Call Options

What are Call Options?

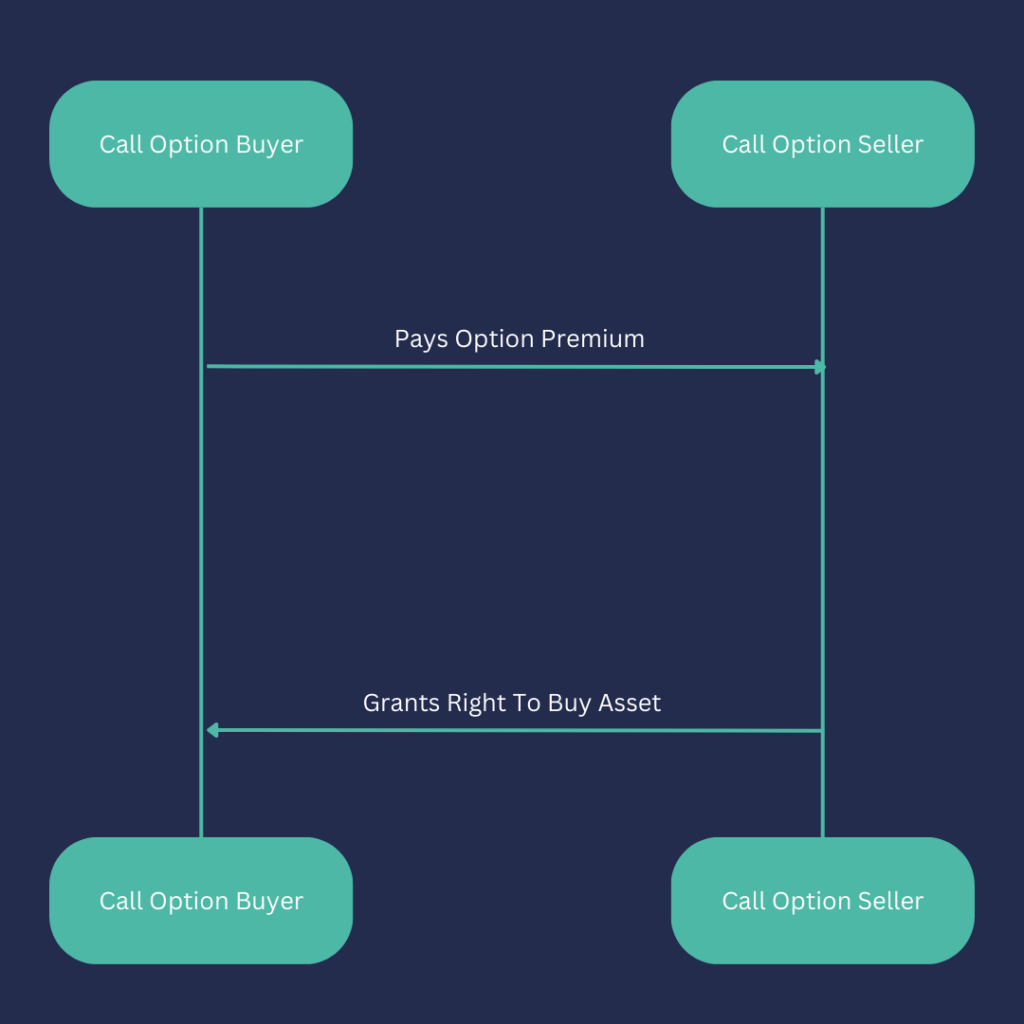

A call option is a contract between two parties that gives the holder the right, but not the obligation, to purchase an asset at a specific price (strike price) by a specific date in the future (expiration date). For this right, the call buyer will pay an amount of money (the premium), which the call seller will receive for taking that risk.

When a call option is purchased, the buyer pays a premium to the seller. This premium is essentially the cost of buying the option. If the underlying asset’s price goes above the strike price within the expiration date, the buyer can exercise the option and buy the asset at the strike price, locking in their profit. However, if the price doesn’t exceed the strike price, the option will expire worthless.

Call Option Example

Let’s think of call options in another way before we dive in. Imagine a potential homeowner sees a new building development that they are interested in. They are not sure about fully committing to the property but want the right to purchase a home in the future and would only want to exercise that right once certain conditions have been met, e.g., the development is completed, or they have seen how the housing market performs in that time.

Imagine the buyer could buy a call option from the developer which allows them to buy the home for £500,000 at any point in the next three years. In the property world, this would be seen as a non-refundable deposit – the developer wouldn’t grant such an option for free as they would also be taking a risk (of missing out on a rising property market over the next 3 years). The potential home buyer needs to contribute a down payment to lock in that right. To a buyer, if the value of the property goes up, they have locked in the price of £500,000. If the value significantly decreases then they have the option to pull out and lose the deposit, buy the house anyway at the lower market price, or simply walk away.

