A Comprehensive Guide to Hedging with Options: Strategies and Techniques for Effective Risk Management

Hedging is a risk management technique used by traders and investors to protect their portfolios against adverse market movements.

Introduction to Hedging with Options

Options are a powerful tool for hedging they are financial instruments that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. By implementing appropriate options strategies, you can limit your losses, protect your gains, and manage your risk exposure more effectively.

Commonly, a hedge would perform inversely to the vulnerable underlying asset an investor is trying to protect. In the event of a negative price move in the asset, the hedge should move in the opposite direction, counteracting any losses.

Key Options Terminology

Before diving into specific hedging strategies, it’s important to understand some key options terminology:

- Call Option: A call option grants the buyer the right to purchase an underlying asset at a predetermined price (called the strike price) before the option’s expiration date.

- Put Option: A put option grants the buyer the right to sell an underlying asset at a predetermined price before the option’s expiration date.

- Option Premium: The price paid by the buyer to the seller for the option contract.

- In-the-Money (ITM): An option is in-the-money when exercising it would result in a profit.

- At-the-Money (ATM): An option is at-the-money when the strike price is equal to the current market price of the underlying asset.

- Out-of-the-Money (OTM): An option is out-of-the-money when exercising it would result in a loss.

Ways to Hedge with Options

Options can be used to hedge various types of financial risks. Some common examples of what you can hedge with options include:

Equity risk

Options can be used to hedge against the risk of a decline in the value of stocks or stock portfolios. For example, you can purchase put options on individual stocks or stock market indices to protect against potential losses.

Foreign exchange risk:

Options can be used to hedge against fluctuations in currency exchange rates. Companies that engage in international trade often use options to hedge their exposure to foreign currency risk.

Interest rate risk

Options can be used to hedge against changes in interest rates. For instance, you can use interest rate options to protect against rising interest rates if you have a variable-rate loan or bond.

Commodity price risk

Options can be used to hedge against price fluctuations in commodities such as oil, natural gas, agricultural products, or precious metals. This allows producers, consumers, and traders to protect themselves from adverse price movements.

Volatility risk

Options can be used to hedge against changes in market volatility. This is often done through strategies like buying or selling options to benefit from expected changes in volatility levels.

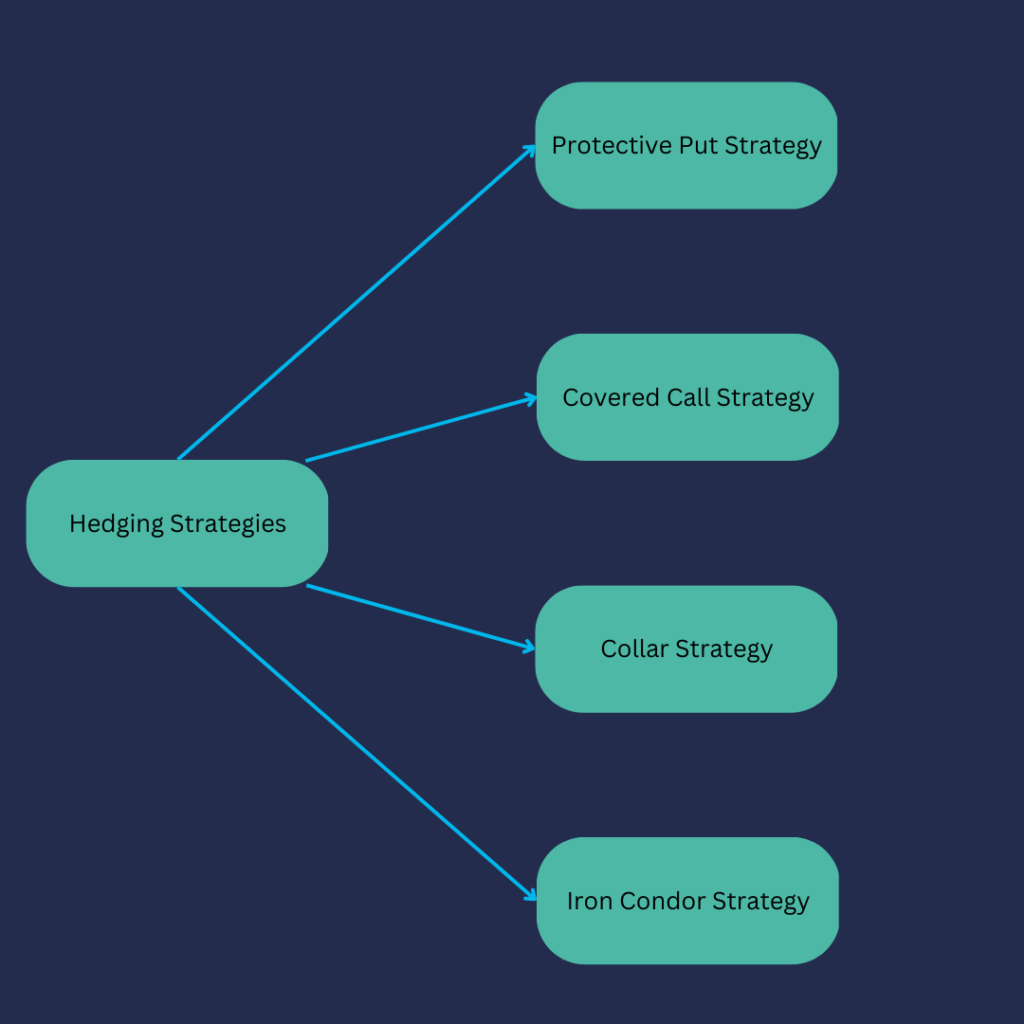

Hedging Strategies with Options

There are several popular hedging strategies that utilise options to manage risk. Here are four key strategies that you can consider for your portfolio.

