Understanding Implied Volatility and Historical Volatility in Options Trading

What is Volatility?

Volatility (often referred to as vol) is a very important factor that affects options. Individuals can often neglect volatility which can lead to the difference between profit and loss with a position.

Volatility measures the risk of an asset and its ability to swing around its mean price. Volatility is the rate at which the price increases or decreases for a given set of times. If the pricd of an asset fluctuates rapidly in a short amount of time, then it is said to have high volatility. If the price of an asset fluctuates by only a small amount over a longer period, then it is said to have low volatility.

Volatility is used in option pricing formulas to work out the fluctuations in the returns of the underlying assets. Volatile assets are usually considered riskier than less volatile ones, and the price of the related options is usually higher to reflect the greater range of trading opportunities and outcomes inherent in volatile markets.

Volatility itself can be broken down into two parts: Historical Volatility, which is often referred to as statistical or realised volatility; and Implied Volatility.

What is Historical Volatility?

Historical volatility is the standard deviation of historical returns of an asset over a set period. The important thing to remember is that this is historical. When historical volatility rises, a security’s price will also move more than normal, meaning that there is an expectation that something has or may change. If historical volatility starts to drop, it means any uncertainty has dissipated.

What is Implied Volatility?

Implied Volatility (IV) is a critical component in the world of option trading. It is a metric that reflects the market’s view of a security’s potential future volatility. Implied Volatility is derived from the option’s price and provides a measure of the market’s expectation of a stock’s future price fluctuations. Simply put it allows traders to see how volatile a market may be going forward.

Implied Volatility Vs Historical Volatility

Implied Volatility and Historical Volatility are two different yet closely related concepts. While IV is forward-looking, projecting future volatility, Historical Volatility (HV) measures past price changes. Though they can sometimes move in sync, discrepancies can occur, offering potential opportunities for astute traders. An option might be under or overpriced if the IV significantly differs from the HV, presenting potential trading opportunities.

Importance of Implied Volatility in Option Pricing

Implied volatility is instrumental in option pricing. It’s the only factor in the Black-Scholes model – the most widely used option pricing model – that isn’t directly observable. Instead, it’s implied by the market’s option prices. High implied volatility often indicates a greater expected fluctuation in the stock price, which translates into higher option prices due to the increased risk.

