How to Trade Options in the UK

Not sure where to start when buying or trading options in the UK? Our comprehensive guide will take you through the where, what and how.

What are Options

In their simplest form, options are financial instruments (derivatives) that derive their price and other characteristics from an underlying asset such as cash equities, indices, bonds, currencies and commodities.

Buying options gives you the right, but not the obligation, to buy (Call Option) or sell (Put Option) an underlying asset at a set price within a set time period.

Most investors and traders focus their attention on buying these underlying assets, hoping that they will increase in value over time and provide some dividend income.

Why Buy Options?

Buying options gives you much more flexibility whatever the underlying market direction – rising, falling, sideways or volatile.

Because they are so flexible, you can utilise options to help protect your current store of wealth, earn extra income from it, or position yourself for market-moving events such as company announcements, changes in the rate of inflation or government policy.

Leverage is inherent in options, so it is important you fully understand how to right-size your positions no matter what your strategy is.

Buying Options

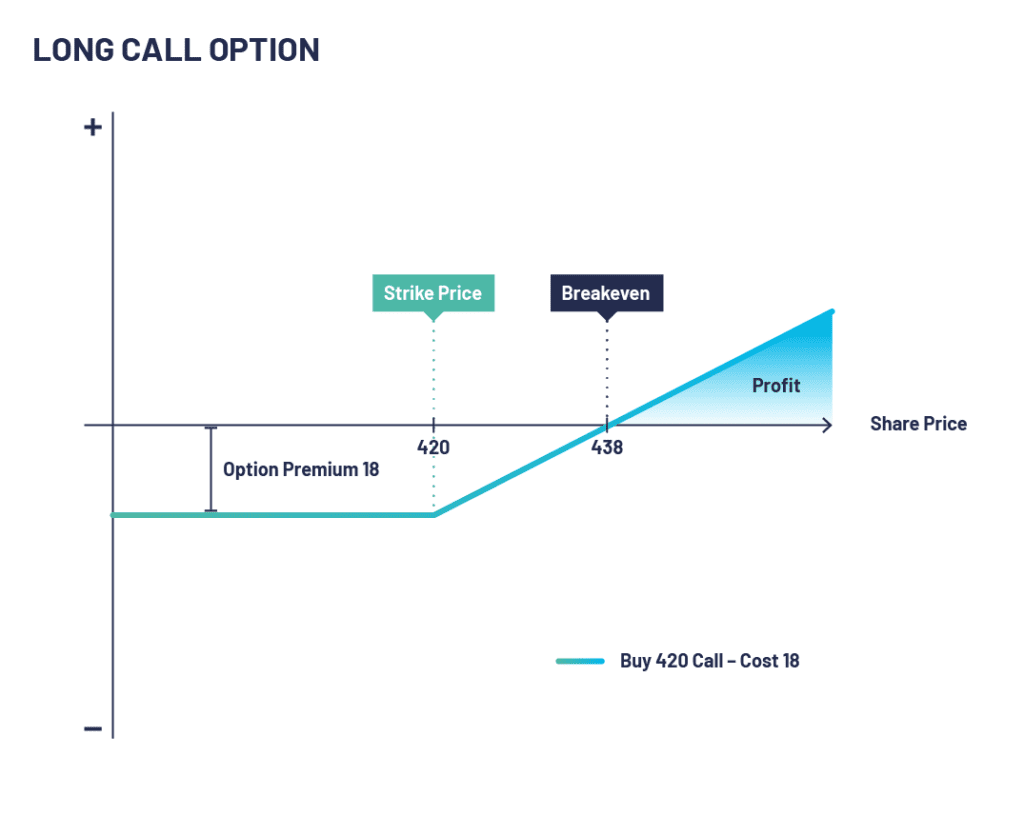

A call option can be purchased if the buyer thinks the underlying market or asset is going to go up in price. The two main advantages of buying a call option are that you know exactly what your maximum loss is (the premium you pay to buy the option), and for a relatively small cost you can get much bigger notional exposure to the underlying asset because of options’ inherent leverage – for a relatively small upfront cost, say 10% of the asset value, you can get exposure to a stock’s gains above the strike price until the option expires.

The call owner can either:

a) sell the option at its fair market value to another buyer through the exchange at any point prior to expiry; or

b) exercise the option at expiry (if a European Option) or anytime (if an American Option), putting up cash to buy the stock at the strike price.

If a buyer decides to buy a call option with a strike price of 420 in XYZ PLC for 18, the buyer has the right, but not the obligation, to buy shares at £4.20 by exercising the option before the end of the contract expiry. This becomes increasingly valuable if the underlying share price has gone above the 420 strike price and is now trading at, say, 460, as technically you will be able to exercise your option purchasing shares at 420 and immediately sell them in the market at 460; or you could sell your option at its fair market value which should be around 40.

