Selling Call Options

What is Selling a Call Option?

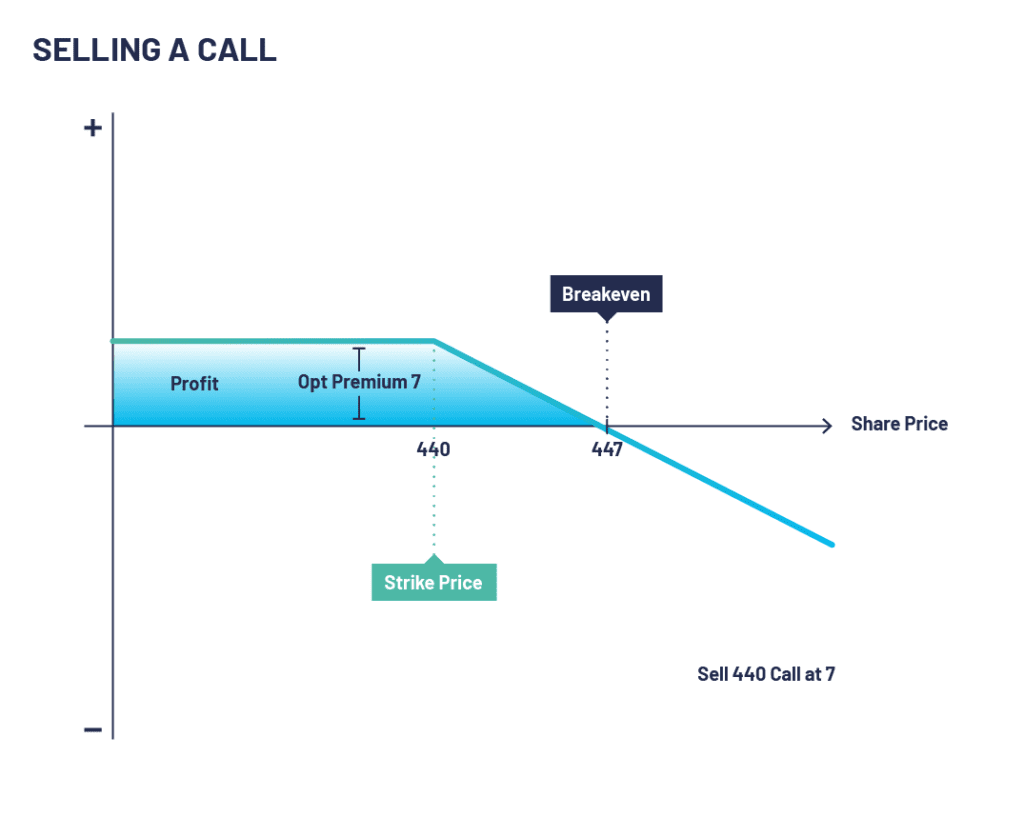

Call option sellers, also known as writers, sell call options hoping that they become worthless when they expire. As a call seller, you have given someone else the right but not the obligation to buy an underlying asset at a predetermined price up to a specific time in the future. Profit is made here by receiving a premium when selling the options and the options subsequently expire worthless.

If you think that the price of XYZ PLC, which is currently 405, is going to decline or move sideways then you could sell a call to profit from this move. Let’s imagine you have sold the 440 calls and taken in a premium of 7. If the market stays below 440 you will simply keep the premium as your option would expire worthless.

Understanding Call Options: An Overview

Call options are financial contracts that grant the buyer the right, but not the obligation, to purchase a certain number of shares (usually 100 shares in the US and 1,000 shares in the UK) of an underlying asset at a predetermined price, known as the strike price, before the contract’s expiration date. Sellers of call options, conversely, assume the obligation to sell the underlying asset if the buyer decides to exercise the option.

Delving into the Mechanics of Selling Call Options

When you sell a call option, you are essentially selling the right for someone else to buy shares of a stock from you at a pre-agreed price on a future date. There are two primary strategies for selling call options: covered calls and naked, or uncovered, calls.

The Covered Call Strategy: Safeguarding Your Portfolio

Covered calls involve selling a call option on a stock that you already own. This is a conservative strategy often employed to generate income, or to protect a portfolio from a moderate drop in the underlying stock’s value. In essence, you’re getting paid to sell your stocks at a potentially higher price while earning a premium.

The Naked Call Strategy: High Risk, High Reward

Selling naked calls, on the other hand, involves selling a call option on a stock that you do not own. This is a high-risk strategy with potentially unlimited loss, as you are obligated to purchase the underlying stock at the current market price if the option is exercised. However, it does offer the possibility of substantial premium income if the stock price stays below the strike price.

What is a Naked Call Option?

Selling a naked call (a call without holding a stock position) is considered to be much riskier since it can result in a substantial loss, as technically there is no limit to how high a stock can go. If the option buyer exercises their option when the underlying security price rises above the option strike price, say 500 in the case of XYZ Plc) you will have to go into the market to purchase the shares you have sold to the option buyer at the strike price (which was 440) at 500.

