The Long Strangle Options Strategy: A Complete guide

What is a Long Strangle?

The Long Strangle offers substantial potential for returns, particularly during times of high volatility. In this article, we’ll delve deep into the Long Strangle strategy, explaining how it works, the conditions under which it is most effective, and how you can execute it efficiently to maximise your profits.

Strangle options strategies can be split into two different configurations, long strangle options and short strangle options. We’re going to explain the long strangle and what is required if you wanted to employ this strategy.

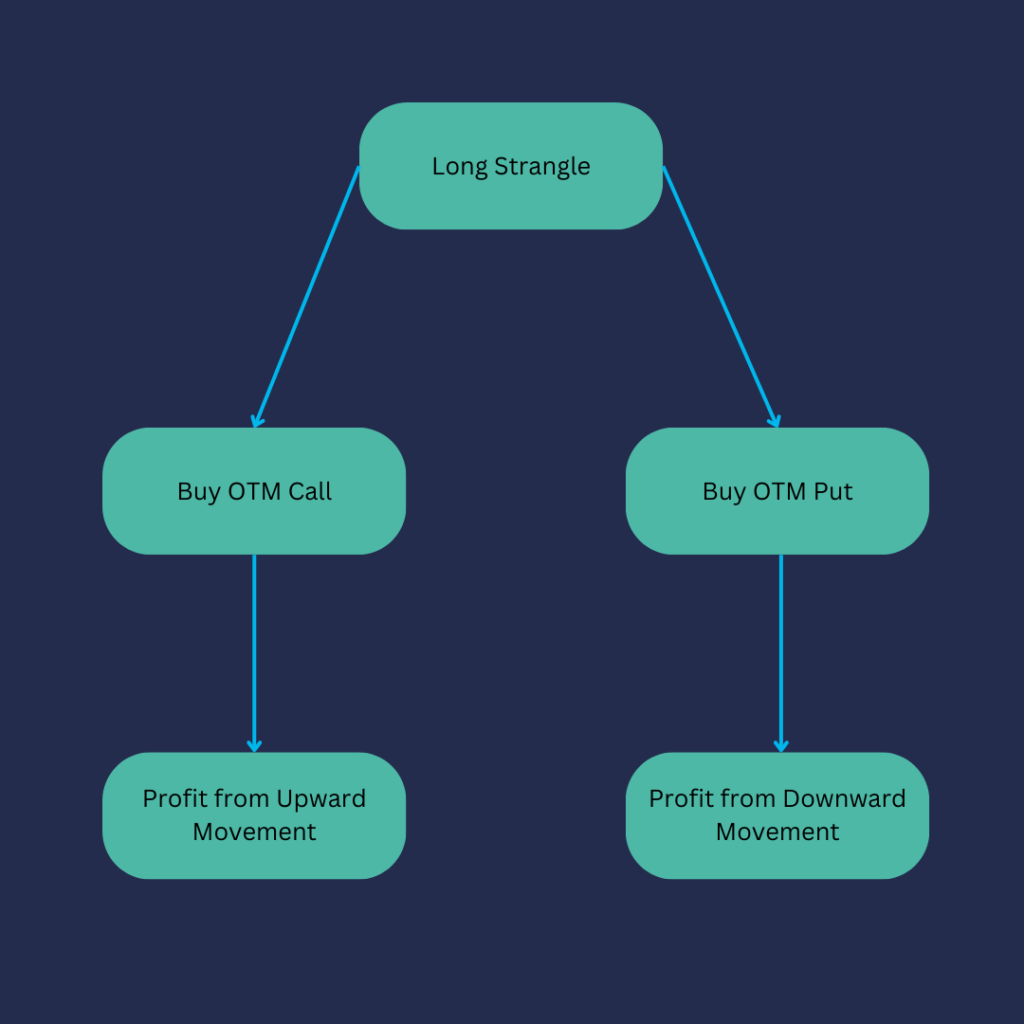

At its core, a Long Strangle involves buying an out-of-the-money (OTM) call option and an OTM put option with the same expiration date but different strike prices. The strategy aims to profit from a significant price movement in either direction. The call option allows you to benefit from upward movement, while the put option covers you in the event of a significant price drop.

When to Use the Long Strangle Strategy

A long strangle is an options strategy that anticipates higher volatility in an underlying asset price. For example, this kind of strategy could be deployed before earnings where you are not sure of the result but anticipate a big move in either direction.

