Q4 Earnings Update: Major Tech Companies To Reveal Results

30-01-2024

A busy week of earnings in the tech sector – Apple, Amazon, Microsoft, Google, Meta, AMD all set to publish their latest Q4 figures.

Last week we had a warmup with Tesla and Intel both falling short of analysts’ estimates.

Over the past year, we have witnessed very bullish growth in the tech-heavy indices, fueled by investment in artificial intelligence across the sector.

NASDAQ Composite Index ended 2023 up 46%

The S&P500 Index closed the year up 25%

Analysts are widely expecting this trend to continue throughout the new year, as all the tech titans continue competing to integrate AI across their respective product offerings.

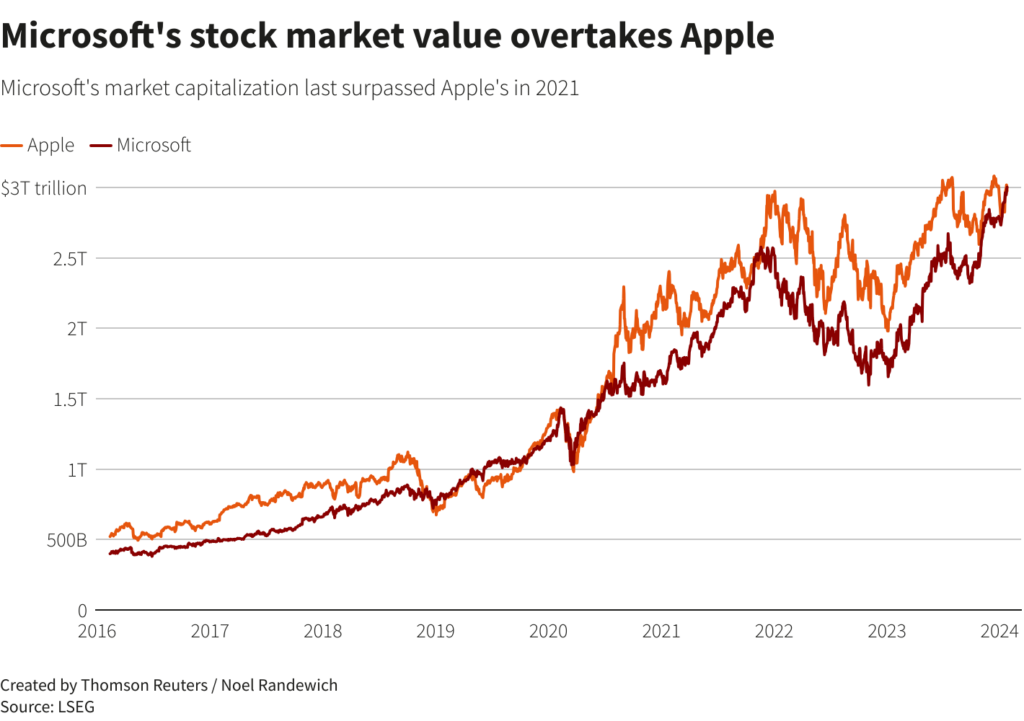

MSFT shares have surged 7% year-to-date, having dethroned AAPL as the most valuable company in the world.

Microsoft’s dominance in the AI sector has given them an edge over Apple whose ‘mature’ iPhone market is set to lag until they detail exactly how they will participate in the AI arms race.

Some analysts are expecting a rally of at least 6% in the share price of AMD before the end of the week, after announcing that their latest MI300 series chips will be adopted by Microsoft, Meta and OpenAI as an alternative to NVIDIA’s chips.

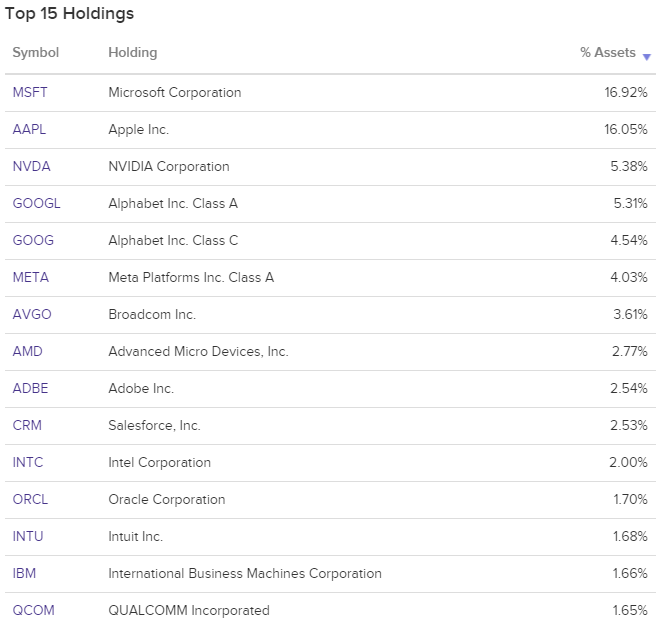

If you believe these tech stocks will meet analysts’ expectations and continue to rise over the coming weeks, then you may consider gaining exposure through a tech-specific Exchange Traded Fund such as the iShares Technology ETF.

HIGHLIGHTS

- Majority weighted amongst the 5 tech stocks in focus this week.

- Minimum exposure to the rest of the NASDAQ index.

- Good Liquidity

- Low option premium vs. other common US tech stock ETFs ($XLK, $QQQ etc.)

LONG AT THE MONEY (ATM) CALLS

Trade Idea

LONG AT THE MONEY (ATM) CALLS

$IYW – iShares U.S. Technology ETF

BUY 10 FEB-2024 129.84 Call @ $2.24

10 contracts x $2.24 x 100 shares underlying

Total consideration: $2,240.00

Breakeven if the value of the underlying is equal to $132.08 @ expiry.

Maximum loss = $2,240 ($224 per 1 lot) if shares expire below 129.84

A 9.45% rise in the share price as we have observed over January 2024, would yield a profit of $9,964.96 at expiry in February.