Bid and Ask Price

You may be asking yourself what does Bid and Ask price mean, or why is the Bid and Ask price so different. Our detailed guide explains these differences and aims to improve your understanding.

The Meaning of Bid and Ask in Market Trading

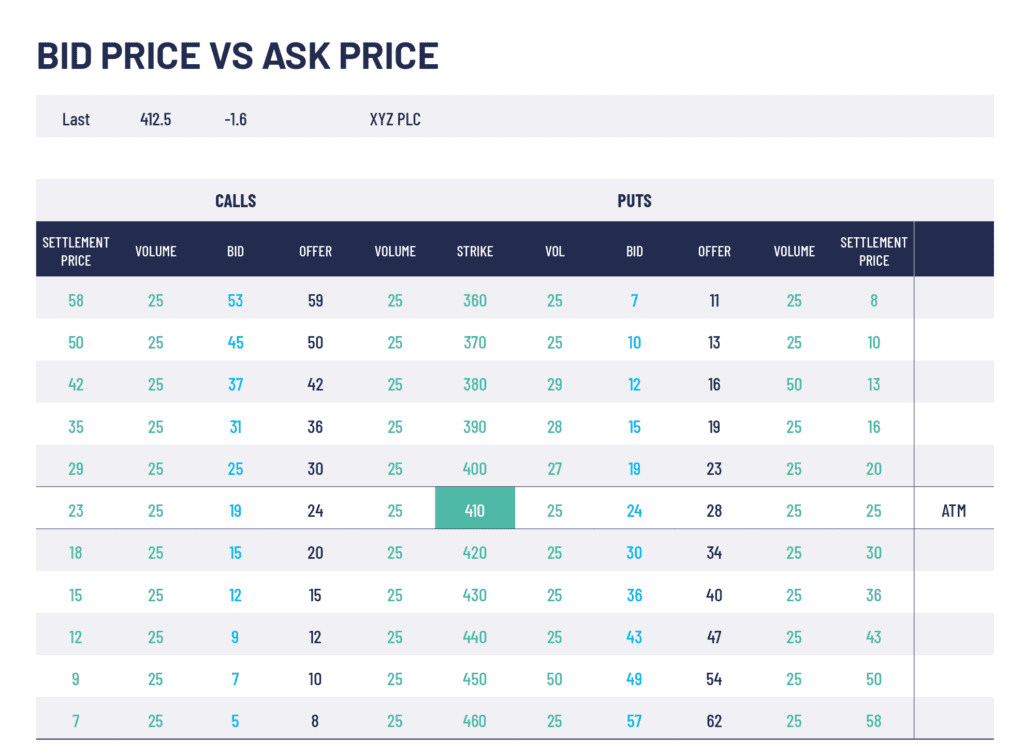

The bid and ask price refers to the two way quote given on all exchanges and are normally the best potential prices to trade at. The market is made up of many different participants but at its simplest, the highest bid (a price at which you can sell) and the lowest offer (the price at which you can buy) determine the current bid and ask (or ‘offer’).