Although this may seem very similar to a long straddle, the difference here is that you separate the strike prices for the two sides of the trade. Although this strategy would be cheaper to use as both options are likely to be out of the money, the move in the underlying asset will need to be more significant to make a profit.

Market Volatility

The Long Strangle is particularly effective when high market volatility is expected. This is because the strategy profits from substantial price swings in either direction. Therefore, the more volatile the market, the higher the likelihood of significant price movement, and consequently, the higher your potential for profits. When buying this strategy, it is best to purchase in a low volatility environment which in turn moves into high volatility.

Strike Price Selection

Choosing the appropriate strike prices for your call and put options is crucial to the success of your Long Strangle. The call option’s strike price should be higher than the current market price, while the put option’s strike price should be lower. The wider the gap between the two strike prices, the cheaper the options but the greater the price movement needed to achieve profitability.

Pros and Cons of the Long Strangle

Like any trading strategy, the Long Strangle carries both potential risks and rewards.

Pros

The Long Strangle has unlimited profit potential. This is because there’s no upper limit to how high the price of the underlying asset can go. Similarly, the put option can continue to increase in value as the price of the underlying asset falls, up until it becomes worthless.

Cons

The risk in a Long Strangle is limited to the premium paid for the options. If the price of the underlying asset remains between the two strike prices at the time of expiration, both options will expire worthless, resulting in a total loss of the premium paid.

Long Strangle Option Example

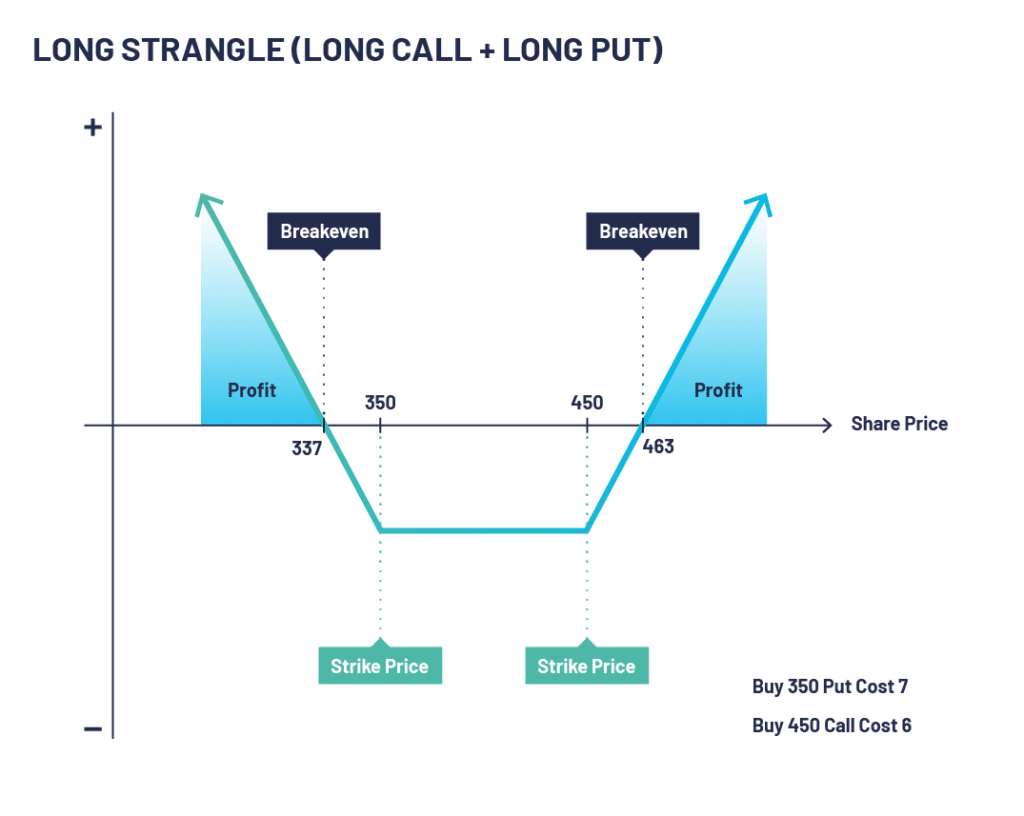

Let’s look at an example of a long strangle. XYZ PLC stock is trading at 405. An options trader executes a long strangle by buying a 350 put at 7 and a 450 call at 6. The net debit taken to enter the trade is the maximum possible loss (13).

