Understanding The Strike Price In Options Trading

What is Strike Price?

Strike price, also known as exercise price, is a pre-determined price at which the holder of a financial option can buy (in the case of a call option) or sell (in the case of a put option) the underlying security. It’s the price that’s locked in at the inception of the contract, providing a benchmark for the execution of the option contract.

The strike determines an option’s value, from this value compared to the underlying asset, an option will be either in-the-money, at-the-money or out-the-money, and the difference between the strike and the underlier’s value will be the intrinsic value of the option’s price.

When trading options you can choose from a range of strike prices that are set at predefined intervals by the exchange. Of course, the underlying asset can trade in between these intervals but the exchange sets the option strike to meet the market’s need.

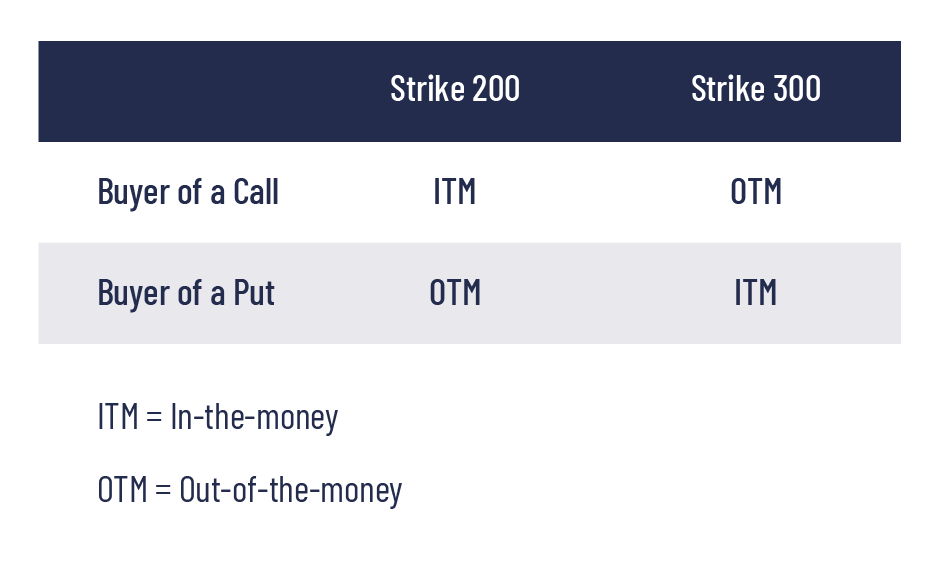

If we look at strike price examples in both calls and puts, we can see which is in or out of the money on an options contract when the underlying market price is at 250p:

Understanding ‘In the Money,’ ‘At the Money,’ and ‘Out of the Money’ Options

The strike price determines whether an option is in, at, or out of the money, which is crucial for the profitability of an options contract.

