Netflix Plummets On Poor Subscriber Growth

Netflix, 24 January 2022

Netflix disappointed the market when it reported its 4th quarter results on 20th January 2022. It added 8.3m net new subscribers for the period, below the market’s expectations of 8.4m-8.7m. It also projected an increase of only 2.5m subscribers in the first quarter of 2022, substantially below expectations of 4m. Its shares sank nearly 20 per cent in after-hours trading, the worst daily drop since July 2012.

To put this in perspective it is now trading at pre-pandemic levels.

If you believe that this is just a temporary correction and the stock has upside, but are still wary that it may have further to fall, it may be worth considering selling a put option. This would also allow you to take advantage of the high premiums generated by the volatility in Netflix’s share price.

At the current stock price of $385 you could sell a June 2022 360 put for $21, a 5.5% credit with the added comfort of the option strike price being 6.5% out of the money.

If the stock price continues to fall and is below 360 at the option’s expiry in June 2022, you would be committed to buy the shares at $360 but would keep the premium of $21. You would effectively be buying the shares at the discounted price of $339 ($360 – $21), nearly a 12% discount to current levels.

If you are averse to committing to buy the shares, but still believe this downside move is overdone and the missed analyst estimates don’t warrant such a sharp correction, then this is an opportunity to gain exposure to a share that has lodged huge gains in the last year.

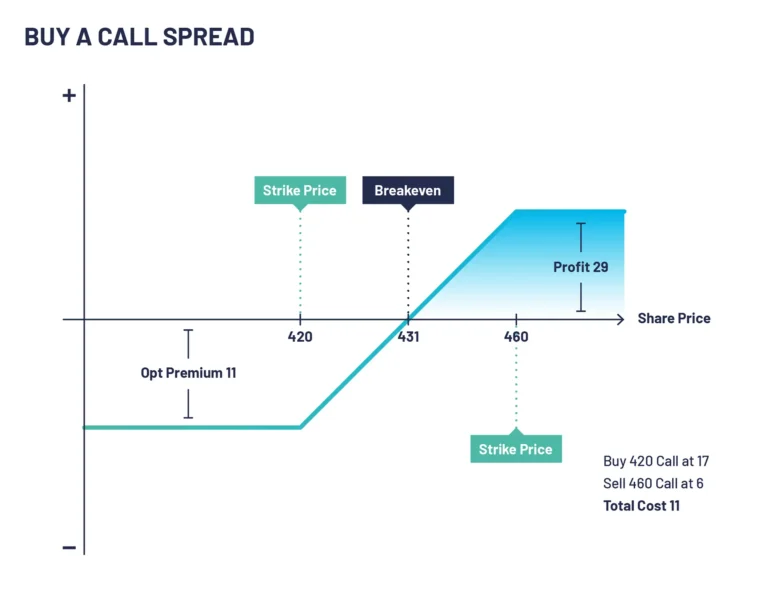

Buying a call spread can give you exposure to the stock without owning the shares and is a limited risk strategy.

For example, buying a June 2022 410/460 Call spread:

Buy 410 calls at a cost of $30 and sell 460 calls for a credit of $16 for a total cost of $14.

If the stock was to rise to above 460 by the options’ expiry in June 2022, you would lock in a $34 profit, almost 2.5 times your initial outlay. If the shares continue to fall then your maximum loss would be limited to your initial outlay of $14.

Check out our other articles

Take a look at our other articles where we discuss the importance of Options Trading.

Open an AccountBarclays Hit By £450m Loss Bond Blunder

Shares in Barclays have fallen as much as 6% as they grapple with a fresh compliance and risk slip-up.

Bull Call Spread

This is a bullish strategy that benefits from a reduction in cost due to selling the higher strike call option