Trade Idea: $50bn Wiped off of Netflix's value with subscriber exodus

Netflix Part2, 21 April 2022

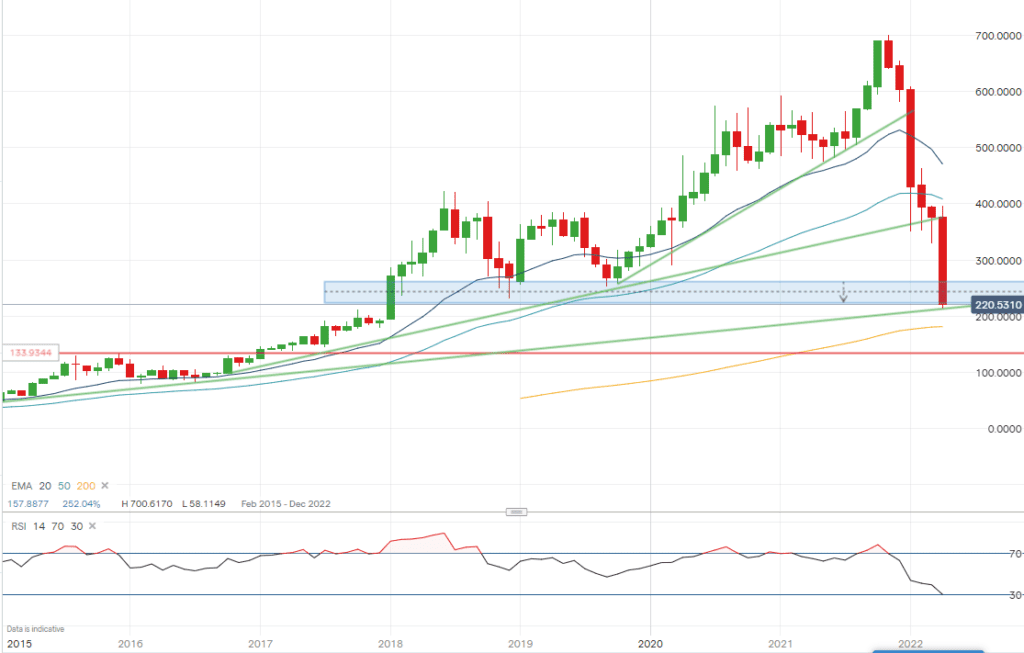

Netflix reported another 200,000 fall in subscriber numbers in their Q1 earnings report. NFLX shares closed 35% lower at $226.19. The shares fell as low as $212.51, the lowest price since January 2018, and more than 70% down from its all-time high of $700, highlighting the exodus of subscribers and increased competition in an already saturated market.

This recent sharp fall in the share price has brought the shares to an interesting confluence of support. Looking at the monthly chart we can certainly see the destruction of Netflix value over the last 6 months, with it continually breaking through major support zones. We are now testing the rising long-term trend from 2015, which could act as support to hold the underlying trend should prices hold. In addition to trend support we are now trading in the support zone of the previous lows of 2018/19. Should these levels hold there could be a bounce to potentially look to resume the underlying uptrend. However, should weakness persist, and the bears continue to hold this market and break the long-term trend, then sharper falls could be witnessed.

Should a bounce occur at these current levels there will still be considerable hurdles to overcome between $223-$265, the previous support zone at the lows of 2019. If these levels get breached and momentum is strong, we could see the shares move towards $300/330 which coincides with the previous low on March 14th.

Putting the technical picture to one side, how could you play Netflix? Are the shares now considered cheap? Will they continue to lose subscribers? Will they lose market share to rival streamers?

Given this uncertain future, what alternatives are there to just buying shares? Buying a call spread is a defined risk strategy that limit your losses should the shares continue to fall, but will give you some upside exposure to this volatile share.

Buy 240 calls at a cost of $7.50 and sell the 265 calls for a credit of $3 for a total cost of $4.50 for the call spread.

If the stock was to rise and be above 265 by the option expiry in May 2022 you would lock in a $20.50 (265-240-4.5) profit, over 4.5 times your initial outlay. If the shares continue to fall then your maximum loss would be limited to your initial outlay of $4.50. If you bought shares at $222.50 and then sold them at $265 you would only make 19% as opposed to a 450% gain on the call spread.

Now inversely, should this trend break and the bears continue to dominate this market, price supports are few and far between. Notably the $200 area may act as a support as it was previous resistance before the stock broke out in Jan 2018, but should this level fail this could pave the way for $133.

Buying the put spread in September will give you enough time for the July earnings to be reported. If you believe that the next earnings figure will be a repeat of the last two and a 25% drop is on the cards this spread gives you ample exposure to a large share price decline.

If the stock was to decline and drop below 130 by the option expiry in September 2022 you would lock in a $41 profit (180-130-9), over 5.5 times your initial outlay. If the shares don’t decline as rapidly and they are above 180 then your maximum loss would be limited to your initial outlay of $9. If you had shorted the shares at $222.50 and then sold them at $130 you would only make 41% as opposed to a 550% gain on the put spread.

Check out our other articles

There are many more option strategies available that can be tailored to you view on Netflix.

Contact UsNetflix Plummets On Poor Subscriber Growth

Netflix disappointed the market when it reported its 4th quarter results on 20th January 2022. It added 8.3m net

Monument Bank’s ‘eye catching’ Savings Rate. Is it ‘eye catching’?

After reading an interesting article in the Times regarding the new British challenger bank, Monument Bank, it got me thinking