UK Savers Pull Record £1.9bn From Equity Funds In August

01-10-2022

“UK investors pulled a record £1.93bn from open-ended equity funds in August as the summer stock market rally fizzled out. It was almost £400m more than previous monthly records set in 2016 after the Brexit referendum, according to Calastone.

August’s large net outflow was driven by a significant increase in selling activity rather than a drop-off in buy orders, indicating a decisive choice to exit holdings, said the funds settlement service.

The mass exodus occurred in the early weeks of the month as ‘unconvinced’ investors took what profits they could during the global bear market rally. As much as £2.08bn had been withdrawn by 17 August, when the bounce that started in mid-July ‘ran out of steam’.” – CityWire Report

The problem with pulling money out of the stock market in anticipation of a market correction is that:

• You risk missing out on any subsequent rally

• You forego dividend income

• You crystallise any capital gains.

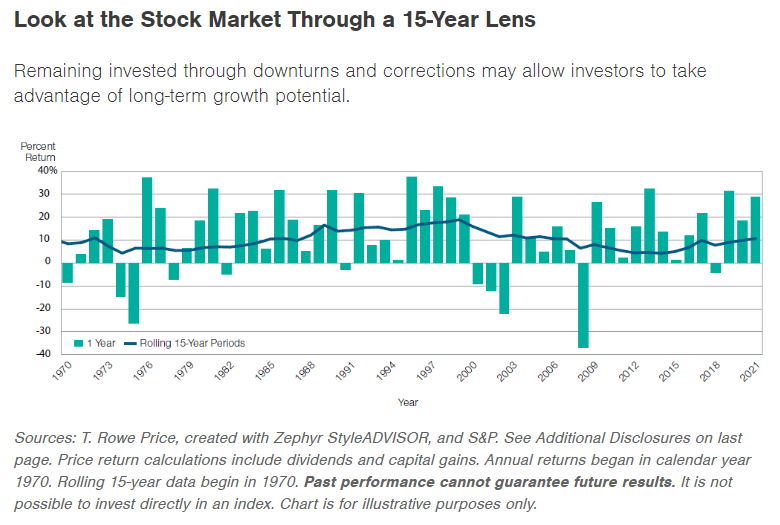

The standard perceived wisdom promoted by traditional wealth managers and IFAs in response to the onset of a bear market is to stay invested and ride out short term volatility.

As T. Rowe Price opines in its report “Is it Smart to Keep Money Invested in Equities During Market Volatility?” published 12 September 2022, notes: “Instead of taking money out of the stock market, sticking to a long-term plan is generally the best move.”

But the report also notes “It can be hard to sit back and stay the course; there’s a real temptation to do something.”

Given recent market falls, many IFAs will have seen not only a fall in the value of their AUM but also significant withdrawals from the assets they manage and/or oversee.

However, there is a third way between doing nothing on the one hand and blind panic on the other.

At OptionsDesk we believe that equity options, either on single stocks or stock indices like the FTSE, Dow, S&P and Nasdaq, are at their most effective when used as an overlay on portfolio of stocks and shares.

At its most primal, trading decisions are driven by fear and greed. But what if you think of your portfolio positioning in a more structured way given current market conditions?

Given the possibility of a protracted [tooltip tip=”A bear market is when a market experiences prolonged price declines. It typically describes a condition in which prices fall 20% or more from recent highs amid widespread pessimism and negative investor sentiment.”]bear market[/tooltip] and high inflation, logic says investors’ priorities should be:

1. Protect my existing store of wealth; and

2. Earn some additional income

So how can options help?

1. They reduce the fear factor of staying fully invested:

- You can buy a put option or put spread on the index with the highest correlation to your underlying holdings – think of this as buying insurance.

- If your wealth is concentrated in just a few shares (for example shares you have accumulated through employee share schemes), you can buy puts or put spreads on the individual shares

If the market goes up you lose the premium you paid, but if it comes down you will receive a pay-out potentially much higher than the premium you paid due to the leverage inherent in the option. You cannot lose more than the premium you pay to buy the options.

2. They allow you to earn additional income PROVIDED THAT you are prepared to make or take delivery of the underlying shares if the option is exercised.

- For example, imagine if you hold shares in IBM, JPMorgan and Goldman Sachs. Each pays a generous dividend, but each could be made to work harder – by selling calls at e.g. 10% above their current price and selling puts at e.g. 10% below their current market price, the combined premium you would receive could be in the region of 5% for options which expire in 3 months. If the shares stay within the two strikes, this income is yours to keep. This effectively would give you an annual dividend (5%) in 3 months.If the shares go down to the strike price of your short put you would have to buy the shares at that price, but you will have already collected the premium so you are effectively acquiring them at a further discount (strike price – premium received = acquisition price)If the shares go up to the strike price of your short call, you would have to sell them at that price. As with the puts, you still keep the premium, making your effective disposal price equal to the strike price + premium received.

You can repeat this cycle endlessly, continuously granting calls and puts referencing the underlying stocks’ price levels.

This is called a Short Strangle.