Bull Put Spread

What is a Bull Put Spread?

The bull put spread is a more advanced options strategy, utilised when traders have a moderately bullish outlook on the underlying asset. It is a credit spread, implying that traders receive a net premium when they initiate the trade. The construction involves two put options—a short put and a long put, with the short put’s strike price higher than the long put.

This is a moderately bullish strategy that benefits from the protection of capping your maximum loss with the trade-off being you have to pay for this protection.

The maximum profit potential of the trade is the net credit received. The maximum loss potential of the trade is easily calculated. Simply take the difference between strike prices and minus the net premium received for the put spread.

This trade is sometimes known as selling a put spread.

When would you use this strategy?

If you think the market will rise but want protection in case your assumption is incorrect and you want to cap your potential losses. If you don’t want to take up the underlying stock it’s prudent to sell put spreads to lock in what you’re able to afford to lose.

The Mechanics of a Bull Put Spread

When setting up a bull put spread, traders sell (or “write”) one put option while concurrently buying another put option with the same expiration date but at a lower strike price. The premium received from selling the higher strike put option is greater than the premium paid for the lower strike put option. Therefore, the traders receive a net credit to their account at the start of the trade.

Employing Risk Management

Just like any trading strategy, a bull put credit spread requires careful risk management:

Monitor the Underlying Asset:

Keep an eye on the asset’s price movements. If the asset’s price is falling towards your short put’s strike price, it might be wise to adjust your position or exit the trade.

Stay Informed:

Stay updated about the market news and any significant events that may affect the asset’s price.

Diversify:

Don’t put all your eggs in one basket. It’s always wise to spread your investments across different assets to mitigate risk.

Advantages of a Bull Put Spread

There are several reasons why the bull put spread is a favourite among options traders:

Income Generation:

The primary motive for employing this strategy is to generate income. Traders receive a premium upfront that can be substantial, depending on the chosen strike prices and the volatility of the underlying asset.

Defined Risk:

The potential loss in a bull put spread is limited to the difference between the strike prices of the two put options, less the net premium received.

Flexibility:

Traders can adjust the risk/reward profile of the spread by altering the strike prices of the involved options.

Considerations for Selecting Strike Prices

While constructing a bull put spread, the choice of strike prices significantly impacts the trade’s potential profits and losses. A wider spread between the strike prices will increase both the potential maximum profit (the credit received) and the maximum risk. On the contrary, a narrow spread results in lower potential profit but also reduces the maximum risk.

Incorporating Volatility into the Strategy

Options prices are significantly influenced by the implied volatility of the underlying asset. Typically, the bull put spread strategy benefits from a decrease in implied volatility. When the implied volatility decreases after the trade has been initiated, it reduces the spread between the two option prices, potentially allowing the trader to close the spread for a lower debit, thus realising a profit.

The Impact of Expiration Time

The expiration time plays a crucial role in a bull put spread. A longer expiration time increases the risk as the underlying asset has more time to move against the position. However, options with longer expiration times also command higher premiums, offering a potentially larger initial credit. Traders should carefully consider their risk appetite and profit goals when selecting the expiration date.