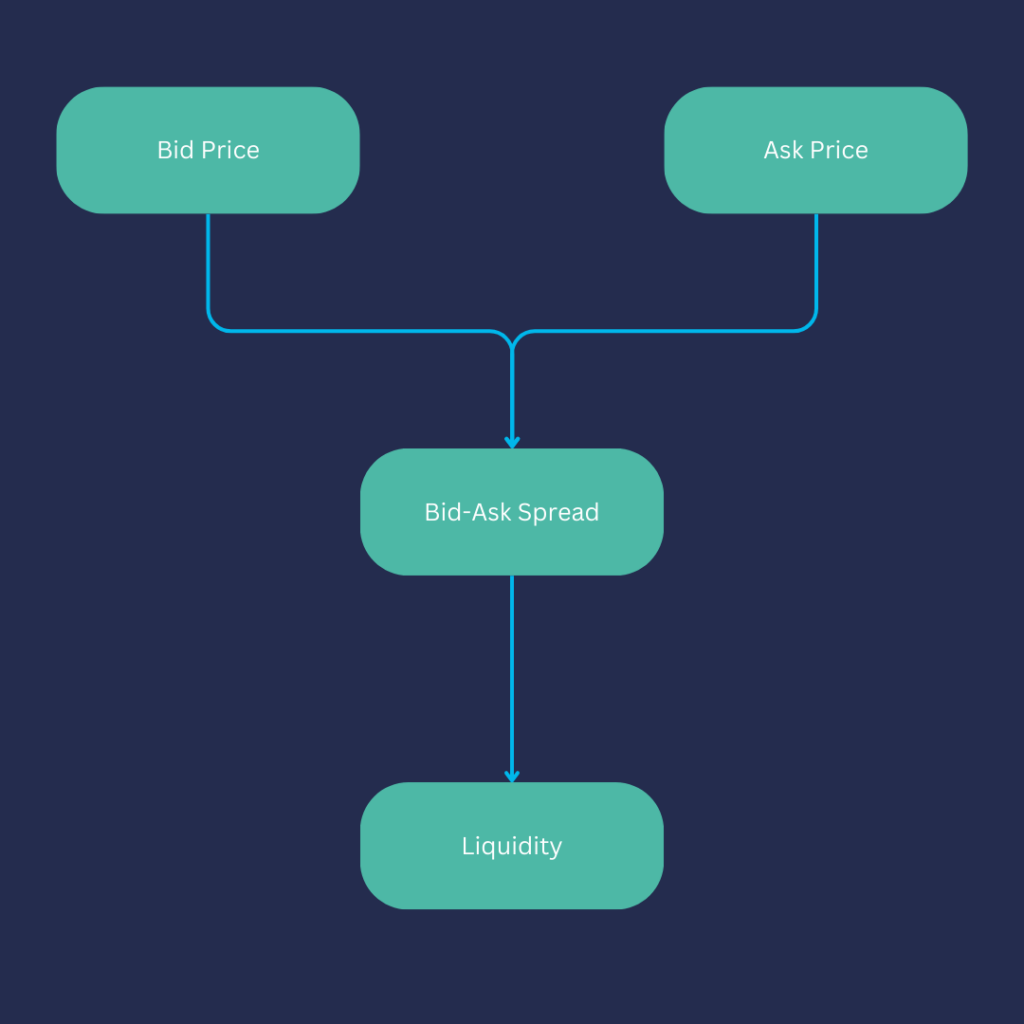

The difference between the bid and ask prices is commonly known as the Spread. It is normally a good sign of liquidity in that product if the spread is low (sometimes also referred to as ‘narrow’ or ‘tight’).

It is easy to get the bid and ask price confused due to the way they are named, but once you understand a few basic terms it should become clear.

Bid Price

The bid price is the highest price for which somebody (other market participants or market makers) is willing to bid you (to buy something). As a trader, you will look at the bid price when you SELL a product.

Ask Price

The ask price (also known as the offer) is the lowest price for which somebody is willing to sell something to you, hence it is the lowest price they ‘ask’ you to pay or ‘offer’ the product to you. So, as a trader, you will look at the ask price as the price you pay to BUY a product.

In addition to the bid and ask price, you will see the volumes of each bid and ask price available for most products. This shows how much quantity of the product is available at the price being shown. These are more commonly referred to as the “bid size” and “ask size”.

How is the Bid and Ask Price Determined?

The bid and ask prices are primarily determined by the forces of supply and demand in the market. If a particular asset’s demand surpasses its supply, the bid price tends to increase. Conversely, if supply exceeds demand, the bid price may decrease.

The ask price follows a similar pattern but in the opposite direction. As demand for an asset grows, sellers can command higher prices, leading to an increase in the ask price. On the other hand, when supply exceeds demand, sellers may need to decrease their ask price to attract buyers.

External Influences on Bid and Ask Prices

Various external factors can also influence the bid and ask prices of a security. These may include market news, economic indicators, changes in investor sentiment, and geopolitical events, among others. These factors can affect traders’ perceptions of a security’s value, leading to changes in bid and ask prices.