In the Money

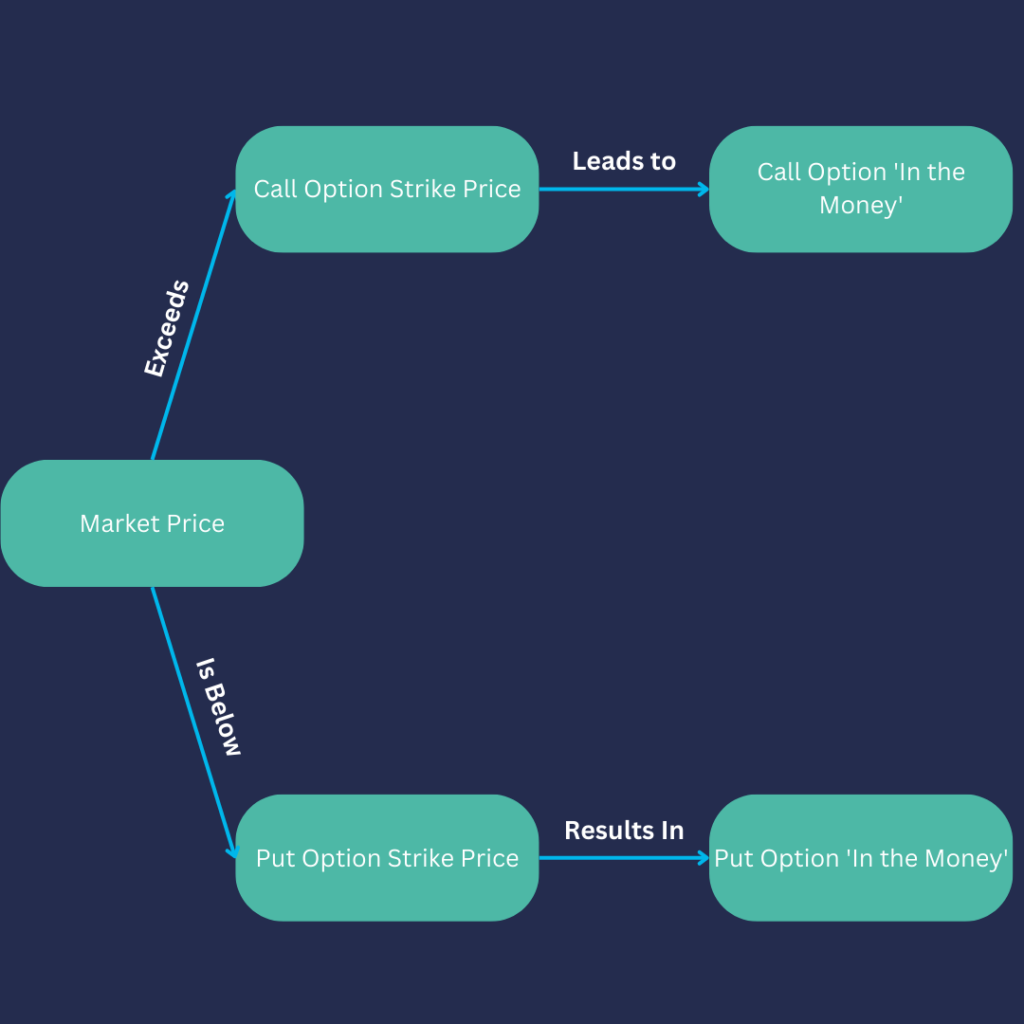

A call option is ‘in the money’ when the market price is above the strike price. A put option is ‘in the money’ when the market price is below the strike price. These options have intrinsic value, meaning they are worth exercising.

At the Money

Options are ‘at the money’ when the market price and the strike price are equal. These options have no intrinsic value, but their worth lies in the time remaining for the option to become ‘in the money.’

Out of the Money

A call option is ‘out of the money’ when the market price is below the strike price, and a put option is ‘out of the money’ when the market price is above the strike price. These options have no intrinsic value, and it wouldn’t be profitable to exercise them.

Call Options and Strike Price

A call option gives the holder the right to buy an underlying asset at the strike price before the option’s expiration. When the market price of the asset exceeds the strike price, the call option is said to be ‘in the money.’ If not, it’s ‘out of the money.’

Put Options and Strike Price

Conversely, a put option allows the holder to sell the asset at the strike price before the option’s expiration. When the market price is below the strike price, the put option is ‘in the money,’ while it’s ‘out of the money’ when the market price is above the strike price.

How Strike Price Affects Option Premiums

Option premiums, the cost of buying an option, are heavily influenced by the strike price. They primarily consist of intrinsic value and time value, however, the Greeks impact options in different ways. When an option is ‘in the money,’ the premium will be higher because of the intrinsic value. Conversely, ‘out of the money’ options’ premiums consist only of time value.

The Importance of Strike Price in Options Trading

Strike price is fundamental in options trading, shaping the dynamics of the contract. It influences whether an option is worth exercising, thereby determining the profitability of the contract. It also affects the premium of an option, which is the cost of buying the option. Therefore, a thorough understanding of the strike price is essential for successful options trading.