Bull Put Spread Example

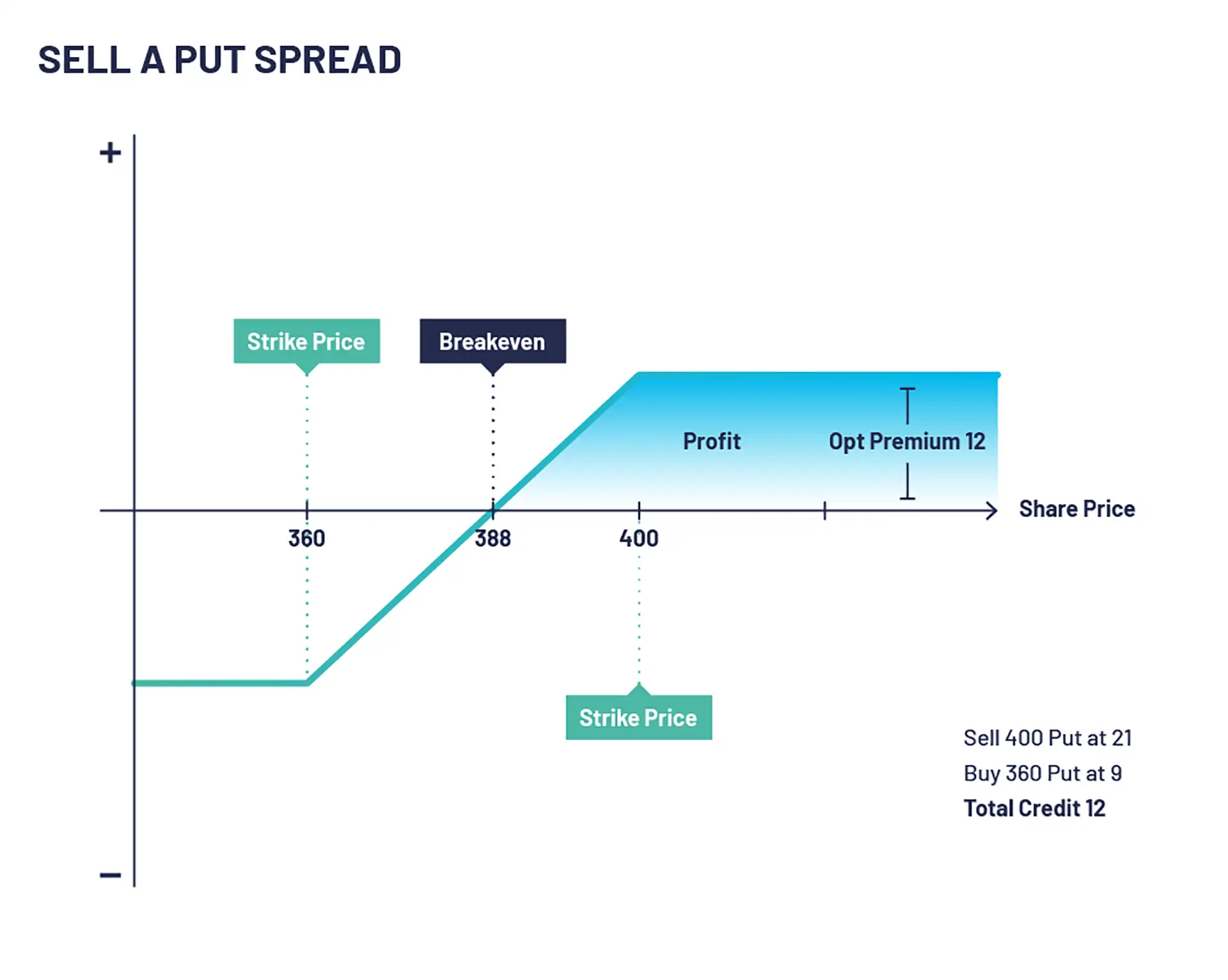

Let’s look at selling a put spread example. XYZ is trading at 412. An options trader executes selling a put spread by selling a 400 put at 21 and buying a 360 put at 9. The net credit received and maximum profit on this trade is 12 (21-9).

If the stock closes above 400 both options expire worthless and the initial credit received is retained.

If XYZ PLC stock falls and is trading below 360 on expiry of the option the maximum loss on this trade is realised. Technically you would be exercised on the 360 puts selling the shares for 360 while simultaneously buying the shares at 400 with the exercise of the 400 put locking in a 40 loss minus the credit received If the stock closes below 360. In practise you would normally buy your put spread back for close to 40 being the difference between the two strike prices.

Bull Put Spread Summary

In conclusion, the bull put spread is a powerful tool in the hands of a knowledgeable trader. Its ability to generate income, coupled with a defined risk profile and high flexibility, makes it an attractive strategy. But remember, risk management is paramount.

Configuration:

- Sell a put option.

- Buy a put option with a lower strike and the same expiry date.

Outlook:

- Anticipate a bullish or neutral move. Volatility falling.

Target:

- Underlying stock price expires above strike of the sold put option.

Pros

- Limited risk strategy.

- Takes advantage of time decay, as both options near expiry the value of the spread becomes cheaper to buyback.

- Lower margin requirement compared to selling naked puts.

Cons

- Can be exercised early if American style.

- Limited profit potential.

- Can be margin intensive if the underlying asset rises sharply.

Bull Put Spread FAQs

What is a Bull Put Spread?

A Bull Put Spread is an advanced options trading strategy that involves selling a put option and buying another put option at a lower strike price with the same expiration date. This strategy is used when a trader has a moderately bullish outlook on the underlying asset.

How does a Bull Put Spread generate income?

The Bull Put Spread generates income from the net premium received when the strategy is initiated. This premium is the result of the difference between the premium received from selling the higher strike put and the premium paid for buying the lower strike put.

What is the risk associated with a Bull Put Spread?

The maximum risk of a Bull Put Spread is the difference between the strike prices of the two put options, minus the net premium received. This risk occurs if the price of the underlying asset falls below the strike price of the long put option.

How does a Bull Put Spread benefit from volatility?

A Bull Put Spread benefits from a decrease in implied volatility. A drop in volatility after the initiation of the trade can reduce the spread between the two options prices, potentially allowing the trader to close out the spread for a profit.

When should a trader use a Bull Put Spread strategy?

Traders typically employ a Bull Put Spread strategy when they have a neutral to moderately bullish outlook on the market or a particular security. It’s ideal when the trader expects the price of the underlying asset to rise, remain stable, or even fall slightly.

How do you select the strike prices for a Bull Put Spread?

The strike prices for a Bull Put Spread are chosen based on the trader’s risk tolerance and market outlook. A wider spread between the strike prices increases both the potential maximum profit and the maximum risk, whereas a narrow-spread results in lower potential profit and risk.

How does the expiration date impact a Bull Put Spread?

The expiration date plays a crucial role in a Bull Put Spread. A longer expiration time increases the risk as the underlying asset has more time to move against the position. However, options with longer expiration times command higher premiums, providing a potentially larger initial credit.

Can a Bull Put Spread result in a loss?

Yes, a Bull Put Spread can result in a loss if the price of the underlying asset falls below the strike price of the long put option. This is why it’s important to implement risk management tactics and to monitor the market continually.

How can you close a Bull Put Spread position?

You can close a Bull Put Spread position either by letting it expire, or by buying it back. If the price of the underlying asset stays above the strike price of the short put option until expiry, both options will expire worthless, and you’ll keep the entire premium received upfront. If the underlying asset’s price is moving closer to the short put’s strike price, you might want to buy back the spread to avoid potential losses.

Check out our other articles