Covered Calls: A Comprehensive Guide to Options Trading Strategy

Covered calls are a popular options trading strategy that can generate income while reducing risk. Our comprehensive guide explains how to implement covered calls, how to manage risk, and provides -examples to help you get started.

What is a Covered Call?

Covered calls are an income-generating investment strategy that can help you enhance your portfolio returns while reducing overall risk. By selling call options against shares of stock that you already own, you can collect premium income while maintaining your long position in the underlying asset. This article will provide you with a comprehensive understanding of the covered call strategy and its mechanics, optimal conditions for its use, selecting the right stocks, and managing risks for maximum profit.

Covered calls are profitable within a defined range; profiting if the stock price drops by less than the amount of your sold call option, and remaining profitable if the stock moves up to or beyond the strike price of the call you sold. The maximum gain is realised if the stock price is at the strike price on expiry, the full value of the sold call is retained while the stock has achieved its maximum rise without being assigned.

How Covered Calls Work

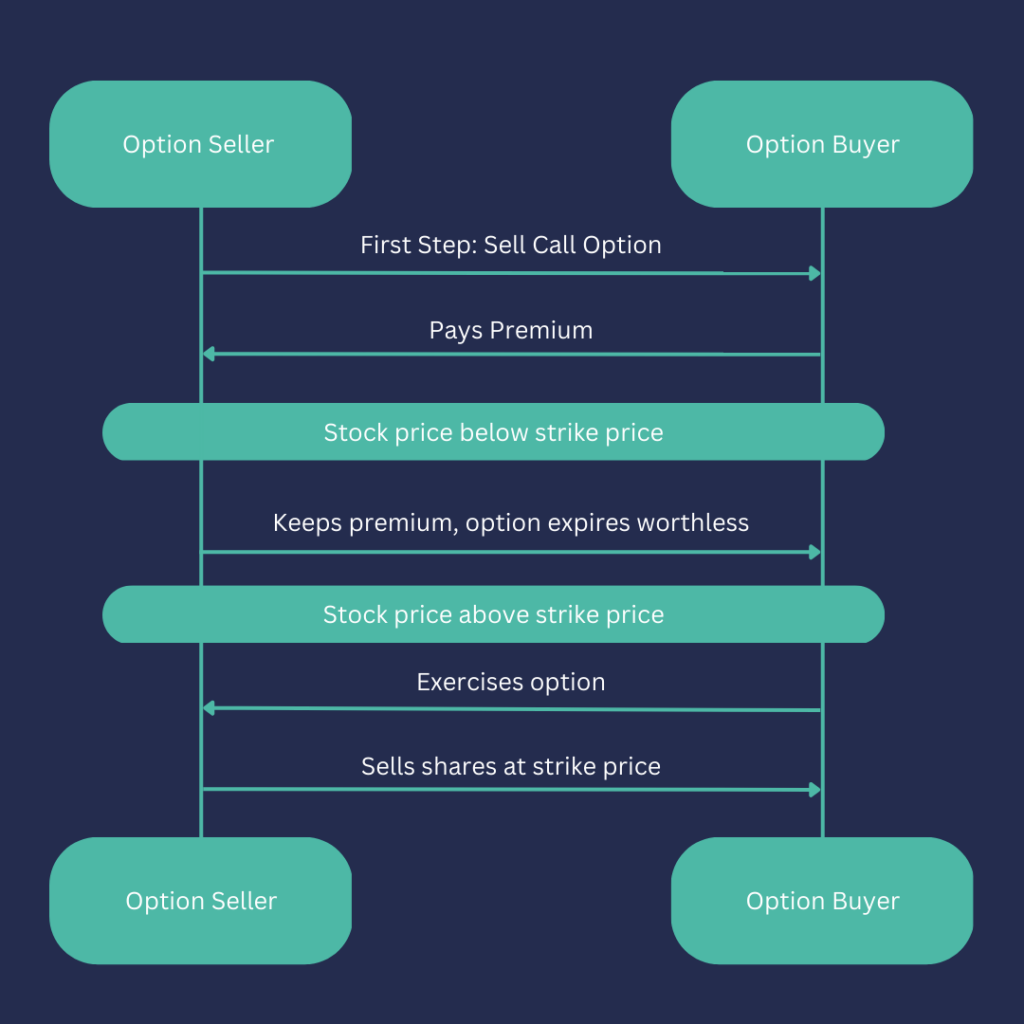

A covered call strategy involves two components:

- Owning at least 1000 shares of an underlying stock or the corresponding contract size.

- Selling a call option against those shares.

