The Wealth Preservation Society

09-10-2022

The FTSE 100 is currently trading at ~7000, down around 400 points or 5% since the beginning of the year; compared with the US Dow Jones Industrial Average which is down 18% and the S&P which is down 22%.

And yet the UK is in much poorer economic shape than the US. Does this make you nervous about your holdings of UK equities; and if so, what can you do to hedge your risk?

The first is to switch some or all of your wealth into cash, but this risks three consequences:

- High inflation erodes the value (purchasing power) of your cash, effectively locking in a loss of the difference between the interest you earn on this cash and the rate of inflation

- You may crystallise a tax bill because of your capital gains

- You will forego the dividend income you receive from your equity holdings

- Perhaps most crucially, you risk being out of or underweight the market when the next bull market resumes

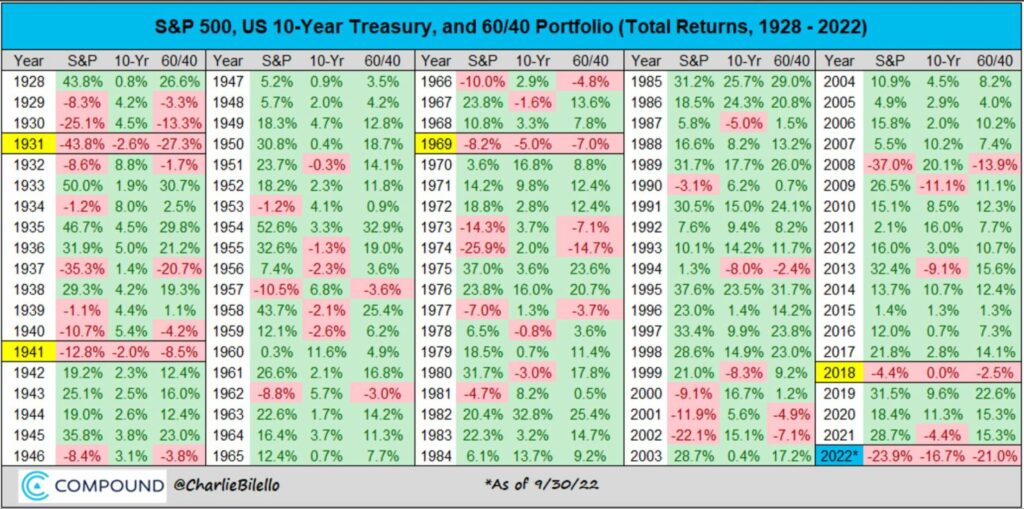

The second is to switch to a more defensive portfolio of equities and bonds, but as the attached table shows, this has not proved to be an effective strategy in the current market, where almost all asset classes are highly correlated (bottom right corner).

The third is to use exchange-traded options to hedge your portfolio.

Listed options have a poor reputation because they are lumped together with other ‘derivatives’ like spread bets and CFDs, but they are not the same. Exchange traded (or ‘listed’) options have three important differentiators: the exchange has to provide the market’s best (ie most competitive) price; the commission you pay is transparent and mutually agreed; and when you buy an option you cannot lose more than the premium and commission you pay. This is unlike any off-market transaction, where the losses are potentially unlimited and the price you pay to trade is hidden in the bid/offer spread. Remember, there is no such thing as ‘free’ trading – the fee you pay is simply buried in the marked-up price you trade at.

So how could you use options to protect your portfolio?

Let’s say you have an exposure to UK equities of £4 million built up over time in your ISAs, pension and other investments either directly or through your wealth manager/IFA.

If the FTSE is currently trading at ~7000, and you think it will fall between now and next summer, you could buy a June 2023 7000 put option for ~£4,500, which would give you a notional value protected of £70,000. Therefore if you wanted to buy protection on ~£1 million of your portfolio, you would need to buy 14 put options for a total cost of £63,000 or 6.3% Your broker commission is unlikely to exceed (£300.00, and may be much cheaper). This put option would give you the right to sell the FTSE at 7000, no matter how low it might drop to.

However, if you think the FTSE is unlikely to drop more than 1000 points, you may like to consider buying a put spread. If you bought a June 7000 put and sold a June 6000 put you would cut the premium you pay by ~40% to £37,000 or 3.7%, but you would not benefit from any drop in the index below 6000. This would enable you to be fully invested and therefore you would still receive your dividend income which is currently around 4%.

If you would like to discuss how puts and put spreads could help you protect your portfolio please don’t hesitate to contact us.