The Correlation between Strike Price and Risk

Strike price is a significant component in evaluating the risk associated with an options contract. ‘Out of the money’ options are riskier as they have no intrinsic value, and the underlying asset would need to move significantly for the option to become profitable. In contrast, ‘in the money’ options are less risky as they have intrinsic value, making them more likely to result in a profitable trade.

Strike Price Summary

In conclusion, the strike price plays a vital role in options trading, influencing the potential profitability and risk level of a trade. Whether you’re buying a call option or buying a put option, the strike price provides a reference point for determining whether an option contract will yield a profit or a loss. By understanding how the strike price works, investors can make more informed decisions, optimising their investment strategies in the complex world of options trading.

Strike Price FAQs

What is a Strike Price?

The strike price, also known as the exercise price, is the predetermined price at which the holder of a financial option can buy (for a call option) or sell (for a put option) the underlying asset.

What are In the Money, At the Money, and Out of the Money Options?

‘In the money’ refers to a situation where the market price of the underlying asset is above the strike price for a call option, or below the strike price for a put option. ‘At the money’ is when the market price is equal to the strike price. ‘Out of the money’ is when the market price is below the strike price for a call option, or above the strike price for a put option.

How is the Strike Price Determined?

The strike price is set when the contract is initially written. It’s established based on various factors, including the underlying asset’s current market price, the time left until expiration, and the risk-free rate of return.

How Does Strike Price Affect Option Premiums?

Option premiums, the cost of buying an option, are influenced by the strike price. If the option is ‘in the money,’ the premium will be higher due to the intrinsic value. Conversely, ‘out of the money’ options only have time value, resulting in lower premiums.

Why is the Strike Price Important in Options Trading?

The strike price determines whether an option is worth exercising and thereby affects the potential profitability of the contract. It also impacts the risk level associated with the option, making it a crucial factor in options trading.

Can the Strike Price Change After the Option is Bought?

No, the strike price is fixed and does not change once the option contract is established. It serves as the reference point for the contract, regardless of the subsequent fluctuations in the market price of the underlying asset.

What Happens When the Market Price Equals the Strike Price?

When the market price equals the strike price, the option is said to be ‘at the money.’ Although this option has no intrinsic value, it still has some value based on the time remaining for the option to become ‘in the money.’

How Does the Time to Expiration Affect the Strike Price?

The time to expiration doesn’t affect the strike price itself, as the strike price is fixed at the inception of the contract. However, the time left until expiration can influence the option’s premium and the likelihood of the option being ‘in the money’ at expiration. The longer the amount of time left before the option expires, the greater the probability that it might move into the money, and therefore the more value it has.

Can an Option Be Exercised at Any Price?

No, an option can only be exercised at its strike price. That’s why it’s crucial for an investor to consider the strike price when purchasing an option, as it determines whether the option will be profitable.

What is the Relationship Between Strike Price and Underlying Asset Price?

The relationship between the strike price and the underlying asset’s price determines whether an option is ‘in the money,’ ‘at the money,’ or ‘out of the money.’ If the market price is higher than the strike price for a call option (or lower for a put option), it’s ‘in the money.’ If it’s equal, the option is ‘at the money,’ and if it’s lower for a call option (or higher for a put option), the option is ‘out of the money.’

How Does Strike Price Affect the Risk of Options Trading?

The strike price is a key component in assessing the risk of an options contract. ‘Out of the money’ options, which have no intrinsic value, carry higher risk as the underlying asset must experience a significant price movement for the option to become profitable. ‘In the money’ options, on the other hand, are less risky as they already have intrinsic value.

Are There Standard Intervals for Strike Prices?

Yes, there are standard intervals for strike prices, often referred to as ‘strike price intervals.’ These intervals can vary based on the underlying asset and the market conditions but are typically standardised to facilitate trading.