Protective Put Strategy

A protective put strategy involves purchasing a put option to protect a long position in the underlying asset. This strategy provides downside protection, as the put option increases in value if the asset’s price falls. The maximum loss is limited to the difference between the asset’s purchase price and the put option’s strike price, plus the option premium.

To implement a protective put strategy:

- Purchase the underlying asset, if not already owned.

- Buy a put option with a strike price close to the current market price of the asset.

Covered Call Strategy

A covered call strategy involves selling a call option against an existing long position in the underlying asset. This strategy generates income from the option premium and provides limited downside protection. The maximum profit is capped at the difference between the asset’s purchase price and the call option’s strike price, plus the option premium.

To implement a covered call strategy:

- Purchase the underlying asset, if not already owned.

- Sell a call option with a strike price above the current market price of the asset.

Collar Strategy

A collar strategy combines a protective put and a covered call to create a “collar” around the underlying asset’s price. This strategy provides downside protection from the put option and generates income from the call option premium, effectively limiting both the potential loss and profit.

To implement a collar strategy:

- Purchase the underlying asset, if not already owned.

- Buy a put option with a strike price below the current market price of the asset.

- Sell a call option with a strike price above the current market price of the asset.

Iron Condor Strategy

An iron condor strategy is a neutral options strategy that involves selling an out-of-the-money call and put option, while simultaneously buying a further out-of-the-money call and put option on the same underlying asset and with the same expiration date. This strategy aims to profit from the underlying asset’s price remaining within a specific range, while limiting potential losses.

To implement an iron condor strategy:

- Sell an out-of-the-money call option with a strike price above the current market price of the asset.

- Buy a further out-of-the-money call option with a higher strike price than the call option sold in step 1.

- Sell an out-of-the-money put option with a strike price below the current market price of the asset.

- Buy a further out-of-the-money put option with a lower strike price than the put option sold in step 3.

Choosing the Right Hedging Strategy

Selecting the appropriate hedging strategy depends on your market outlook, risk tolerance, and investment goals. Consider the following factors when choosing a strategy:

Market Outlook

If you expect the market to remain stable, an iron condor strategy may be suitable. If you anticipate a potential decline in the asset’s price, a protective put or collar strategy may be more appropriate.

Risk Tolerance

Determine your risk tolerance and choose a strategy that aligns with your level of acceptable risk. Protective puts and collar strategies offer more downside protection, while the iron condor strategy relies on the asset’s price staying within a specific range.

Investment Goals

Consider your investment goals when selecting a hedging strategy. If you seek to generate income, a covered call or iron condor strategy may be more fitting. If your priority is to protect your long position, a protective put or collar strategy may be more suitable.

Summary of Hedging Strategies

An Example to Hedging with Options

Let’s consider an existing position in XYZ PLC Stock which was purchased at 405.

The investor feels that the stock may move lower due to market conditions and thus wants to protect themselves from any adverse move.

The current market price of XYZ is 395 so the investor buys a 370 put in the market as a hedge. A negative news article is released regarding XYZ and the stock tumbles to 280.

The investor now has the option to exercise their right to sell their position of XYZ at 370, significantly higher than the prevailing market price of 280; or simply to sell the option and use the profits to counteract the move in the stock.

This is a common use of options for protecting a portfolio. See Protective Put for more detail.

Hedging with Options Summary

Hedging with options provides investors and traders with a powerful tool to manage risk and protect their portfolios against adverse market movements. By implementing the appropriate options strategies, such as protective puts, covered calls, collars, or iron condors, you can limit your losses, protect your gains, and manage your risk exposure more effectively. Choose a hedging strategy that aligns with your market outlook, risk tolerance, and investment goals to ensure the best possible outcome for your portfolio.

Hedging with Options FAQs

What is hedging with options?

Hedging with options is a risk management strategy where options contracts are used to offset potential losses or gains in an underlying asset. It involves taking positions in options that act as insurance against adverse price movements.

How does hedging with options work?

Hedging with options involves buying or selling options contracts to limit potential losses or gains in an underlying asset. By taking offsetting positions, investors can protect their portfolio from unfavourable price movements while still allowing for potential upside.

What are the advantages of hedging with options?

Hedging with options offers several advantages. It allows investors to protect their portfolios against adverse price movements, reduce downside risk, and limit potential losses. It also provides flexibility in managing risk, as options can be adjusted or closed out before expiration.

What are the types of option strategies used for hedging?

There are various option strategies used for hedging, including buying put options, selling call options, employing collars, and using protective puts. Each strategy has its own characteristics and is suitable for different hedging objectives.

How can options be used to hedge against price fluctuations?

Options can be used to hedge against price fluctuations by taking positions that offset potential losses in the underlying asset. For example, buying put options can provide downside protection, while selling call options can limit upside potential.

What are some considerations when hedging with options?

When hedging with options, it’s important to consider factors such as the cost of the options, the expiration date, the strike price, and the desired level of protection. Understanding the market conditions and the risks associated with options trading is also crucial.

Can options be used for hedging in any market?

Yes, options can be used for hedging in various markets, including stocks, commodities, currencies, and indices. However, it’s important to understand the characteristics and risks specific to each market before implementing hedging strategies.

Are there any risks involved in hedging with options?

Yes, there are risks involved in hedging with options. Options contracts have expiration dates, and if the price movements are not as expected, the options can expire worthless, resulting in a loss of the premium paid. Additionally, options trading carries inherent risks related to market volatility and liquidity.