US Earnings Season Kicks Off with Strong Bank Results

15-07-2024

Kicking off US Earnings season we have the banks coming in with their latest quarterly results. This week Goldman Sachs, Bank of America and Morgan Stanley are set to publish their latest figures, following Citigroup, JPMorgan and Wells Fargo’s results released last Friday.

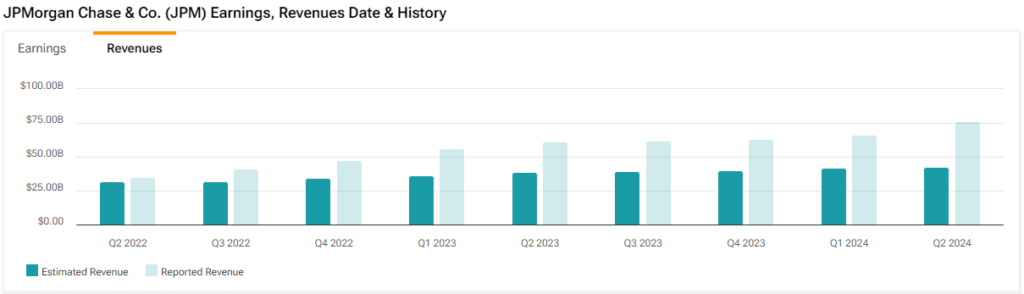

The atmosphere is sound, with Citigroup reporting $1.52 earnings per share beating estimates of $1.40, and JPMorgan producing earnings per share of $6.12 for the 3 months ended June 30th beating estimates of $5.88, marking an improvement on the $4.75 per share printed a year earlier. JPM has consistently beat its forecast revenues since Q2 2022.

Source: https://www.tipranks.com/stocks/jpm/earnings

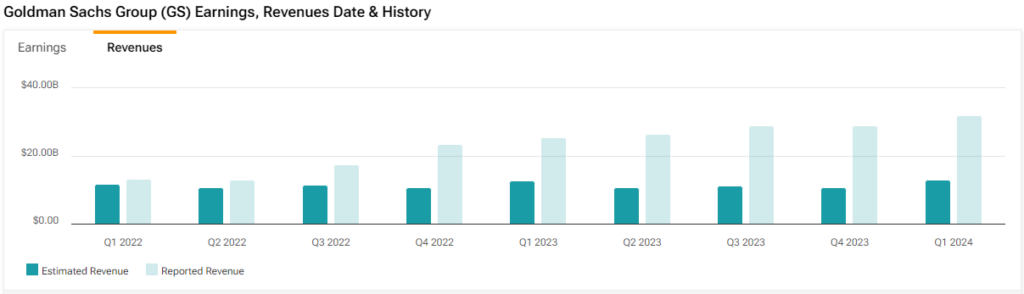

Goldman Sachs are reporting this afternoon before market open, with a consensus analyst forecast of $8.35 EPS vs. last year’s $3.08. Their previous Q1 earnings of $11.58 per share published in April soared past expectations of $8.71.

Source: https://www.tipranks.com/stocks/gs/earnings

The US banks have benefited greatly from the high interest rate environment spawned by the Federal Reserve. Today Fed Chairman Jerome Powell will be speaking ahead of US retail sales data set to be released tomorrow, which will offer insight into the health of the US consumer. The US Census Bureau is forecasting no overall increase in retail sales for the month of June following the increase in May. Should retail sales come in lower than expected, the data bodes well for a September rate cut following the slowdown in the labour market and tame June inflation data. Futures markets are now fully pricing in a reduction this September.

Given their recent performance, investors may consider a long position in one of the major US banks, as they continue to reap the rewards of a high interest rate environment and resurgence in dealmaking and IPO activity.

Call Option

Trade Idea

Long-Dated Deep in-the-money Call Option

Options can be used to gain leveraged exposure to an equity. For example, rather than buying 50 Goldman Sachs Shares @ $480 for $24,000, an investor could instead buy one deep in-the-money call option such as the 250 Call, for a premium of $240, gaining exposure to 100 shares for the same price.

GS Cash Price = $480 (as of 15/07/2024 @ time of writing)

Total consideration: $24,000 (excl. fees + commissions)

1 (number of contracts) x $240.00 (contract price) x 100 shares (contract size) = $24,000 debit

Goldman Sachs has increased by over 40% since June 2023.

A 40% increase on the current share price to $672 by 20-June-2025 expiry would value the call option @ $672 (share price) – $250 (strike price) = $422 for a total of $42,200; yielding a 175% return on your initial investment.

The 250 call option would breakeven if the Goldman Sachs share price increases to $490 at expiry on 20-June-2025

If Goldman Sachs’ share price remains unchanged by 20-June-2025 expiry, the call option would be worth $230, for a total of $23,000, representing a loss of $1,000 or 4.2%.

Defined risk profile, maximum loss of a long option position is equal to the premium paid.

Investing $24,000 into shares at $480, a final share price of $672 would be a 140% return on your investment.

The contents of this article are for general information purposes only. Nothing in this article constitutes advice to any person and any investments and/or investment services referred to therein may not be suitable for all investors. If you’re unsure whether any investment is right for you, you should contact an independent financial adviser. For more information, please see Terms and Conditions | OptionsDesk.