Selling a Put Option

Understanding Put Options

Before diving deeper into the strategy, we must first understand the basics. A put option is a contract that gives its holder the right, but not the obligation, to sell a specific number of shares (usually 1,000 in the UK and 100 in the USA) of an underlying asset at a predetermined price (known as the strike price) before a set expiration date.

What is Selling a Put Option?

Put option sellers, also known as writers or granters, sell put options hoping that they become worthless when they expire. As a put seller, you have given someone else the right but not obligation to sell an underlying asset to you at a predetermined price up to a specific time in the future. It’s important to remember here that you are essentially giving someone else the right to sell to you an amount of an asset at a predetermined price so it can be costly for you (the writer/ (seller), especially if the underlying asset price falls sharply. Individual shares can fall very quickly, especially if the company announces a profit warning.

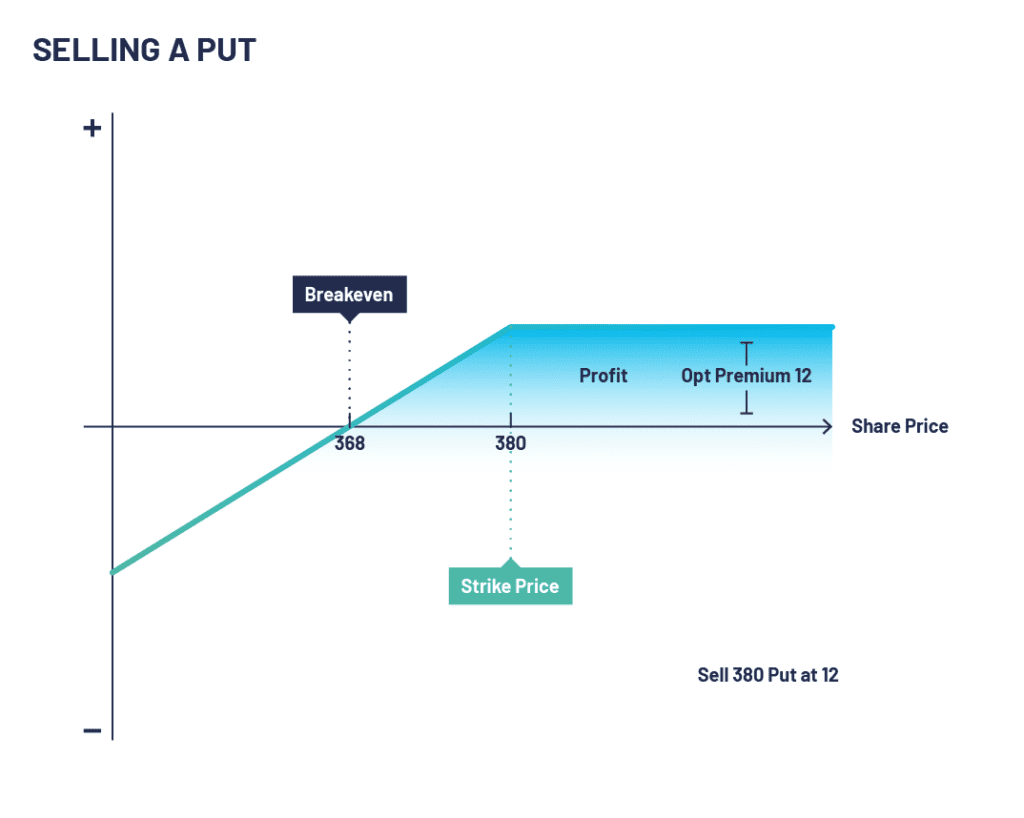

When selling puts with no intention of buying the stock, you want the puts to expire worthless. This option has a limited profit potential as the premium received is your maximum gain, but you have substantial potential risk if the stock goes down.

Given that markets generally trend upwards, some traders run this strategy as there is a good probability for success when selling very out-of-the-money puts.

A short put is also a good way to get potential exposure to a market or stock that you are interested in buying while taking in a premium. Some investors will sell a put with full intention to buy the stock if it reaches that lower level (strike price), effectively getting paid to place a “stop-in” order. In most cases, this is a very cost-effective way of gaining exposure to stock.

The Mechanics of Put Option Selling: Breaking the strategy down

Selling put options, often termed as ‘writing put options,’ is a strategy wherein an investor sells a put option. The writer (seller) of the put option receives a premium. In return, they take on the obligation to buy the underlying asset at the strike price if the buyer decides to exercise the option.

The process of put option selling can be outlined in three key steps.

The Initiation: You, as the seller, initiate a sell order on the option of a specific underlying asset with a chosen strike price and expiration date. In return for taking on the obligation, you receive the premium from the buyer.

The Waiting Game: Post-sale, one of three things can occur:

The price of the underlying asset stays above the strike price until expiration. The option expires worthless, and you keep the premium. This is the optimal outcome for you.