The Impact of Liquidity on Bid and Ask Prices

Liquidity can significantly impact the determination of bid and ask prices. In a highly liquid market, where there are many buyers and sellers, the bid-ask spread tends to be narrow. This is because competition among market participants often leads to bid and ask prices being close to each other. In contrast, in a low liquidity market, the bid-ask spread may widen due to a lack of competition.

The Role of Bid and Ask in Stock Markets

In the stock market, the bid and ask determines the price at which a stock can be bought or sold at any given moment. When you decide to buy a stock, you pay the ‘ask’ price. Conversely, if you wish to sell a stock, you’d receive the ‘bid’ price.

The bid-ask spread, defined as the difference between these two prices, is a key indicator of the stock’s liquidity. A smaller spread often implies a more liquid market, where buyers and sellers are in close agreement on price. Conversely, a wider spread may signal a less liquid market, which could involve more price risk for traders.

Bid and Ask in Bonds and Options

Bond and options markets also rely on the bid and ask system. In bond markets, these quotes represent the most favourable terms at which you can buy or sell a bond. Options markets, too, use bid and ask prices to indicate the rates at which an option contract can be bought or sold.

Market Makers and the Bid-Ask Spread

Market makers play a significant role in managing the bid-ask spread. As official intermediaries between buyers and sellers, they use their own inventory (book) to meet demand, thus helping to maintain liquidity and keep an active quote while following exchange rules. Market Makers will look to make a profit on the bid-offer spread.

Bid and Ask Price Summary

Understanding the bid and ask prices, along with the bid-ask spread, is fundamental to successful trading. These concepts drive the mechanics of buying and selling in financial markets, making them essential knowledge for any trader or investor. By comprehending how these prices interact, one can make more informed decisions and potentially increase the likelihood of profitable trades.

Bid and Ask Price FAQs

What is a bid price?

The bid price is the highest price that a buyer is willing to pay for a particular security or asset. It represents the demand side of the market and is typically lower than the ask price.

What is an ask price?

The ask price is the lowest price at which a seller is willing to sell a security or asset. It represents the supply side of the market and is typically higher than the bid price.

What is the bid-ask spread?

The bid-ask spread is the difference between the bid price and the ask price of a security or asset. It represents the transaction cost or the profit margin for market makers. A narrower spread indicates higher liquidity, while a wider spread suggests lower liquidity.

Why is there a difference between the bid and ask prices?

The bid and ask prices differ because of the inherent market forces of supply and demand. Buyers are generally willing to pay less for an asset, while sellers expect to receive more. This difference accounts for the bid-ask spread.

How are bid and ask prices determined?

Bid and ask prices are determined by market participants based on their assessment of the value and prospects of a security or asset. The forces of supply and demand in the market influence these prices, along with other factors such as liquidity, order flow, and market conditions.

Can bid and ask prices change?

Yes, bid and ask prices can change frequently throughout the trading day as new orders are placed and executed. Market conditions, news events, and changes in investor sentiment can all impact bid and ask prices, leading to fluctuations in the market.

What is the significance of bid and ask prices for traders and investors?

Bid and ask prices are crucial for traders and investors as they determine the entry and exit points for trades. The bid price is important for sellers looking to sell at the best possible price, while the ask price is vital for buyers seeking to buy at the lowest possible price.

How can I interpret the bid-ask spread?

The bid-ask spread provides insights into the liquidity and efficiency of a market. A narrower spread suggests a liquid market with tight competition between buyers and sellers. Conversely, a wider spread may indicate a less liquid market with fewer participants.

Are bid and ask prices the same for all securities and assets?

No, bid and ask prices can vary significantly across different securities and assets. Highly liquid and actively traded securities typically have tighter bid-ask spreads, while less liquid or thinly traded assets may have wider spreads.

How can I make use of bid and ask prices in my trading decisions?

Traders often consider bid and ask prices when determining the optimal price to buy or sell a security. They may use limit orders to specify the desired bid or ask price and wait for the market to reach those levels before executing a trade. Additionally, monitoring bid and ask prices can provide insights into market sentiment and potential price movements.