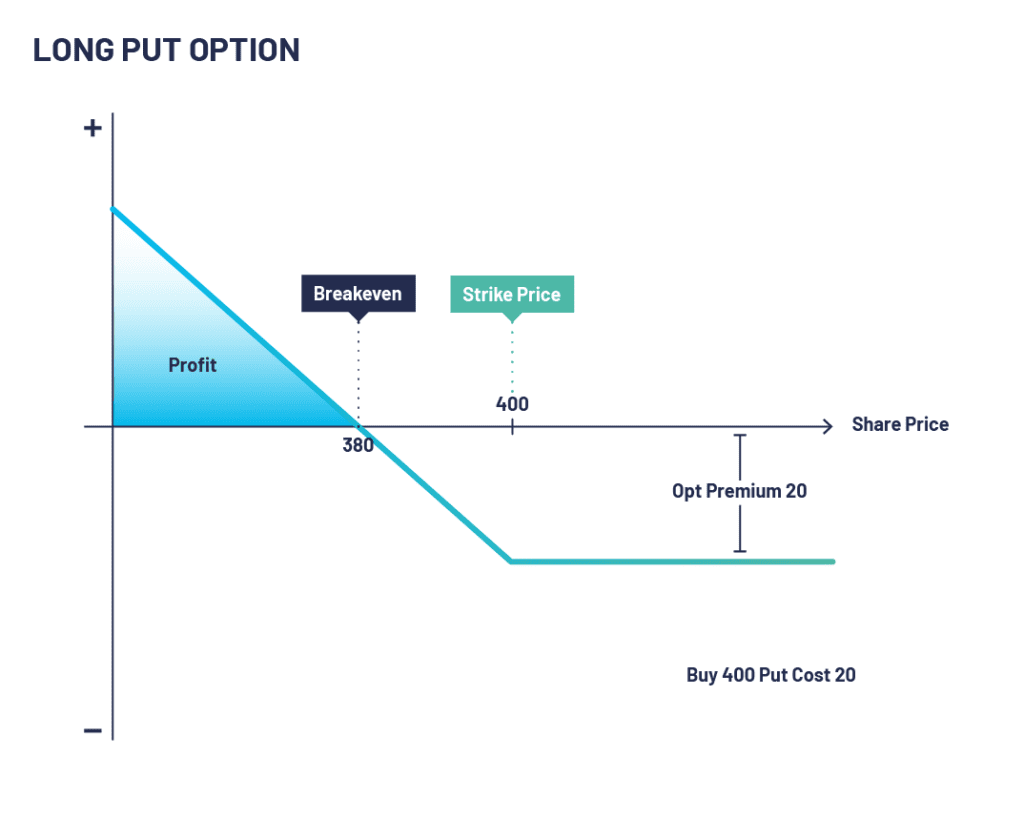

Now let’s consider puts. Buying put options is a way of profiting from a downward move in an asset, or protecting a portfolio from any adverse market moves. Puts are directly impacted by changes in the underlying asset and will normally increase in value as the underlying asset falls in price. Investors who think that the markets will fall may buy put options to take advantage of this downward price move; and investors with existing portfolios may also buy put options to protect their investments, in effect using them as a type of insurance policy, or hedge, against adverse market moves.

For example, if a buyer purchases a 400 put option in XYZ PLC at 20 when the stock was £4.05 and it subsequently falls to £3.50, the buyer then has the right to sell a pre-agreed amount of XYZ stock at £4.00. A trader would enjoy the rise in the premium value as the stock has moved lower, giving the option an intrinsic value of 50p, making a profit of 30p, or 150% on an underlying stock move of -14%.

An investor who has an existing stock position could do the same as a type of hedge but could also exercise their right to sell at the higher value of 400p, therefore protecting their position as the market falls. The risk of buying a put is limited to the premium you pay for it but has near-unlimited profit potential.

If you are buying call or put options your risk is always limited to the premium you pay to open the position. However, it’s important to remember that when selling options your risk is potentially unlimited.

Before making any trade, it’s imperative to know the maximum potential profit or loss you could incur. The maximum potential profit for buying calls is the same profit potential as buying stock, theoretically unlimited. The reason for this is that a stock can rise indefinitely, which is the same for an option as it derives its price from an underlying asset.

When trading any options, you need to understand how options are priced as market forces affect the value of the underlying asset which in turn affect the market value of the options attached to those assets. The option itself has no underlying value, its value is derived from the value of the asset itself and your ability to buy or sell that asset. These components are intrinsic value and time value.

Option Price = Intrinsic Value + Time Value

There are three main factors which affect the price of an option.

Underlying Market Price – This is the core of where an option’s price derives from and ultimately will tell if your option has expired in or out of the money.

Time to Expiry – The longer an option has before it expires, the more time the underlying market has to move through the strike price.

Volatility – The more volatile an option’s underlying market is, the more likely it is that it will move through its strike price. Volatility usually increases the price of an option.

Where to Buy Options UK

Buying options is relatively easy but you have to go through a few steps before you place your first trade. Choose a company that will help guide you through not only the account opening process but also how you can harness the power of options to meet your investment objectives. Options are highly flexible tools that allow you to trade not only price but also volatility and time. They also allow you to trade with leverage, so understanding the implications of this is critical.

Options are leveraged products which allow you to speculate on the movement of a market without ever owning the underlying asset. This means your profits can be magnified as you have not had to pay the total cost to hold the underlying asset in your portfolio.

At OptionsDesk, we require that you complete an application form which asks various questions about your financial situation and investing experience. This information is important as it allows us to see if option investing is appropriate for you as per the guidance of our financial regulator, the Financial Conduct Authority (FCA) and to get a better picture of how appropriate these instruments are for you. Once you have passed and signed an options trading agreement, the process of buying options is pretty straightforward.

Once your account is open, you can talk to us anytime during market hours about your investment objectives and ways to express them. OptionsDesk can talk you through your trades and after you’ve selected the specific options contract that you’d like to trade, an OptionsDesk broker will do the rest for you.

There are a number of financial institutions that allow clients to trade options, but you should take time to understand how they operate. At OptionsDesk we make sure what we charge you for our brokerage service is clear and transparent, with no hidden fees. We take our duty of best execution extremely seriously and do not make money from the difference (or ‘spread’) between the bid and offer. Unlike many firms in our industry we do not, under any circumstance, get any payment for your order flow.

At OptionsDesk, we execute your orders on regulated stock markets and derivative exchanges. Because these trading venues are obligated to offer ‘best execution’, you get the best possible price for your order.

If you are comfortable with how to buy options, you can consider implementing other options strategies to protect, generate income or position yourself in the market. Buying options is just the start of your options journey.