When you sell a call option, you receive a premium from the buyer. In return, you agree to sell your shares at a specified price, known as the strike price, before the option’s expiration date. If the stock’s price remains below the strike price, the option expires worthless, and you keep the premium as income. If the stock’s price exceeds the strike price, the option will likely be exercised, and you’ll be obligated to sell your shares at the strike price.

When to Use a Covered Call Strategy

Covered calls are best suited for the following market conditions:

Neutral or moderately bullish markets

In these conditions, stock prices tend to move sideways or experience slow growth. Covered calls can generate additional income from your stock holdings during these periods.

Lower-volatility stocks

Covered call premiums increase with higher implied volatility. However, high volatility can lead to unpredictable price movements, which may result in the call option being exercised. Lower-volatility stocks minimise this risk.

Covered Call Example

For example, you hold shares in a stock and believe in the long run this stock will do well. In the short term, your view is that the stock will be flat, but you would also consider selling the stock if the right terms were offered. You can sell a call option on this stock to generate extra income over the short term.

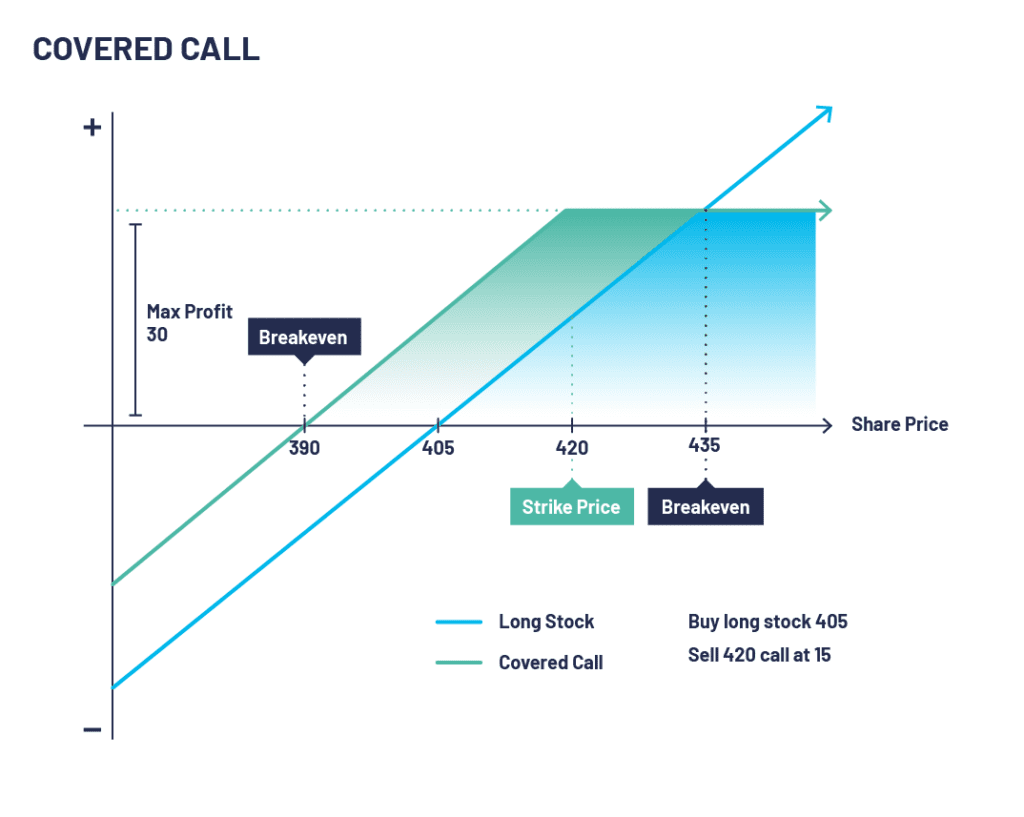

Let’s just say that XYZ Plc is trading at 405. If you sell a call option on XYZ Plc at a strike price of 420 at a premium of 15, you earn the premium from the option sale but also cap your upside potential to 420. One of these three things is going to happen with the position:

- XYZ Plc trades flat and remains below your strike price of 420 – the option will expire worthless, and you keep the 15p premium you took in from the option. By doing this, you have successfully outperformed the stock.

- XYZ Plc shares fall in price – the option expires worthless, you keep the premium, and again you outperform the shares. You may wish to repeat the strategy on a rolling basis

- XYZ Plc rises above 420 – your option is exercised (your shares sold at 420), and your upside is then capped at 420, plus the 15 premiums from selling the call option. Although this is still a profitable outcome it will not be as profitable if XYZ Plc trades above 435 (breakeven price) at the expiry of the call option

How to Select the Right Stocks

When selecting stocks for a covered call strategy, consider the following factors:

Quality

Focus on fundamentally strong companies with steady growth, low debt, and reliable earnings.

