Twitter Trade Idea: Elon Musk Becomes Twitter's Biggest Shareholder

After the announcement that Elon Musk is purchasing a 9.2% stake in the social platform, pre-market activity saw the stock rally 23% to $44.50. Does this deal now highlight the potential rush in to this beaten tech/social platform, having seen its shares trade as low as $30.60?

Looking at the technical picture of Twitter we have seen a consolidation at the lower ranges of the bottom of the falling trend. Today’s announcement saw price action breaking out of the $40.85 resistance, highlighting possible further strength.

Should this momentum continue we have a measuring target of $50.40 which coincides with May 2021 lows that saw the stock bounce to $77 before retreating to its lows of $30.60. This being said, there are a few areas of resistance, notably the 38.2% retracement of $48.54 then the previous lows of $50.40.

If this scenario prevails how does one take advantage of this? There are a few ways an investor can potentially take advantage of this momentum:

• Buy the underlying shares in the market and hold until the price objective achieved. This is the more expensive route to market as the investor will have to pay full price for the shares.

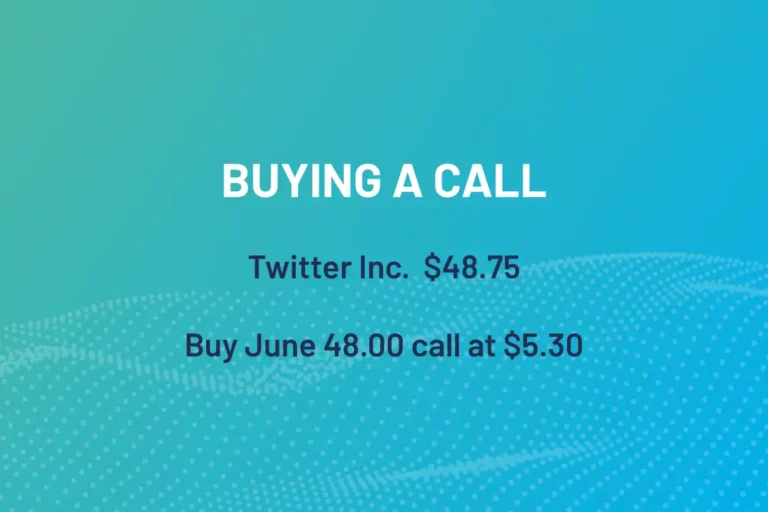

• Another avenue is to use the options market;

Let’s break down the trade

At a cost of $5.30, just under 11% of what it would cost to buy the shares outright, this is one way to gain exposure to a share without committing the total capital to the trade.

The added benefit is that if the shares do fall sharply after a quick rise you don’t end up holding a share position that has fallen in value, and all you have lost is your initial premium of $5.30.

Let’s break down the trade

The cost to implement this strategy is $2.70, just over 5.5% of the value of the underlying shares. This again is a defined risk strategy so if the stock were to fall after this sharp rise your total loss is known before entering the trade.

If the stock does continue to rise and is above $60.00 by June expiry the trade would lock in a $10 profit minus the $2.70 initial outlay. This returns just under 3 times your initial investment.

Check out our other articles

Take a look at our other articles where we discuss the importance of Options Trading.

Bull Call Spread

This is a bullish strategy that benefits from a reduction in cost due to selling the higher strike call option

Barclays Hit By £450m Loss Bond Blunder

Shares in Barclays have fallen as much as 6% as they grapple with a fresh compliance and risk slip-up.