E-commerce Earnings: A Tale of Two Giants

15-08-2024

The E-commerce industry has benefitted greatly following the COVID-19 pandemic as consumers have diverted their bricks-and-mortar spending habits online. This article looks at the relative performance of Amazon and Alibaba, taking each company in turn as they compete to satisfy Western and Eastern markets.

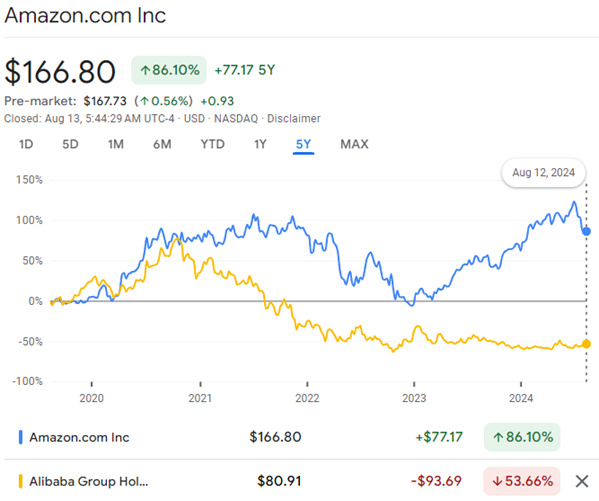

Figure 1. 5 Year Comparison of AMZN / BABA

Amazon

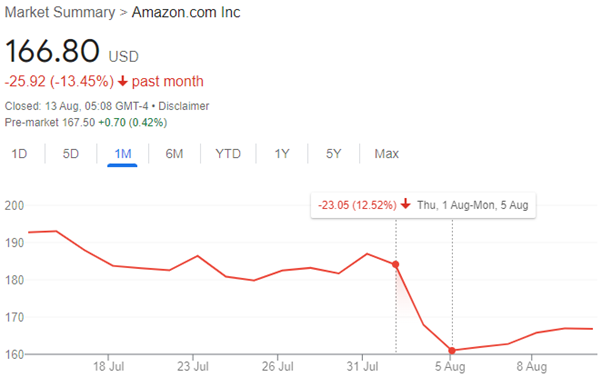

Figure 2. AMZN Share Price following the COVID-19 pandemic

On August 1, 2024, Amazon (AMZN) reported its Q2 earnings, delivering mixed results that led to a significant decline in its share price. The e-commerce and cloud computing giant posted Earnings Per Share (EPS) of $1.26, significantly beating analysts’ expectations of $1.03 by 22.33%. This strong performance in EPS highlighted Amazon’s ability to manage costs and improve profitability despite a challenging economic environment.

However, the company’s revenue figures fell short of expectations, which triggered concern among investors. Amazon reported Q2 revenue of $147.98 billion, slightly missing the forecasted $148.57 billion by -0.40%. The revenue miss, though marginal, raised questions about the company’s growth trajectory, particularly in its core e-commerce segment, which has been facing increasing competition and saturation in key markets.

The market’s reaction to the earnings report was swift and negative. In the two trading sessions following the release, Amazon’s share price declined by 12.5%, reflecting investor disappointment over the revenue miss and concerns about future growth.

Figure 3. Amazon 12.5% two-day decline following Q2 Earnings

Amazon’s core e-commerce business faced mixed results in Q2 2024. While the segment continues to generate substantial revenue, the company is contending with several challenges, including changing consumer spending patterns and increasing competition from other online retailers. The slight revenue miss indicates the complexities Amazon faces in scaling its vast e-commerce operations amidst shifting market dynamics.

To combat these challenges, Amazon has been investing in automation and AI-driven logistics to enhance delivery speed and efficiency. The company’s push towards expanding its physical retail presence, including Amazon Fresh stores and Amazon Go cashier-less convenience stores, also signals its strategy to blend online and offline retail experiences.

If you remain optimistic about Amazon’s strong fundamentals, long-term potential for recovery and believe in Amazon’s all-consuming ecosystem which holds a leading position in cloud computing with Amazon Web Services and has now further expanded into groceries, then you may consider buying a long-dated call spread.