How Call Options Work

A call option can be purchased if the buyer thinks the underlying market is going to go up in price. The biggest advantage of buying a call option is that it magnifies the gains in a stock’s price using leverage. For a relatively small upfront cost, you can enjoy exposure to a stock’s gains above the strike price until the option expires. A call option is in profit when the underlying asset price is above the sum of the strike price and the premium paid at expiration.

The call owner can either:

- Exercise the option at expiry (if a European option) or anytime (if an American option), putting up cash to buy the stock at the strike price; or

- Can simply sell the option at its fair market value to another buyer through the exchange at any point prior to expiry.

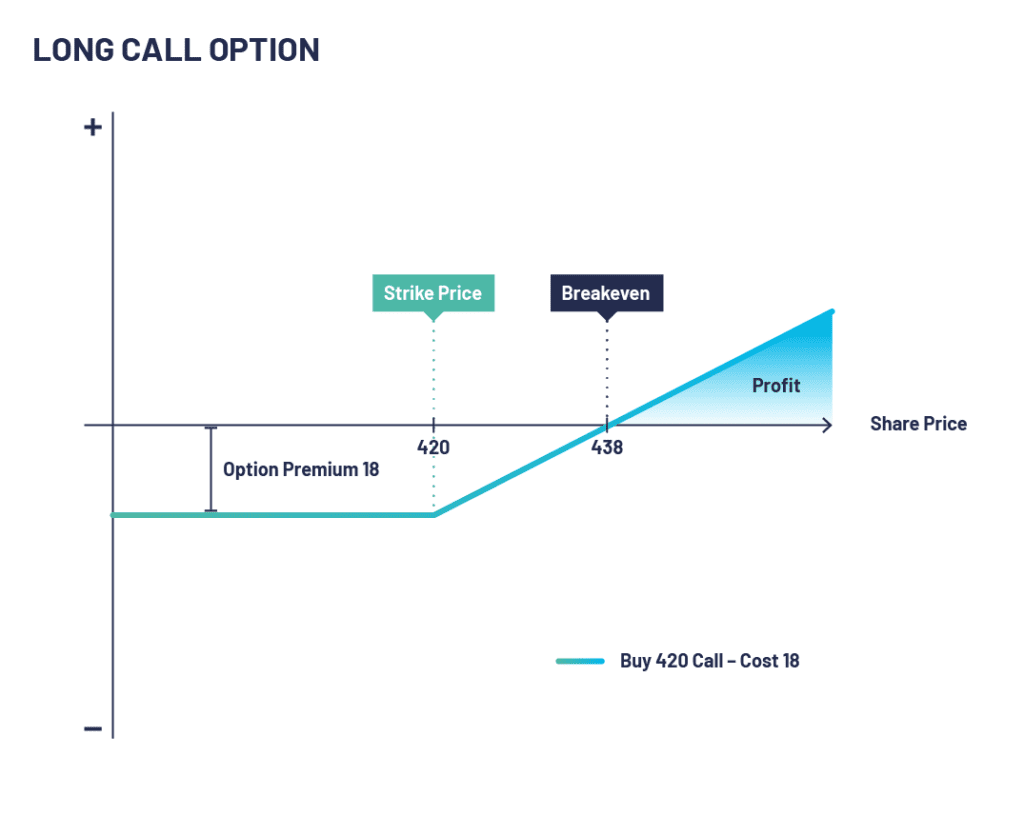

If a buyer decides to buy a call option with a strike price of 420 for 18, the buyer has the right, but not the obligation to buy shares at 420 by exercising the option before the end of the contract expiry. This becomes valuable if the underlying share price has gone above the 420 strike price and is now trading at say 460, as technically you will be able to exercise your option to purchase shares at 420 and immediately sell them in the market at 460; or you could sell your option at its fair market value which should be around 40.

Types of Call Options

There are two primary types of call options:

American Call Options: These can be exercised anytime before the expiration date.

European Call Options: These can only be exercised on the expiration date itself.

Both can be sold to close out the position at any time.

Key Terms for Call Options

Understanding call option trading necessitates the knowledge of a few critical terms:

Strike Price:

The predetermined price at which the buyer of a call option can purchase the underlying asset.

Expiration Date:

The date at which the call option expires.

Option Premium:

The cost that the buyer pays to the seller to buy the call option.

Intrinsic Value:

This is the difference between the underlying asset’s market price and the strike price of the option.

Why Invest in Call Options?

Call options offer various benefits to investors:

Potential for High Returns:

They can provide significant profit if the price of the underlying asset rises significantly.

Limited Risk:

The maximum loss is limited to the premium paid.

Flexibility:

They offer the flexibility to profit from the potential price rise of an asset without owning the asset itself.

The Benefits of Call Options

Call options offer several benefits to investors seeking to optimise their returns. By utilising call options, you can:

- Leverage Capital

Call options allow you to have an economic interest in a larger amount of shares with a relatively small upfront investment. This leverage amplifies your potential returns, as even a small increase in the price of the underlying asset can result in substantial profits.

