DATA CENTRES: STRONG DEAL FLOW FOR AI PARTNERS

16/09/25

- $APLD – Applied Digital – struck a 15-year lease with CoreWeave for 250 MW of AI/HPC infrastructure at its Ellendale, North Dakota campus, a deal expected to generate ~$7 billion.

- $NBIS – Nebius Group N.V. – Signed a $17.4 billion (potentially rising to ~$19.4 billion) 5-year deal with Microsoft to provide GPU infrastructure capacity for AI workloads.

- $IREN – Iris Energy – Recently sealed a deal with NVIDIA and entered into a cloud services agreement with AI startup Poolside to provide access to 248 NVIDIA H100 GPUs for AI model training using its data centre

Surging interest in so-called ‘hyperscalers’ and data centre providers has resulted in significant deal flow from cash-rich AI companies racing to build out their infrastructure globally. McKinsey analysis shows that by 2030, companies will invest almost $7 trillion in capex for data centres, which equates to ~1% of global GDP annually, as global demand for data centre capacity more than triples by 2030.

The magnitude of investment across the AI sector comes with its logistical challenges; however, the deal flow for AI partners in recent weeks has shown that the big US tech giants are on the hunt to deploy capital in companies which are sufficiently competent to satisfy their demands.

Applied Digital has made one of the boldest moves in the space, securing a landmark 15-year agreement with CoreWeave (which listed on the NASDAQ earlier this year for $23 billion in March and has since ballooned to $55 billion) to lease 250 megawatts of capacity at its new Polaris Forge campus in Ellendale, North Dakota. The deal, which could generate around $7 billion over its term according to Applied Digital, represents one of the longest-dated commitments yet seen in the AI infrastructure market. A phased build-out is expected, with the first 100 megawatts coming online in late 2025, followed by further expansions into 2026 and beyond. CoreWeave also holds an option to add an extra 150 megawatts, potentially taking the site to 400 megawatts of leased capacity.

At the other end of the spectrum, Nebius Group has vaulted into the headlines with one of the largest infrastructure deals in the sector to date. The company, which emerged from Yandex’s international operations, signed a five-year contract worth $17.4 billion with Microsoft to supply GPU infrastructure capacity, with an option that could lift the value to $19.4 billion. The agreement centres on a new data centre in Vineland, New Jersey, and positions Nebius as a critical supplier of AI-ready infrastructure to one of the world’s largest technology companies. For Microsoft, the deal secures dedicated GPU capacity at a time when demand far outstrips supply; for Nebius, it provides the financial foundation and credibility to expand aggressively across the United States and Europe. Like Applied Digital, Nebius faces the challenge of executing at scale, managing energy costs, and navigating intense competition, but the sheer size of its agreement demonstrates both the market opportunity and its ambition to become a global player.

Lesser-known Iris Energy has taken an altogether different approach by pivoting from its origins as a Bitcoin miner into GPU cloud services. Strained crypto-miners have found that their cross-compatible hardware and existing market access to high-performance GPUs fit neatly into the growing AI infrastructure business. The company recently struck a deal with Poolside, an AI start-up, to provide access to cutting-edge NVIDIA H100 GPUs for model training. Initially set at 248 units, the agreement was later expanded to 504 GPUs, highlighting the strong demand for this scarce hardware. Contracts have so far been short in duration – measured in months rather than years – but Iris Energy is clearly demonstrating how its renewable-powered data centres can be repurposed to capture value in the AI market. That said, its current scale remains modest compared with the hyperscale commitments being signed elsewhere, and the company faces the challenges of securing continued access to premium GPUs and maintaining high utilisation to ensure profitability.

Long Call Option

Trade Idea: Nebius Group (Ticker: NBIS)

Buy a Long Call Option

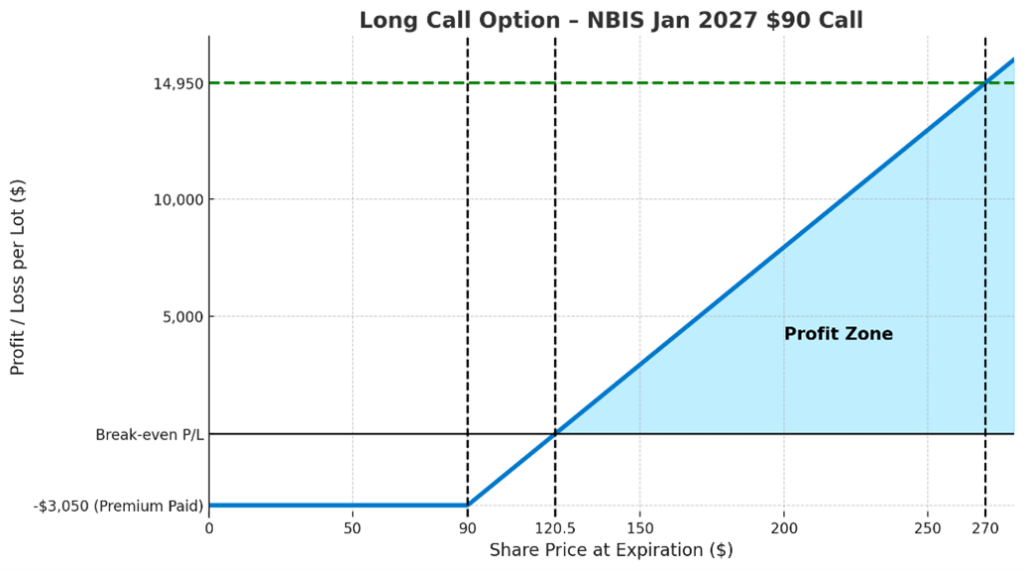

Total consideration: $3,050 per lot (excluding commissions and fees)

Maximum potential loss: Limited to the option premium paid ($3,050 per lot) if NBIS closes below $90 at expiry.

Breakeven at expiration: $120.50 per share.

Performance Context

- NBIS shares have already advanced approximately +200% year-to-date, reflecting heightened optimism around the company’s AI infrastructure strategy.

- If NBIS were to repeat a 200% gain from its current level of ~$90 by 2027, the implied share price would be around $270. At that price, the call option would have an intrinsic value of $180 per share, equating to a profit of $14,950 per lot (excluding commissions).

Diagram displays NBIS Jan 2027 $90 call option with the break-even and profit zone.

This article is a marketing communication and is not investment advice or a personal recommendation. It does not consider your individual circumstances and should not be relied upon when making investment decisions. Trading in derivatives involves substantial risk and is not suitable for all investors.

If you are unsure whether any investment or trading strategy is appropriate for your situation, you should seek advice from an independent financial adviser. Contacting us does not constitute a personal recommendation or investment advice.

For important risk disclosures, please refer to our Trading Notes. AMT Futures Limited is authorised and regulated by the Financial Conduct Authority.