UK Election: Are you positioned for a future Labour Government?

01-07-2024

A Labour majority is likely to be advantageous for banks, builders and supermarkets, according to a note from JP Morgan’s head of global equity strategy, Mislav Matejka. The American investment bank noted that Labour’s policies are expected to be moderately growth-oriented while maintaining a cautious fiscal approach.

Meanwhile, analysts from the Japanese investment bank MUFG have stated that a significant Labour victory would likely be highly beneficial for the Pound, as it could boost expectations of increased government spending. Since Prime Minister Rishi Sunak announced the election on the 4th of July, the Pound has weakened by 0.6% against the Dollar whilst the Greenback has strengthened by 1% against a basket of 6 currencies over the same period.

Below are some key areas where changes are anticipated, presenting opportunities for investors to strategically position themselves for potential gains.

Home builders

Labour is trying to capitalise on the big under-supply of housing in the UK, making it one of their main policies to win over more voters.

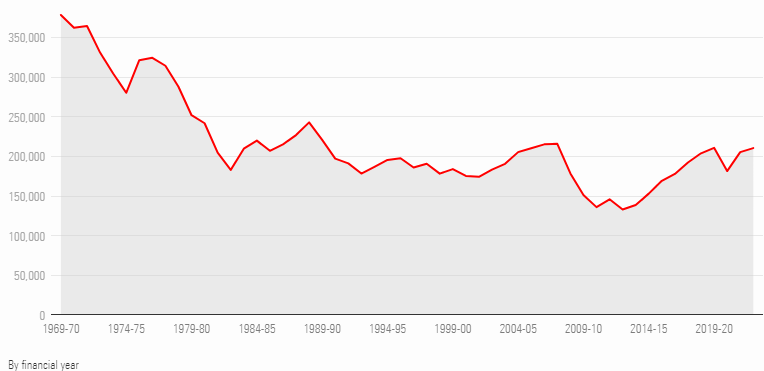

The UK is building roughly the same number of homes every year as we were in 1980, despite the UK population being almost 20% higher today. The lack of housing built under the Conservative government over the last 14 years is one of the principal reasons for discontent among the non-home owning population, who have seen prices rise massively while forced to watch from the sidelines and paying increasing rents.

UK Home Completions

(Chart displaying UK home completions from Morningstar from ONS)

UK home builders have lost up to two thirds of their value over the last four years from their peak. Currently names like Barratt Developments (BDEV) and Persimmon (PSN) are offering around a 50% upside potential to recent highs of 2020. Whether a Labour government will be able to close the home completion vs expectation gap is still unsure; however, positioning into the election could be tempting for many investors.

(Chart displaying monthly Barratt Developments PLC stock price, 2015 – Present)

Long Call Option

Trade Idea

Long-Dated OTM Call Option

Long-Dated Out of the Money Barratt Developments Call Options

Buying calls for March 2025 covers the expected budget in September 2024 as well as the Spring budget in March 2025

BDEV Cash Price = £4.81 (as of 01-July-2024 @ time of writing)

Buy 1 BDEV 21-March-2025 540 Call @ 20p for total consideration of £200 (excl. fees + commissions)

1 (number of contracts) x 20p (contract price) x 1000 (contract size) = £200 debit

Defined risk profile: maximum loss of long option positions is equal to the premium paid (plus fees and commissions)

Breakeven if held to expiry: underlying BDEV = £5.60 on 21-March-2025 (strike price plus premium paid)

Energy

With Labour expected to gain an overwhelming majority, Keir Starmer’s Labour government has made clear their policy to increase windfall taxes on oil and gas producers which is expected to make most North Sea projects unprofitable. David Latin, Chair and inter-rim Chief Executive Officer of leading mid-tier oil and gas company Serica (responsible for ~5% of UK gas production) has stated that the company is actively seeking opportunities overseas, comparing the current UK fiscal environment to a warzone. Harbour Energy is already moving in a similar direction under the fiscal pressures.

Labour aims to significantly enhance the UK’s standing in renewable energy by concentrating on wind and solar power, advancing hydrogen technology, and intensifying carbon capture and storage initiatives. The party plans to establish Great British Energy, a venture to own, manage, and operate green energy projects in partnership with private companies.

Labour’s push to increase investment in the green economy could highlight UK-listed specialists such as Costain, which provides advice on energy transition; and environmental services company Ricardo.

Accelerating the decarbonisation of the power grid could benefit National Grid and other power generation utilities such as Orsted, Centrica, RWE, and SSE. These companies are investing heavily in renewable energy and stand to gain from increased government incentives.

Oil companies have slowly retreated from the ageing North Sea over the past two decades, now leaving the smaller players subject to punitive taxation at the hands of a future Labour government. Labour has pledged to raise the windfall tax burden to a total of 78% from 75% on North Sea profits – matching the tax regime enforced in Norway.

This could have a widespread impact on the sector. With oil supermajors Exxon Mobil, ConocoPhillips and Shell gradually reducing their interests in the North Sea since the 2000s, further taxation could force the remaining players to search for oil in new frontiers.

Last month, Chevron announced a sale of its 19.4% stake in the Clair oilfield in the West Shetlands, hanging-up its boots after more than five decades in Scotland. This followed a meeting with Chancellor Jeremy Hunt in which he refused to commit to easing the windfall tax imposed on North Sea producers after the surge in energy prices following the invasion of Ukraine in 2022.

Long Straddle

Trade Idea

Long Straddle

SSE Cash Price = £18.02 (as of 01-July-2024 at time of writing)

Buy +1 SSE 19-July-2024 1800 Call @ 44p

Buy +1 SSE 19-July-2024 1800 Put @ 37p

1 (number of contracts) x 0.44 (contract price) x 1000 (contract size) = £440

1 (number of contracts) x 0.37 (contract price) x 1000 (contract size) = £370

Total consideration: £810 debit per 1 lot (excl. fees and commissions)

- Defined risk profile: maximum loss of long option positions is equal to the premium paid

- Breakeven if held to expiry: if SSE = £17.19 or £18.81 on 19-July-2024 (strike price minus/plus premium paid)

If you believe that there will be a big move in the share price of SSE – in either direction – following the UK election then you could opt for a short-dated long straddle to gain exposure to this volatility.

The contents of this article are for general information purposes only. Nothing in this article constitutes advice to any person and any investments and/or investment services referred to therein may not be suitable for all investors. If you’re unsure whether any investment is right for you, you should contact an independent financial adviser. For more information, please see Terms and Conditions | OptionsDesk.