How to Calculate Implied Volatility

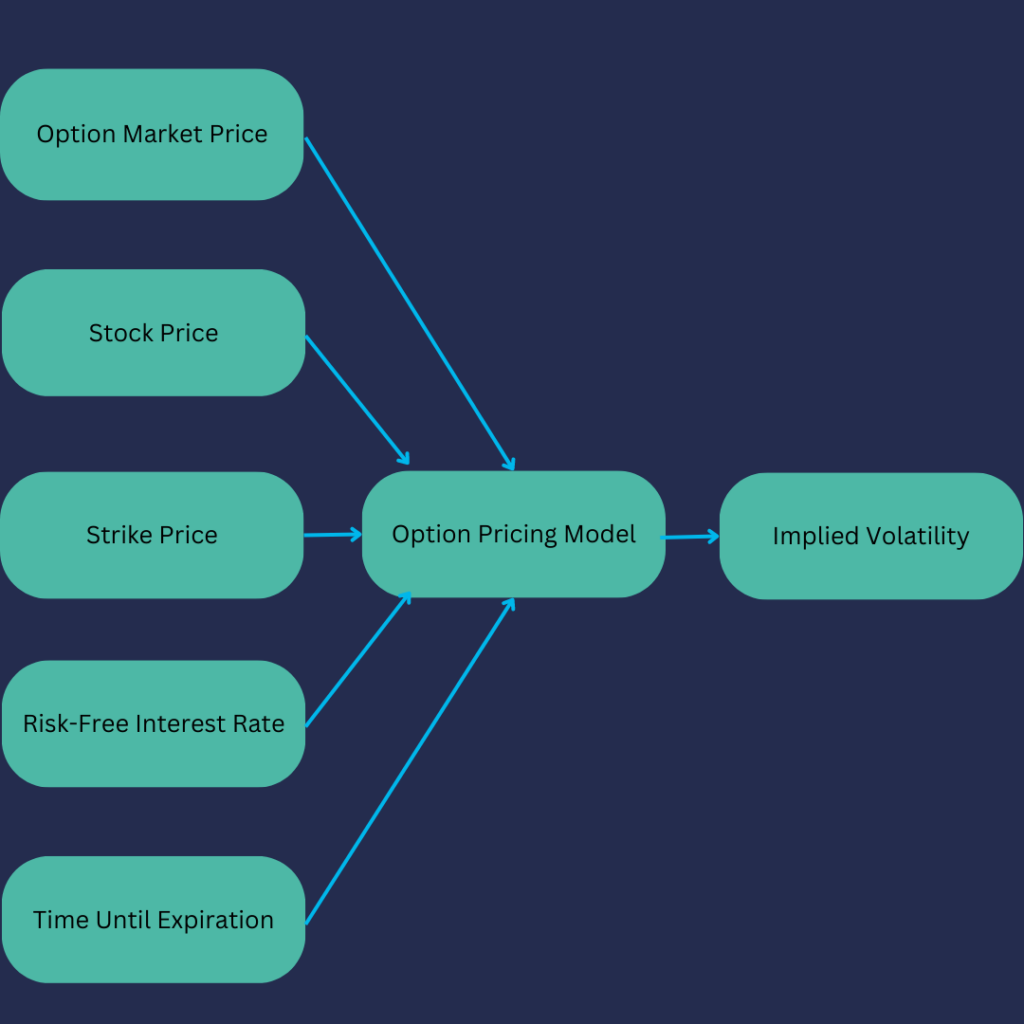

Calculating Implied Volatility is an iterative process because it is a value derived from the option’s current market price. Calculating it requires using the Black-Scholes model or a similar option pricing model. By inputting the option’s market price, the underlying stock’s price, the strike price, the risk-free interest rate, and time until expiration, the implied volatility value is derived.

Implied Volatility and Option Strategies

In the world of options trading, different strategies can be employed based on the level of implied volatility. For instance, strategies such as long straddles or long strangles might be more effective in high IV environments. These strategies involve buying both a call and a put option, profiting from significant price movements in either direction. On the other hand, in low IV scenarios, strategies like short vertical spreads or iron condors, which involve selling options, might be more suitable due to the lower risk of large price swings.

Implied Volatility: The IV Rank and IV Percentile

The IV Rank and IV Percentile are two tools that traders use to interpret IV. The IV Rank gives a snapshot of where the current IV stands relative to its 52-week high and low. The IV Percentile, on the other hand, provides a more nuanced view, indicating the percentage of days in the past year that the IV was lower than the current level.

The Strategic Significance of Implied Volatility

In conclusion, understanding implied volatility is essential for anyone involved in options trading. It plays a significant role in option pricing and can greatly influence the selection of appropriate trading strategies. By analysing and interpreting implied volatility, traders can make more informed decisions and potentially find lucrative trading opportunities.

Volatility FAQs

What is implied volatility?

Implied volatility is a financial concept that refers to the estimated volatility of an underlying asset’s price, as implied by the prices of its options in the market.

How is implied volatility different from historical volatility?

Implied volatility is based on the market’s expectations of future price movements, while historical volatility is calculated based on past price movements of the underlying asset.

What factors influence implied volatility?

Several factors can influence implied volatility, including supply and demand dynamics for options, market sentiment, economic indicators, company news, and geopolitical events.

Why is implied volatility important in options trading?

Implied volatility is crucial in options trading because it affects the price of options. Higher implied volatility generally leads to higher option premiums, reflecting greater uncertainty and potential for larger price swings.

How is implied volatility measured?

Implied volatility is typically expressed as a percentage and can be calculated using various pricing models, such as the Black-Scholes model or the Implied Volatility Index (VIX).

What does it mean if implied volatility is high?

High implied volatility suggests that the market expects significant price fluctuations in the underlying asset. It often indicates increased uncertainty or the anticipation of potential market-moving events.

What does it mean if implied volatility is low?

Low implied volatility implies that the market expects relatively stable price movements in the underlying asset. It may indicate a period of calm or a lack of anticipated market-moving events.

How can implied volatility be used in options trading strategies?

Traders can use implied volatility to assess the attractiveness of options prices, implement strategies like volatility spreads, or determine the likelihood of achieving certain profit targets based on market expectations.

Can implied volatility predict future price movements?

Implied volatility is not a direct predictor of future price movements, but it reflects the market’s expectations. It can be used as an indicator of market sentiment and uncertainty, which may influence future price trends.

Are there any limitations to implied volatility?

Yes, implied volatility is based on market expectations and can be subject to overestimation or underestimation. It’s important to consider other factors and use additional analysis techniques when making trading decisions.