How to Start a Portfolio

There are a few ways to start a financial portfolio but we look at the difference between stock and options, with some examples and a few details about what may be better for you.

Constructing an equity portfolio from scratch begins with buying one or more securities, but is now the right time to be entering the market?

Guessing day-to-day market movements is a fool’s errand, but you have to start somewhere, so focus on what you can control rather than what you can’t. Top of the list is how much cash you have to invest, and how much you can afford to lose.

Next is what you feel comfortable owning, and why – is it because of the company’s historic earnings, its dividend, its market segment, or its management’s other priorities?

Now that you’ve identified the first stock you want to buy, it’s decision time – buy at the market price, place a bid below the market in the hope that it comes down a little, or buy some now and add some more if the price comes down.

But assuming you want to start investing today, there’s another way you might want to consider. Instead of buying the share today, you could sell a put option on the share you want to buy. Why would you do this, and how would it work?

Stock Vs Options

Below we look at a real-world example of stock vs options, where we compare buying the stock at market price vs selling a put option. Let’s look at BP.

BP Plc. Trading at 400p 12th May 2022.

Buy the equity

You buy 10,000 shares at the market price of 400p. You are now holding £40,000 of BP. If the shares go up you make money and if they go down you lose money. Obviously, if they stay at 400p you neither make nor lose.

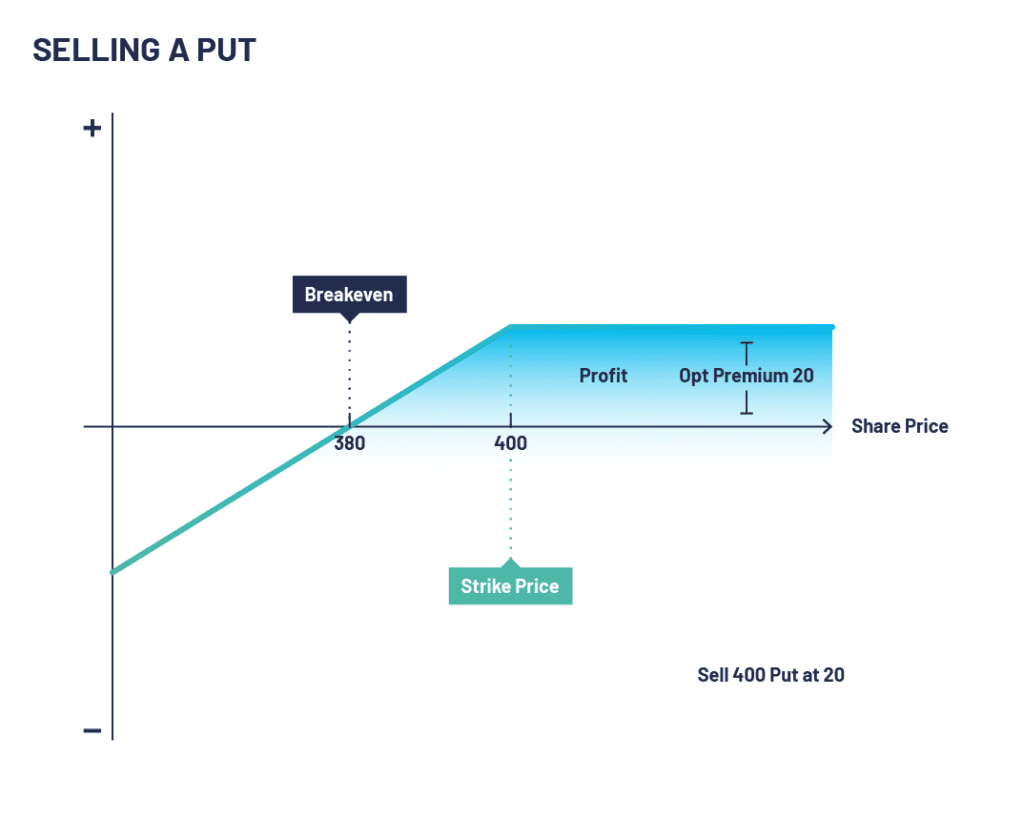

Selling a put option

You sell 10 put contracts with a strike price of 400p with an expiry date of 17th June 2022, and receive a premium of 20p.

One contract equals 1000 shares so you have sold puts based on 10,000 shares. You receive 20p which equates to £2,000 (0.20p x 1000 shares x 10 contracts).

This is 5% of the value of the shares for an option which only has 5 weeks until expiry.

Now we will look at 3 different scenarios which can affect the outcome of the option.

If the put is assigned, you’ll be obligated to buy 10,000 shares of BP at 400p.

Scenario 1: BP shares go up and are above 400p by expiry

The options you have sold expire worthless and you keep the £2,000 premium.

If you want, you could repeat the exercise. Each and every time you sell a put and the price goes up, you are earning income which can be used towards buying the shares if and when you have to buy the shares (when BP’s share price falls below the strike price of the put option you have sold).

There is however an ‘opportunity cost’ of this trade. If the price of BP shares goes up more than 5% (ie more than £2,000), you will not benefit from any further increase above the £2,000 you have already received.

Scenario 2: BP’s share price falls and is trading below 400 by expiry

The option is assigned and you have to buy the shares at 400p. Taking into account the premium collected, you would own the shares at 380p (400-20) which is a 5% discount to the price you would have paid if you had bought the shares on day 1.

Owning shares through assignment: 10,000 shares x 400p – £2000 premium = £38,000.

Scenario 3: The stock trades sideways and is trading at 400 on expiry

You can buy your option back for a fraction of what it cost 5 weeks ago (now trading at say 2p, for £200), locking in a profit of £1,800 (4.5%) in 5 weeks.

If you are still interested in buying the shares, you could then repeat the same process again.

The market direction will always have the biggest part to play in the outcome of your stock portfolio.

Options are worth considering because you can enhance your profits and limit your losses, whichever way the market moves.

Starting a Financial Portfolio

Constructing a portfolio is relatively simple and will constantly evolve over your investment journey. Choose a broker that will help you meet your investment objectives for the long term.

Options are leveraged products which allow you to speculate on the movement of a market without ever owning the underlying asset. This means your profits can be magnified as you have not had to pay the total cost to hold the underlying asset in your portfolio.

At OptionsDesk, we require that you complete an application process to help us with your financial situation and investing experience. This information is important as it allows us to see if these types of products are appropriate for you as per the guidance of our financial regulator, the Financial Conduct Authority (FCA). Once you have passed and signed an options trading agreement, the process of buying options is straightforward.

Once you have an account, OptionsDesk can talk you through your investment objectives and after you’ve selected the specific options contract that you’d like to trade, an OptionsDesk broker will do the rest for you.

There are a number of financial institutions that allow clients to trade options, but you should take time to understand how they operate. At OptionsDesk we make sure what we charge you for our brokerage service is clear and transparent, with no hidden fees. We take our duty of best execution extremely seriously and do not make money from the difference (or ‘spread’) between the bid and offer. Unlike many firms in our industry we do not, under any circumstance, get any payment for your order flow.

At OptionsDesk, we execute your orders on regulated stock markets and derivative exchanges. Because these trading venues are obligated to offer ‘best execution’, thus giving you the best possible price for your order.

If you are comfortable with using options to start a portfolio, you can consider implementing other options strategies to protect, generate income or position yourself in the market. Buying options is just the start of your options journey.