Call Spread

Trade Idea

Buy a Call Spread

AMZN Cash Price = 170.62 (as of 15/08/2024 @ time of writing)

Buy: 1 (number of contracts) x $12.30 (contract price) x 100 (contract size) = $1200 debit

Sell: 1 (number of contracts) x $4.50 (contract price) x 100 (contract size) = $650 credit

Total consideration of $550 per 1 lot spread (excl. fees + commissions)

A further 21% increase on the current share price to $205 by 21-Mar-2025 expiry, would yield a 163% return on your initial investment, valuing the call spread at $2,000 (205 – 185 x 100), yielding a maximum profit of $1,450 ($2000 – $550) (excl. fees + commissions)

A rise to $205 in the underlying share price would yield a 7.95x greater return on the call spread than buying shares outright.

Maximum loss $550 (excl. fees + commissions)

Defined risk profile, maximum loss is equal to the net option premium paid.

Lower initial outlay in exchange for a capped maximum profit.

Breakeven if underlying share AMZN = $190.5 @ Expiry 21-Mar-2025 (strike price + net premium paid)

Alibaba

Alibaba Group (BABA), China’s e-commerce titan, is also set to release its quarterly earnings this Thursday, August 15th, before the market opens. Alibaba’s core e-commerce segment, which includes its Taobao and Tmall platforms, continues to be the company’s primary revenue driver, however, Alibaba remains a dominant force in e-commerce, cloud computing, and digital payments more generally.

Alibaba Cloud, the company’s cloud computing division, has grown rapidly and is the leading cloud service provider in China – holding a 39% market share – and is a significant player globally. With the increasing adoption of digital services across industries, Alibaba Cloud is poised for continued growth. The segment has benefited from strong demand for cloud infrastructure, artificial intelligence (AI), and big data services.

However, competition in the cloud market is intensifying, with global giants like Amazon Web Services (AWS) and Microsoft Azure, as well as local players like Tencent Cloud, vying for market share, Alibaba’s ability to maintain its leadership position in this space will be crucial for its long-term growth prospects.

For the upcoming Q1 2025 earnings release, analysts have set higher expectations for Alibaba, reflecting the company’s ongoing growth initiatives. The company is expected to report Earnings Per Share (EPS) of $2.11, a significant increase from the $1.40 reported in the previous quarter. This growth in EPS underscores the anticipated recovery in Alibaba’s profitability after a period of regulatory and economic challenges.

Figure 4. All time equity price summary of Alibaba Group Holding Ltd ADR

On the revenue front, Alibaba is projected to post $34.46 billion, up from the $30.73 billion reported for Q4 2024. This revenue increase suggests that Alibaba’s diverse business segments, particularly its e-commerce and cloud computing divisions, are gaining momentum despite the headwinds in the broader market. The comparison to the previous quarter’s results shows a strong trajectory, with the company likely benefiting from both seasonal factors and the continued expansion of its digital ecosystem.

Alibaba has faced considerable regulatory pressure in China over the past few years, particularly related to antitrust issues. The company has been subject to fines and has had to make significant changes to its business practices to comply with new regulations. While Alibaba appears to have navigated the worst of these challenges, the regulatory environment remains a source of uncertainty, and the share price has suffered against its western rival Amazon following accusations of data sharing and anti-competitive market behaviour, leading US and Chinese regulators to clamp down on the oriental rival.

If you believe that a return to glory for Alibaba is possible despite its fall from grace in the past two years after being caught in the regulatory crossfire between China and the United States, you may consider purchasing long call options ahead of their earnings announcement.

Call Option

Trade Idea

Buy a Call Option

BABA Cash Price = $79.47 (as of 15/08/2024 @ time of writing)

Total consideration: $350 (excl. fees + commissions)

1 (number of contracts) x $3.50 (contract price) x 100 shares (contract size) = $350 debit

BABA has increased by over 10% since 1st July 2024.

A further 10% increase on the current share price to $87.40 by 20-Sep-2024 expiry would value the call option @ $87.40 (share price) – $80 (strike price) = $7.40 for a total of $740; yielding a 111% return on your initial investment.

The $80 call option would break-even if the Alibaba share price increases to $83.50 at expiry on 20-Sep-2024

Defined risk profile, maximum loss of a long option position is equal to the premium paid.

The contents of this article are for general information purposes only. Nothing in this article constitutes advice to any person and any investments and/or investment services referred to therein may not be suitable for all investors. If you’re unsure whether any investment is right for you, you should contact an independent financial adviser. For more information, please see IMPORTANT DERIVATIVE PRODUCT TRADING NOTES.