike price – total premium received

When to Use a Short Strangle

A short strangle is best implemented when the following conditions are met:

Low Implied Volatility

Once established, this strategy benefits from a decrease in Implied volatility, which normally results in the option premium decreasing.

Range-bound Market

Since the strategy profits from the underlying asset’s price remaining within a specific range, it works best when the market is range-bound or has limited price movement.

Neutral Outlook

A short strangle is a neutral strategy, meaning that it works best when the investor believes that the underlying asset’s price will not experience significant movement in either direction.

Short Strangle Risks

Short strangles are not without risk, and individuals should be aware of the potential downsides. If the price of the underlying asset moves beyond the strike prices of either option, the trader could be exposed to potentially unlimited loss. This can be unlimited on the call side if the price of the underlying asset continues to rise, and unlimited on the put side if the price of the underlying asset continues to fall. It is important to consider and employ risk management strategies, such as stop-loss orders or understanding your personal risk tolerance.

Managing Short Strangle Risk

Position Sizing

Allocate only a small portion of your portfolio to short strangles, as the potential losses can be significant if the underlying asset’s price moves significantly.

Monitor Implied Volatility

Keep an eye on implied volatility, as an increase can result in higher option premiums and increased risks.

Rolling Options

If the underlying asset’s price moves close to one of the strike prices, consider rolling the option to a later expiration date or adjusting the strike prices to create more breathing room for the trade.

How does Implied volatility affect a Short Strangle Strategy?

Implied volatility can have a direct impact on a short strangle strategy. Higher implied volatility generally leads to higher premiums received for selling options, potentially increasing initial profitability. However, this can also indicate greater market uncertainty and the risk of adverse price movements. Implied volatility levels should be considered before implementing a short strangle.

How does the Underlying Asset Price affect Short Strangle Movement?

The price movement of the underlying asset is a significant factor in a short strangle. The strategy is most profitable when the underlying asset’s price remains relatively stable and stays within the range of the two strike prices. If the price moves significantly beyond the strike prices, it can result in losses.

How does Time Decay affect a short strangle?

Time decay, also known as theta decay, is beneficial to a short strangle strategy. As time passes, the options’ premiums tend to decrease due to the diminishing time value. Traders employing this strategy expect time decay to work in their favour, but it is important to monitor the time decay rate and manage the position accordingly.

Short Strangle Summary

Configuration

- Sell a put with a strike price below the current market price of the underlying.

- Sell a call with a strike price above the current market price of the underlying.

Outlook

- Anticipates decreased volatility – You think a period of low volatility is coming and have a neutral view.

Target

- The underlying price of the asset is to be in the middle of the two strikes you have sold so that the options can expire worthless.

Pros of the Short Strangle

- Premiums can be very attractive.

- High-time decay in a neutral market.

Cons of the Short Strangle

- Higher risk strategy

- Beware of high margins.

- Potential losses can accumulate very quickly.

- Assignment risks on both options if they are American style.

What is a short strangle?

A short strangle is an options trading strategy where a trader simultaneously sells a call option and a put option with different strike prices, but the same expiration date.

How does a short strangle strategy work?

The strategy profits when the price of the underlying asset remains between the two strike prices. It takes advantage of time decay and a decrease in implied volatility to generate income from the options’ premiums.

What is the risk in a short strangle strategy?

The main risk in a short strangle is that if the price of the underlying asset moves significantly beyond either strike price, the trader can face unlimited losses. Risk management techniques, such as setting stop-loss orders, are crucial to mitigate potential losses.

When is a short strangle strategy used?

Traders typically employ a short strangle when they anticipate low volatility and expect the price of the underlying asset to remain relatively stable. It is often used in neutral market conditions.

What is the maximum profit and loss potential of a short strangle?

The maximum profit in a short strangle is the premium received from selling the options. The maximum loss is unlimited if the price of the underlying asset moves significantly beyond the strike prices.

How do changes in implied volatility affect a short strangle?

Higher implied volatility generally leads to higher premiums received initially, potentially increasing profitability. However, it also implies a higher risk of adverse price movements. Traders should monitor and manage implied volatility levels throughout the trade.

Can a short strangle be adjusted or closed before expiration?

Yes, a short strangle can be adjusted or closed before expiration. Traders may choose to adjust the strategy by rolling the options to different strike prices or closing the position early to capture profits or limit potential losses.