If XYZ PLC stock rises and is trading at 500 on expiry, the 350 puts will expire worthless, but the 450 calls expire in-the-money and have an intrinsic value of 50. The same will happen if, for example, the stock was trading at 300 but with the 350 puts having an intrinsic value of 50.

On expiration, if XYZ stock is still trading at 405, both the 350 put and the 450 call expire worthless and the options trader suffers a maximum loss of 13 which is the initial debit they paid when opening the strategy.

Managing the Long Strangle Strategy

Effective management of your Long Strangle strategy involves monitoring market conditions and adjusting your positions as necessary.

Adjusting the Position

If the price of the underlying asset moves significantly in one direction, it can be advantageous in some scenarios to close the unprofitable leg of the strangle and ride the profitable one. This can help to lock in profits and limit potential losses.

Exiting the Strategy

Knowing when to exit your Long Strangle position is crucial. If the underlying asset’s price has not moved sufficiently in either direction as the expiration date approaches, it may be best to exit the strategy to salvage any remaining premium.

Long Strangle Summary

The Long Strangle is an advanced options trading strategy that, when used correctly, can offer substantial profit potential. By understanding the factors that influence its success and effectively managing your positions, you can leverage the Long Strangle to capitalise on periods of high market volatility.

Configuration:

- Buy a put with a strike price below the current market price of the underlying asset

- Buy a call with a strike price above the current market price of the underlying asset

- Both options must have the same expiry date

Outlook:

- Anticipates high volatility – you think a move is coming but are not sure which way (for example, before an earnings announcement where you think consensus is wrong and you expect a significant market reaction one way or the other).

Target:

- The underlying asset moves strongly in either direction.

Pros of the Long Strangle:

- Defined risk strategy

- Can benefit from a strong move in either direction

Cons of the Long Strangle:

- High-time decay in a neutral market

- Premiums can be very high, especially in volatile markets.

Long Strangle FAQs

What is a long strangle?

Long strangle is an options trading strategy that involves buying both a call option and a put option on the same underlying asset with the same expiration date. The strike price of the call option is typically higher than the current market price of the asset, while the strike price of the put option is usually lower.

What is the purpose of using a long strangle strategy?

The purpose of using a long strangle strategy is to profit from significant price movement in the underlying asset. It is a strategy used when the investor believes that the price will move significantly but is unsure about the direction of the movement.

How does a long strangle make a profit?

A long strangle makes a profit if the price of the underlying asset moves significantly in either direction. If the price increases significantly, the call option can be exercised for a profit, while if the price decreases significantly, the put option can be exercised for a profit.

What are the risks associated with a long strangle?

The main risk with a long strangle is that the price of the underlying asset remains relatively stable. In this case, both the call and put options may expire worthless, resulting in a loss of the initial investment. Additionally, time decay and changes in implied volatility can also impact the profitability of the strategy.

How do I select the strike prices and expiration date for a long strangle?

The selection of strike prices and expiration date depends on various factors, including the expected price movement, volatility, and risk tolerance. Generally, the strike prices are chosen to be out-of-the-money to keep the initial investment lower, and the expiration date is selected to allow sufficient time for the anticipated price movement to occur.

Can a long strangle be used on any underlying asset?

A long strangle can be used on a wide range of underlying assets, including stocks, commodities, ETFs and indices. However, it is important to consider the liquidity and volatility of the asset and its options when implementing this strategy.

Are there any alternatives to a long strangle strategy?

Yes, there are alternative strategies that can be used depending on the investor’s outlook and risk appetite. Some alternatives include the long straddle, short strangle, or using more complex options strategies such as iron condors or butterfly spreads.

Are there any tax implications associated with long strangle trades?

Tax implications may vary depending on the jurisdiction and individual circumstances. It is recommended to consult with a tax professional or accountant to understand the specific tax implications of options trading in your country or region.

What are some factors that can affect the profitability of a long strangle?

The profitability of a long strangle can be affected by factors such as the magnitude and timing of the price movement, changes in implied volatility, time decay, and transaction costs. It is important to monitor these factors closely and adjust the strategy if necessary.

Is a long strangle suitable for beginners?

A long strangle is a more advanced options strategy that requires a good understanding of options trading and associated risks. It is generally recommended for experienced traders who are familiar with options strategies and have a thorough understanding of the market conditions. Beginners are advised to start with simpler strategies and gradually build their knowledge and experience.