Copper Breakout: Is This The Start Of A New Supercycle?

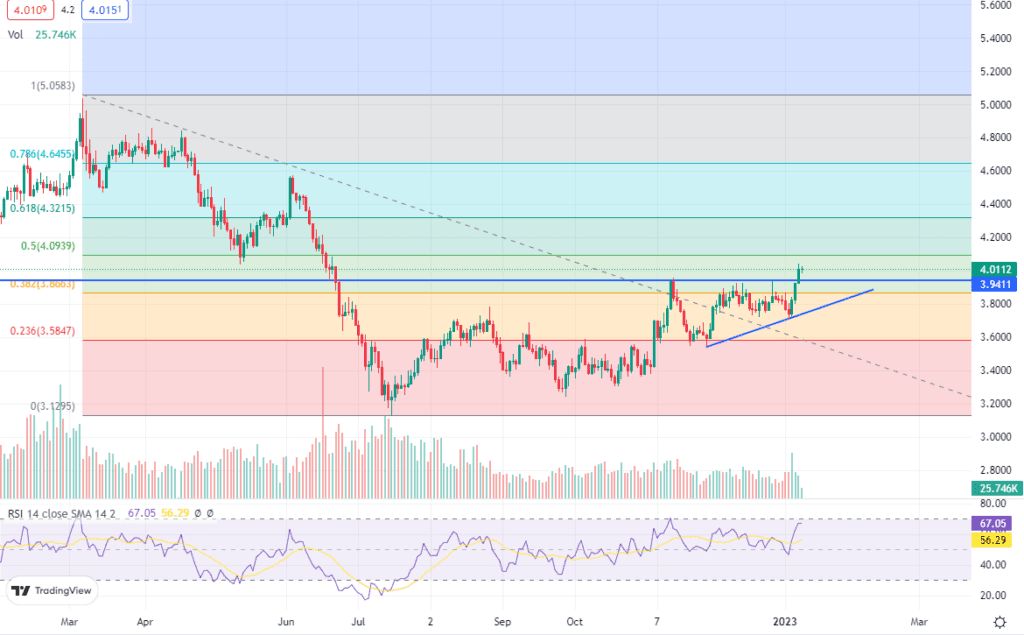

Copper spent the last few months of 2022 trading in a sideways range bashing its head on the 3.92 – 3.95 level until yesterday (9th Jan 23). The price broke through this barrier on the news that China started to re-open its border which brightened prospects of higher demand for the red metal. Dan Smith, Head of Research at AMT says “We are firmly bullish on copper for the year ahead. China had a slump in late 2022, but is now recovering strongly”. Major mining companies such as BHP and Rio Tinto have announced plans to increase copper production in the coming years, but some experts warn that this may not be enough to meet the growing demand.

Alongside improved expectations for the world’s second largest economy, the US dollar saw a fall to a 7-month low against a basket of currencies (DXY) adding support of dollar priced commodities.

The technical backdrop of copper is quite supportive of the bulls. Not only has the red metal made a 7-month high, but it has also broken out of an [tooltip tip=”The ascending triangle is a bullish formation that usually forms during an uptrend as a continuation pattern. There are instances when ascending triangles form as reversal patterns at the end of a downtrend, but they are typically continuation patterns. Regardless of where they form, ascending triangles are bullish patterns that indicate accumulation”] ascending triangle formation[/tooltip] which is typically a bullish continuation pattern. If this pattern tests its mettle and achieves its measuring target of $4.35, we could witness a potential 10% gain.

Gaining direct exposure to copper via futures can be costly and there are ways an investor can gain access to the copper market via ETFs that track the price of copper. ETFs provide investors with a way to gain exposure to a diverse range of assets in a single investment, and they can be used as a way to diversify a portfolio or gain exposure to a specific market or sector. Because ETFs are traded on an exchange, they can be bought and sold like individual stocks. The below trade is an example:

CPER is a commodity pool tracking copper futures contracts on COMEX. The fund uses a complex optimisation process to select two or three contracts each month to mitigate the effects of contango. Contracts are selected using quant analysis on prices of eligible copper futures, developed by Summer Haven Index Management.

The SummerHaven Copper Index (SCI) is composed of copper futures contracts on the COMEX exchange. One- or three-month copper contracts are selected and weighted each month.

Long Call Spread

The Trade

Net Debit $1.47

Initial outlay: $1.47 per lot ($1.47x10x100 = $1470 total outlay for 10 lots)

Maximum profit $2530

Potential profit is limited to the difference between the strike prices minus the net cost of the spread $28-$24 = $4

$4-$1.47 = $2.53

This would be realised if the CPER ETF is trading at or above $28 on expiry.

Insights

Check out some of our insights on markets around the world

Could Metals Be a Steel?

Fed chairman Jerome Powell indicated that the Fed intends to moderate the pace of rate increases with the caveat of

Is Gold Losing Its Shine?

The dollar has seen an impressive run in 2022 seeing the Dollar index (DX) rise as high as 16.8%.