This would result in a loss of 60 minus the option premium of 7 so a net loss of 53. Individual shares can rise very quickly especially if, for example, they are subject to a takeover bid.

Although a profit can be made by selling options and receiving a premium, there is always a risk of the market rising and causing losses.

Practical Considerations When Selling Call Options

There are a few key aspects to consider when selling call options, each of which can significantly impact your trading success.

Timing and Volatility

The timing of selling call options can significantly impact the premium you receive. When market volatility is high, option premiums tend to increase, making it potentially more profitable to sell options. However, higher volatility also means greater risk, as the underlying stock’s price can move unpredictably.

Strike Price and Expiration Date Selection

Choosing the right strike price and expiration date is critical when selling call options. A higher strike price generally means a higher potential profit if the option is exercised, but also a lower premium. Conversely, a lower strike price results in a higher premium, but less potential profit if the option is exercised.

Risk Management

An effective risk management strategy is paramount when selling call options. For covered calls, this means being comfortable with potentially having to sell your stock. For naked calls, it means being prepared for potentially large losses if the underlying stock’s price significantly exceeds the strike price.

Steps to Sell a Covered Call

Now that we understand why you might want to sell a call options, let’s dive into the steps involved.

Stock Selection

Choosing an appropriate underlying stock is paramount. Ensure you pick a stock with which you are familiar and have a firm conviction in its likely price movements.

Decide on the Strike Price

The strike price is the price at which the option buyer has the right to buy the stock. You decide on this price based on your expectation of the stock’s future price.

Select the Expiration Date

The expiration date is the date by which the option must be exercised or it expires worthless. The duration can range from one day to several months or more.

Sell the Call Option

Finally, you can sell the call option via calling your broker and executing the trade.

Risk Factors to Consider

As with any investment strategy, selling covered calls carries risks.

- Loss Potential

If the stock’s price rises significantly above the strike price, you would be obligated to sell your stock at the strike price, missing out on further potential profits.

- Market Volatility

A volatile market can pose challenges to your predictions about a stock’s future price, potentially resulting in losses.

Short Call Summary

CONFIGURATION:

- Selling a call option

OUTLOOK:

- Bearish to a neutral stance

TARGET:

- The option just needs to expire below the strike price you sold

PROS

- Benefits from time decay and falling volatility

- Can be used as a type of hedge against underlying assets. (See Covered Call)

CONS

- Higher risk strategy

- Can be exercised early if American style

- Potentially unlimited losses

- Can be margin intensive if underlying asset rises sharply

Selling a Call Option FAQs

What is a call option?

A call option is a financial contract between two parties, the buyer and the seller of this type of option. The buyer of the call option has the right, but not the obligation, to buy an agreed quantity of a particular commodity or financial instrument (the underlying) from the seller of the option at a certain time (the expiration date) for a certain price (the strike price).

What does selling a call option mean?

Selling a call option, also known as writing a call option, refers to the process where an individual or entity sells the rights to buy a specified amount of an underlying security at a predetermined price (the strike price) within a specified timeframe. The seller receives a premium (payment) from the buyer for writing this option.

What is the risk associated with selling a call option?

When you sell a call option, the risk can be significant. If the price of the underlying asset rises significantly, you may have to sell the asset at the strike price, which could be much lower than the market price. This can lead to unlimited potential losses as there’s no upper limit to how high the asset price can rise.

What happens when a call option I sold is exercised?

If a call option you sold is exercised by the buyer, you are obligated to sell the underlying asset at the agreed strike price. If you do not already own the asset, you would have to purchase it at the current market price to fulfill your obligation.

What is the incentive for selling a call option?

The primary incentive for selling a call option is to earn premium income. Sellers receive the premium immediately upon the sale of the call option, and in many cases, sellers hope the option will expire worthless so they can keep the full amount of the premium.

What does it mean for a call option to expire worthless?

A call option expires worthless if the price of the underlying asset is below the strike price at the expiration date. In this case, the buyer would not exercise the option, as they can buy the asset cheaper in the open market. If you have sold this option, you would not need to sell the asset, and you would keep the premium you received when you sold the option.

What is a covered call?

A covered call is a strategy in which the call option seller owns the equivalent amount of the underlying security. In this strategy, the seller writes a call option on the securities they own to earn premium income, offering some downside protection but limiting the upside potential.

What is an uncovered or naked call?

An uncovered, or naked, call is when you sell a call option without owning the underlying asset. This is a high-risk strategy because you may need to buy the asset at the current market price to sell to the option holder if they choose to exercise their option.

How do I sell a call option?

To sell a call option, you need to have a brokerage account that allows options trading. You then choose the underlying asset, the strike price, and the expiration date for the option. The broker will provide a quote for the premium you can receive for selling the option. If you agree, you can sell the option and the premium will be credited to your account.

What factors affect the premium I can receive for selling a call option?

Several factors influence the premium for selling a call option. Some of these include the price of the underlying asset, the strike price, the expiration date, the volatility of the underlying asset, and the risk-free interest rate. Generally, the more likely the option is to be exercised, the higher the premium.