Dividend-paying stocks

Combining dividend income with option premiums can significantly enhance your overall returns.

Liquidity

Choose stocks with high trading volumes and options with narrow bid-ask spreads to ensure ease of entry and exit.

Choosing the Best Option Strike Price and Expiration Date

Selecting the right strike price and expiration date is crucial for maximising your covered call income.

Consider the following:

- Strike price: Choose an out-of-the-money (OTM) strike price, as it provides a balance between premium income and the potential for capital appreciation. In-the-money (ITM) options have higher premiums but limit capital gains, while further OTM options offer lower premiums but greater potential for stock price growth.

- Expiration date: Shorter-dated options, such as 30-45 days until expiration, allow you to collect premiums more frequently, capitalising on time decay. However, longer-dated options may offer higher premiums due to increased time value.

Managing Risks and Maximising Profits

- Set a target return: Determine the desired annualised return on your covered call strategy and select option contracts that help you achieve that goal.

- Monitor your positions: Keep a close eye on your stock holdings and option positions, adjusting your strategy as needed to respond to market changes or new opportunities.

- Use stop-loss orders: Implement stop-loss orders on your stock holdings to protect against significant declines in value. This can help you maintain a strong portfolio while still generating income from covered calls.

Advanced Covered Call Strategies

- Rolling options: If an option is about to expire worthless, you can “roll” it to a later expiration date or a different strike price. This allows you to collect additional premiums while maintaining your covered call position.

- Buy-write ETFs: Exchange-traded funds (ETFs) that employ a buy-write strategy can provide diversified exposure to covered calls. These ETFs typically hold a basket of stocks and sell call options against their holdings, distributing the premiums as income to shareholders.

- Collars: Combine a covered call with a protective put option to create a collar. This strategy limits both potential losses and gains, providing a defined range of outcomes for your investment.

Covered Call Summary

Configuration:

- Currently own the underlying asset

- Sell a call with a strike price near the current market price

Outlook:

- Neutral.

Target:

- You want the stock to remain as close to the strike price as possible without going above it at expiry

Pros:

- Can generate extra income from your underlying asset

- Benefits from time decay and falling volatility

Cons:

- Can restrict the upside potential of your underlying asset

- Short call can be exercised early if European style option

- Can be margin intensive if underlying asset rises sharply

Summary of a Covered Call

Covered calls are a powerful income-generating strategy that can help you enhance your investment portfolio returns and reduce risk. By understanding the mechanics of covered calls, selecting the right stocks, and managing risks effectively, you can optimise your covered call strategy for maximum profit. Additionally, incorporating advanced strategies such as rolling options, buy-write ETFs, and collars can further improve your investment outcomes. By mastering the art of covered calls, you can take control of your financial future and achieve long-term investment success.

Covered Call FAQs

What is a covered call?

A covered call is an options trading strategy in which an investor holds a long position in an underlying asset (such as a stock) and sells call options on that same asset. The investor “covers” the position by owning the underlying asset, hence the name “covered” call.

How does a covered call work?

In a covered call strategy, the investor sells call options against their long position in the underlying asset. By selling the call options, the investor receives a premium, which provides some downside protection for the underlying asset. If the price of the underlying asset remains below the strike price of the call options, the investor keeps the premium and can repeat the process if they wish. If the price rises above the strike price, the investor may be obligated to sell the asset at the strike price.

What are the benefits of using covered calls?

Covered calls offer several potential benefits. They can generate income through the premiums received from selling call options. Additionally, they can provide a form of downside protection by reducing the effective purchase price of the underlying asset. Covered calls can also be used to potentially enhance returns in a neutral or slightly bullish market environment.

What are the risks associated with covered calls?

The main risk of covered calls is the potential opportunity cost. If the price of the underlying asset rises significantly above the strike price of the call options, the investor may miss out on potential gains. Additionally, there is still downside risk if the price of the underlying asset declines, although the premium received from selling the call options provides some buffer.

How do I select the strike price and expiration date for a covered call?

The choice of strike price and expiration date depends on the investor’s goals and market outlook. A lower strike price will provide a higher premium but offers less potential for capital gains. A higher strike price provides a lower premium but allows for greater potential capital gains. The expiration date should align with the investor’s time horizon and market expectations.

Can I buy back the call options before expiration?

Yes, you can buy back the call options at any time before expiration. This action is known as “buying to close” the position. Buying back the call options eliminates your obligation to sell the underlying asset at the strike price and allows you to retain ownership of the asset.