- Mitigate Risk

Unlike owning the underlying asset outright, call options limit your risk to the initial premium paid. If the market moves against your position, your potential losses are capped at the premium, providing a level of downside protection.

- Enhance Portfolio Flexibility

Integrating call options into your investment strategy provides flexibility in navigating various market conditions. Whether the market is bullish, bearish, or range-bound, call options can be tailored to suit your desired risk-reward profile.

- Generate Additional Income

Selling call options on a stock that you already own, also known as writing covered calls, can be an effective way to generate additional income from your existing portfolio. By selling calls against shares you already own, you collect premiums, which can enhance your overall investment returns. However, the buyer of the option will exercise it if the shares trade above the strike price, so you would have to be prepared to deliver these shares at the strike price and forego any additional upside.

Risk Factors of Call Options

While offering potential benefits, call options also come with risks:

Premium Loss: If the underlying asset’s price does not exceed the strike price before expiration, the premium paid for the option will be lost.

Market Volatility: The value of call options can be highly sensitive to market volatility.

Call Option UK Summary

Break-Even

If the price of the underlying stock goes above your break-even price, you are “in profit” and can crystalise your profit by selling your option

Break-even price = call option strike price + premium paid

Loss

If the price of the underlying stock goes below your strike, your option is “out of the money”, and at expiry your option will be worthless. You will lose the price you paid to hold the call. If yYou bought the 420 call at 18, you lose 18, which in this case is about 4% of the underlying asset price.

Maximum Loss = Limited to the premium paid for the option.

Profit

If the price of the underlying stock goes above your strike, your option is “in the money” (the difference between the strike price and the underlying stock price). If this is greater than the premium paid (18) then your option is in profit. If the underlying price is 460 then your profit is 22 or 5.2% (460-420-18).

Maximum profit = Technically unlimited

Configuration of a Call Option

Outlook:

- Bullish, volatility rising

Target:

- Underlying asset being higher than the call strike bought – premium paid

Pros:

- Defined risk strategy

- Unlimited profit potential

Cons:

- Premiums can erode quickly is a neutral or falling market

- Can be relatively expensive at outset

- Market timing very important

Call Option FAQs

What is a call option?

A call option is a financial derivative that gives the holder the right, but not the obligation, to buy an underlying asset at a specified price within a specific time period.

How does a call option work?

When you buy a call option, you pay a premium to the seller (writer) of the option. This premium gives you the right to purchase the underlying asset at the predetermined price (strike price) within a specified time frame (expiration date).

What is the difference between buying and selling a call option?

Buying a call option gives you the right to buy the underlying asset, while selling a call option obligates you to sell the underlying asset if the option is exercised by the buyer.

What is the expiration date of a call option?

The expiration date is the date on which the call option contract expires. After this date, the option becomes worthless, and you can no longer exercise your right to buy the underlying asset.

What is a strike price?

The strike price, also known as the exercise price, is the predetermined price at which the underlying asset can be bought when the call option is exercised.

How is the value of a call option determined?

The value of a call option depends on several factors, including the price of the underlying asset, the strike price, the time remaining until expiration, volatility in the market, and interest rates.

Can I exercise a call option before the expiration date?

It depends on the option. American-style options can be exercised anytime. European-style options can only be exercised at expiry Early exercise may incur additional costs or limitations.

What happens if I exercise a call option?

If you exercise a call option, you are buying the underlying asset at the strike price. You will need to have sufficient funds in your account to cover the purchase.

What is the risk involved in buying a call option?

The risk of buying a call option is limited to the premium you paid for the option. If the price of the underlying asset does not rise above the strike price before the expiration date, the option may expire worthless, and you would lose the premium.

Can I sell a call option before expiration?

Yes, you can sell both American and European call options any time before expiration in the options market. The price you receive will depend on various factors, including the current market price of the option and the time remaining until expiration.

What is the maximum profit potential of a call option?

The maximum profit potential of a call option is theoretically unlimited. As the price of the underlying asset increases, the value of the call option also rises, allowing you to benefit from the price appreciation.

What is the maximum loss potential of a call option?

The maximum loss potential of a call option is limited to the premium paid for the option. If the price of the underlying asset falls below the strike price, the option may expire worthless, resulting in a loss of the premium.

Can I use call options for hedging?

Yes. Call options are usually bought to take advantage of a rising market price, but if you are a professional investor running short positions, call options can be a useful hedge.

Are call options only available for stocks?

No, call options are available for a variety of underlying assets, including stocks, commodities, currencies, ETFs and indexes. The availability of call options depends on the specific market and asset class.

Are call options suitable for all investors?

Call options are complex financial instruments and involve risks. They may not be suitable for all investors, as they require an understanding of options trading and the potential for loss of the premium paid. It is important to carefully assess your investment goals, risk tolerance, and seek professional advice before engaging in options trading.