The price of the underlying asset falls below the strike price. The buyer exercises their right, and you’re obliged to buy the shares at the strike price. However, the premium received reduces your effective purchase price.

You can buy the same option back to close out your position if your view of the market changes.

The Outcome: Depending on the market movement and the buyer’s decision, you either get to keep the premium with no further obligations, or you purchase an asset at a potentially discounted price.

A short put is a good way to get potential exposure to a market that you are interested in buying while taking in a premium. Some investors will sell a put with full intention to buy the stock if it reaches that lower level (strike price), effectively getting paid to place a “stop-in” order. In most cases, this is a very cost-effective way of gaining exposure to stock.

Potential Benefits and Risks

The potential benefits of selling put options include:

Premium income generation, which can serve as a buffer in down markets.

Potentially owning an underlying asset at a lower cost basis, courtesy of the premium collected.

Conversely, the risks entail:

You might be obligated to buy the underlying asset at a price higher than the current market value.

The premium collected may not be sufficient to offset the decline in the asset’s price.

Selling Put Options in Different Market Scenarios

Contrary to popular belief, selling put options isn’t a strategy confined to bullish or neutral markets. It can indeed be beneficial across various market scenarios.

In a Bull Market

In a bull market, the risk of the option being exercised is lower as prices generally rise. As a result, you can reap benefits by collecting premiums with a lower risk of being assigned the shares.

In a Bear Market

In a bear market, the strategy of selling puts can provide you with an opportunity to buy a desired asset at a lower price. If the option is exercised, you acquire the underlying asset at a discount, effectively lowering your cost basis.

In a Neutral Market

In a neutral market, where the price of the asset remains relatively unchanged, the put options are likely to expire worthless. This allows you to pocket the premium without any obligation to purchase the underlying asset.

Volatility with Put Option Selling

Volatility is another significant factor that can influence the outcomes of selling put options.

High Volatility Environment

In periods of high volatility, option premiums tend to increase due to the heightened uncertainty about the direction of price movements. This environment can be favourable for option sellers, as they receive higher premiums for the options they write.

Low Volatility Environment

During periods of low volatility, premiums are generally lower, reducing the potential income from selling options. However, this can be mitigated by carefully choosing options with a higher implied volatility relative to their historical levels.

Selling Put Options: A Prudent Approach

For a successful put selling strategy, consider the following points:

Understand the Underlying Asset: Only write puts on assets you understand and wouldn’t mind owning.

Risk Assessment: Always be aware of the potential risks involved. The premium collected might not always be sufficient to offset significant declines in the asset’s price.

Exit Strategy: Establish your exit strategy upfront. If the market view changes, consider buying back the option to close the position.

Market Analysis: Keep an eye on market volatility. Higher volatility usually translates to higher premiums.

Hedging: Use put selling as a part of a larger, well-diversified portfolio strategy, rather than relying on it as a standalone tactic.

Short Put Summary

Selling put options, when used judiciously, can be a versatile strategy offering potential benefits in various market scenarios. Not only can it provide an additional income stream, but it also provides an opportunity to purchase desirable assets at a potentially lower cost. As with all trading strategies, understanding the risk-reward dynamics and maintaining a well-diversified portfolio is key to long-term success.

Configuration:

- Sell a put option

Outlook:

- Bullish to neutral stance

Target:

- The market to expire above the strike price of the option

Pros:

- Falling volatility

- Time decay

- Alternative to buying the underlying asset

Cons:

- Higher risk strategy

- Potential high loss if underlying asset goes to zero

- Can be exercised early if American style

Selling Put Options FAQs

What is a put option?

A put option is a contract that gives the holder the right, but not the obligation, to sell a specific number of shares of an underlying asset at a predetermined price (the strike price) before a set expiration date.

What does selling a put option mean?

Selling a put option, also known as writing a put option, refers to the act of creating a new option contract and selling it in the market. The seller of the put option receives a premium in exchange for taking on the obligation to buy the underlying asset at the strike price, should the buyer choose to exercise the option.

What are the potential benefits of selling put options?

The benefits of selling put options include generating premium income and the potential to own a desired asset at a lower cost basis, courtesy of the premium collected.

What are the risks involved in selling put options?

The risks include the obligation to buy the underlying asset at a price higher than the current market value if the option is exercised. In addition, the premium collected may not always be sufficient to offset the decline in the asset’s price.

Can selling put options be beneficial in all market conditions?

Yes, selling put options can be a viable strategy in all market conditions – bull, bear, or neutral. However, the approach and potential benefits vary depending on the market scenario.

How does market volatility impact the strategy of selling put options?

Market volatility has a direct impact on option premiums. In periods of high volatility, option premiums tend to increase, potentially benefiting the sellers. Conversely, in low volatility conditions, premiums are lower, which may reduce potential income from selling options.

What should be considered for a successful put selling strategy?

Factors such as understanding the underlying asset, risk assessment, having an exit strategy in place, analysing market volatility, and using put selling as part of a diversified portfolio strategy are crucial for successful put selling.