The Greeks - Understanding Option Vega

What is Vega in Options Trading?

Vega is the measurement of an option’s price sensitivity to changes in the volatility of the underlying asset. Vega represents the amount that an option contract’s price changes in reaction to a 1% change in the implied volatility of the underlying asset but does not have any effect on the intrinsic value of options and will only affect the time value of an option’s price.

Options are normally more expensive when volatility is higher. So, whenever volatility increases, the price of the option goes up as an increase in implied volatility suggests an increase of potential movement for the stock. Equally, when volatility decreases, the price of the option will drop as the potential risk of movement lowers.

When calculating a new option price due to a volatility change, we add the vega when volatility goes up but subtract it when the volatility falls.

An Example of Vega in Options

Imagine an XYZ PLC option contract is trading at 25p with an implied volatility of 25% and a vega of 0.92.

If implied volatility dropped to 20% we could expect the price to decrease to 20.4p. With every 1% move in implied volatility the price will drop 0.92p (5 x 0.92 = 4.6p decrease).

If the implied volatility had instead increased by 5%, then the price of the option would also increase to 34.6p.

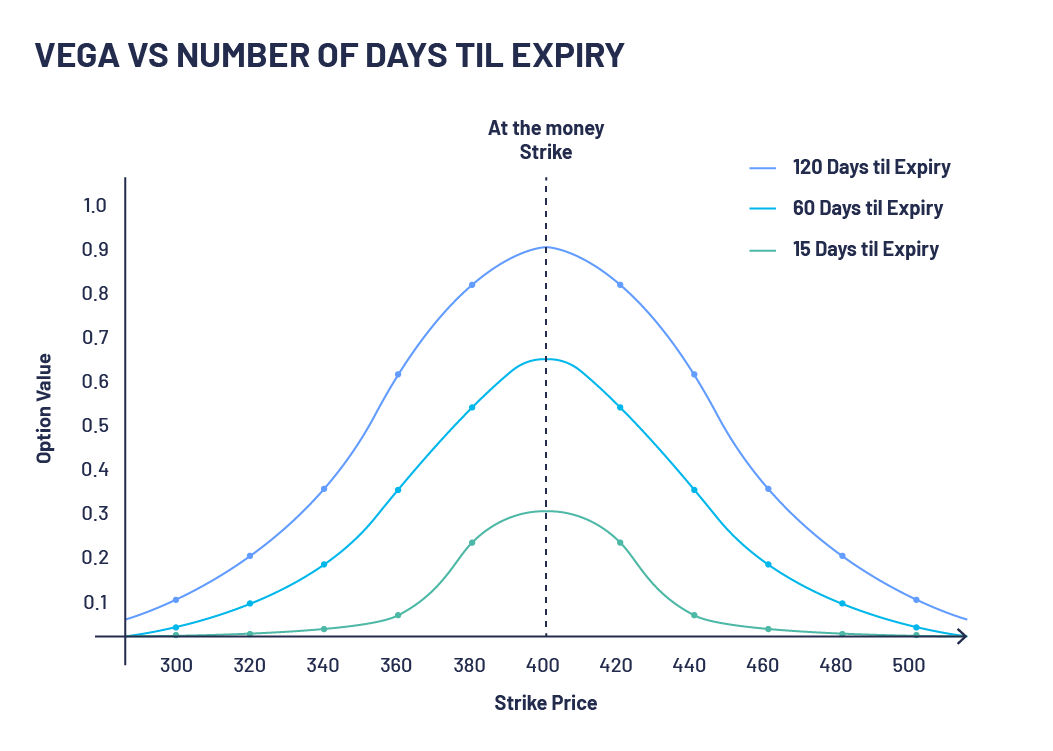

Vega changes when there are large price movements (increased volatility) in the underlying asset, and falls as the option approaches expiration which is shown in the following chart.