Buy Iron Condor

How to Buy an Iron Condor

The iron condor consists of four options: two calls and two puts. A simple way of looking at an iron condor is a position consisting of buying a call spread and buying a put spread. All four legs of the strategy will have the same expiration date.

Buying an iron condor has no directional bias but requires a large enough move in the underlying asset to exceed the break-even price. A debit is paid when the position is opened and the risk is limited to the amount paid. Buying iron condors needs a significant price change and/or increased volatility before expiration to collect higher premiums when the trade is exited. A sharp rise in implied volatility typically accompanies large moves in stock prices. An investor would look to buy an iron condor when the belief is the stock price will make a large move in either direction before expiration and implied volatility will increase.

BUY IRON CONDOR EXAMPLE

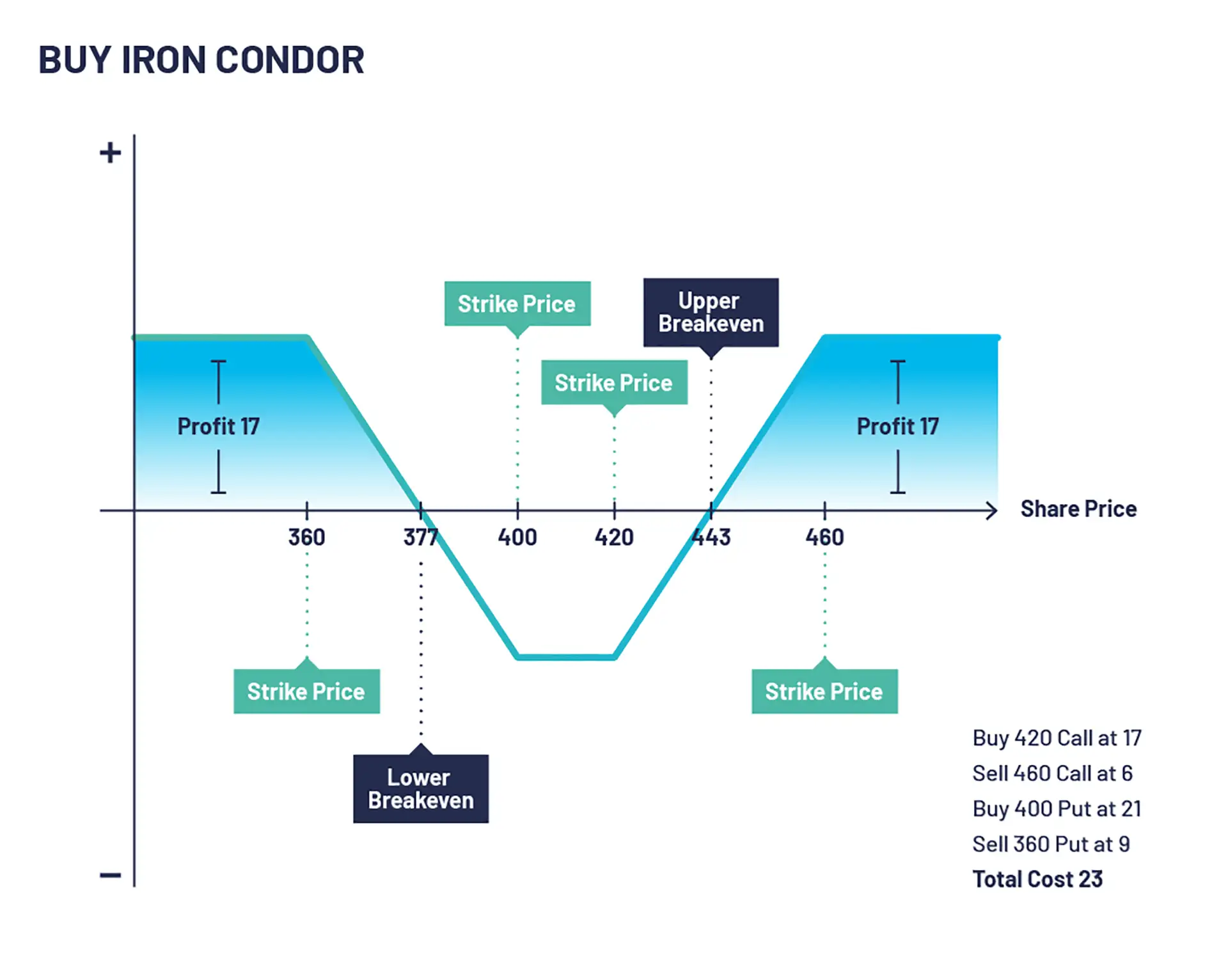

Let’s look at buying an iron condor example. XYZ is trading at 412.

An options trader executes buying a call spread and buying a put spread

Buy call Spread

Buy a 420 call at 17 and sell a 460 call at 6 costing 11 (17-6)

Buy put Spread

Buy a 400 put at 21 and sell a 360 put at 9 costing 12 (21-9)

If XYZ PLC stock rises and is trading above 460 on expiry of the option the maximum profit on this trade is realised. Technically you would be able to exercise the 420 calls purchasing the shares for 420 while simultaneously selling the shares at 460 with the exercise of the 460 call. In practise you would normally sell your call spread for close to 40 being the difference between the two strike prices.

If XYZ PLC stock falls and is trading below 360 on expiry of the options the maximum profit on this trade is realised. Technically you would be able to exercise the 360 puts purchasing the shares for 360 while simultaneously selling the shares at 400 with the exercise of the 400 put. In practise you would normally sell your put spread for close to 40 being the difference between the two strike prices.

If the stock closes between the 400 put and the 420 call the maximum loss on this trade is realised all options expire worthless and and initial debit paid for both spreads is lost.

BUY IRON CONDOR SUMMARY

CONFIGURATION:

- Buy a put option

- Sell a put option with a lower strike

- Buy a call option

- Sell a call option with a higher strike

- All options to have the same expiry

OUTLOOK:

- Anticipate a sharp move in either direction with an increase in volatility

TARGET:

- Underlying stock price expires above the sold call or below the sold put

PROS

- Defined risk strategy

- Able to profit whether the stock moves up or down

CONS

- Time decay works against this strategy eroding the value of the options spreads.

- Gains are capped on the upside/downside

Check out our other articles