Fed Interest Rate Decision: Market Reactions and Tactical Trading Opportunities

13-06-2023

Investors are focusing on the Federal Reserve’s latest interest rate decision, due on Wednesday, with investors widely betting that the U.S. central bank will pause on a long-running policy tightening cycle.

Markets tend to price in this key data with consensus being that Inflation will come in lower than the market is expecting, this has caused markets to react positively with the Dow Jones + 1.67%, S&P 500 +1.64%, Nasdaq +1.83 % and the CBOE Volatility Index 14.98 +8.32% all posting strong gains over the last 5 days. Economists predict that the reading will rise by 4.1% on an annual basis, cooling from the prior level of 4.9% in April giving the Fed reason enough to pause. The overall market response to a lower interest rate environment is that it’s generally favourable for equity valuations hence the recent upswing we have seen across the major indices.

There is still an outside chance that the Fed could decide to lift rates yet again, particularly if today’s (13-06-2023) May consumer price index surprises on the upside. This could catch out investors and lead to the markets giving up recent gains.

Recent events highlight just how large the impact of FOMC press conferences can be on markets, during six FOMC press conferences in the past year, the S&P 500 lost or gained over 1% this by no means guarantees similar moves going forward but it presents a great opportunity to trade tactically around this event.

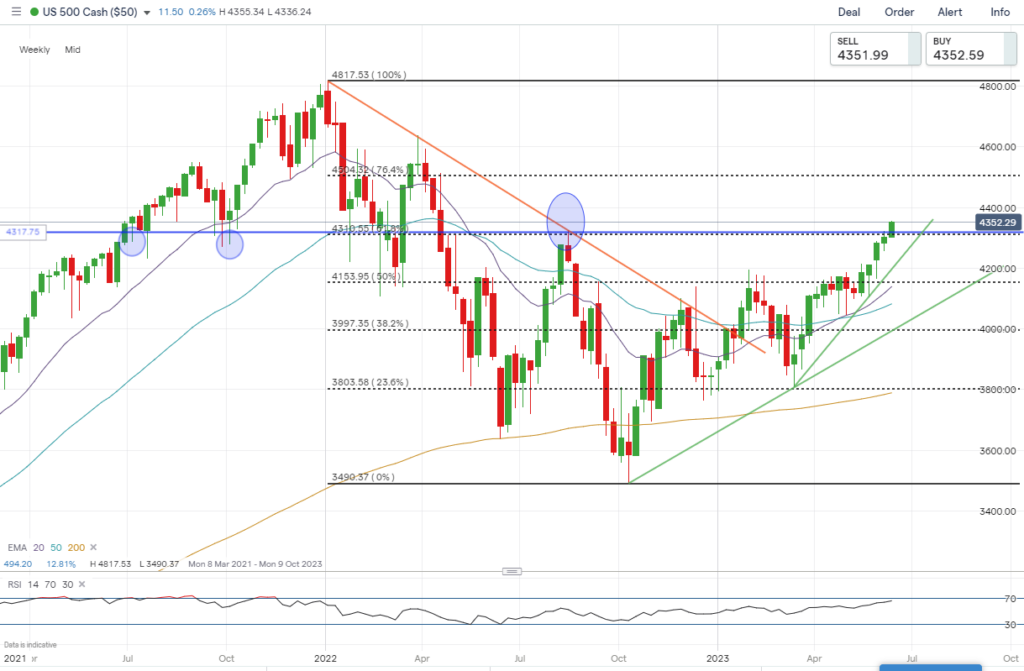

Key resistance

- 4400

- 4430

- 4505

- 4530

- 4600

Key Support

- 4310

- 4265

- 4200

- 4165

US equities are continuing their ascent, the S&P has printed a new high for the move of 4355, prices not seen since April 2022. The S&P has now taken out the 61.8% retracement of 2022’s bear market and taken out a significant swing high of 4325, as highlighted by the blue circle.

Other bullish factors include that price has held above its EMAs 20,50,200, supporting the current trend, moreover, momentum is still in play as the RSI on the weekly chart has not indicated that the market is overbought. It is crucial to remember that on the daily chart the RSI is currently in overbought territory.

Buy Call Spread

Trade Idea

Inflation comes in lower as expected and the Fed decides to pause

Jun23 Mini S&P 4347.25

$17.75 x 50 underlying ($887.50)

Max profit $1,612.50

Buy Put Spread

Trade Idea

Inflation comes in higher than expected and Fed decides to raise rates

Jun23 Mini S&P 4347.25

$17.25 x 50 underlying ($862.5)

Max profit $1,637.5