AMD's Q2 Earnings: Growth Amidst Challenges

29-07-2024

Advanced Micro Devices (AMD), a leading fabless chip maker in the semiconductor industry, is set to release its quarterly earnings this Tuesday July 30th after the market close. AMD has been making significant strides with its Ryzen and EPYC processors, which have gained substantial traction in both the consumer and enterprise markets. The company’s continued focus on high-performance computing, gaming, and data centre solutions has bolstered its market position against competitors like Intel and NVIDIA.

The launch of the Ryzen 7000 series and the third-generation EPYC processors has been met with positive reception, highlighting AMD’s commitment to innovation and performance improvements.

The company has also forged strategic partnerships with major tech firms, including a notable collaboration with Microsoft to power the Azure cloud platform. These alliances are anticipated to drive revenue growth and expand AMD’s influence in the cloud computing space.

Analysts are forecasting strong revenue growth for AMD, driven by robust demand for its processors and graphics cards. The company’s data centre segment, in particular, is expected to show significant gains, reflecting the broader industry trend towards cloud computing and artificial intelligence applications whilst the gaming segment remains a crucial revenue stream, driven by the popularity of AMD’s Radeon graphics cards, which are already integrated into gaming consoles such as the PlayStation 5 and Xbox Series X/S.

Despite the optimistic outlook, AMD faces challenges including supply chain constraints and increased competition. The global semiconductor shortage has impacted production capacities across the industry, and AMD is not immune to these disruptions.

Intel’s recent advancements and aggressive strategies in the processor market, along with NVIDIA’s dominance in the GPU space, present ongoing competitive pressures for AMD.

Investor sentiment towards AMD has been largely positive, buoyed by the company’s consistent performance and strategic initiatives. However, the stock has experienced volatility logging a 9% intra-day drop in response to weaker than expected forward guidance despite earnings falling in line with expectations at their last Q1 earnings round in April.

AMD yearly chart highlighting last earnings report

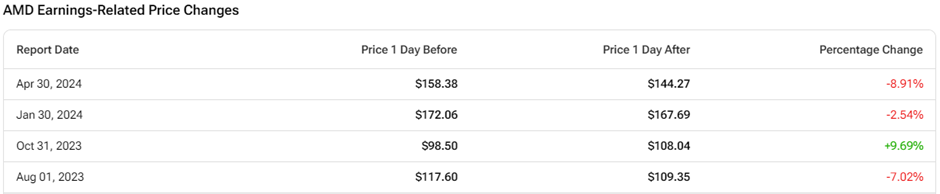

For the upcoming earnings release, a consensus analyst forecast of $0.68 per share is expected, up from the $0.62 reported for Q1 in April. Recent earnings-related price changes can be viewed in the table below, with 3 out of 4 logging a greater than 7% intraday move.

Source: https://www.tipranks.com/stocks/amd/earnings

If you anticipate a stronger than expected Q2 earnings for AMD, you may consider purchasing a short dated out of the money call option

Call Option

Trade Idea

Buy an out of the money Call Option

AMD Cash Price = $141.42 (as of 29/07/2024 at time of writing)

Buy 1 AMD 20-Sep-2024 145 Call @ 9.65 for total consideration of $965 (excl. fees + commissions)

1 (number of contracts) x $9.65 (contract price) x 100 (contract size) = $965 debit

AMD has decreased by 11% over the course of July.

A 15% increase on the current share price to $162 by 20-Sep-2024 expiry, would yield a 77% return on your initial investment.

Maximum loss: $965 (excl. fees and commissions)

Defined risk profile, maximum loss of long option positions is equal to the premium paid.

Breakeven if underlying AMD = $154.65 at expiry on 20-Sep-2024. (strike price plus premium paid)

The contents of this article are for general information purposes only. Nothing in this article constitutes advice to any person and any investments and/or investment services referred to therein may not be suitable for all investors. If you’re unsure whether any investment is right for you, you should contact an independent financial adviser. For more information, please see IMPORTANT DERIVATIVE PRODUCT TRADING NOTES.