How to Trade During Earnings Season

Earnings season refers to the period of time when publicly traded companies release their financial results, this how to guide details what you should do during earnings season.

Earnings Season

Earnings season refers to the period of time when publicly traded companies release their financial results. This occurs every quarter and publicly held U.S. companies are required by the Securities and Exchange Commission (SEC) to announce their latest earnings and sales results, otherwise known as ‘Earnings Season’.

Investors, analysts, and market participants pay particular attention to a company’s financial figures in their earnings report during the US earnings season, as well as any accompanying remarks or management conference calls. The outcomes may significantly affect the stock price of a firm as well as the market’s mood. Generally, investors and traders tend to be more active during this period due to the opportunity, which normally causes an increase in the volatility of the stock price.

Stock Earnings Season

Stocks can sharply rise on the back of a positive earnings result. A strong performance will normally see buyers opting to invest in the company as it is seen as being profitable with investors wanting to add the stock to their portfolios.

On the other hand, if a company announces earnings that are far worse than anticipated this can result in a sharp, sudden decline in the price of the stock, as investors sell the shares in order to avoid holding onto a company that is not performing well.

Either scenario can offer a potentially profitable trading opportunity via the use of an option trading strategy known as the long straddle.

Long Straddle

If you’re looking to take advantage of an earnings announcement in anticipation of a large move, buying a straddle is a strategy that should be considered. The goal of a long straddle is to make a profit from a large price movement in either direction, regardless of the direction of the move.

What is a Long Straddle?

A long straddle option is a type of trading strategy that involves simultaneously buying a call option and a put option with the same strike price and expiration date. The call option gives the holder the right to buy the underlying asset at the strike price, while the put option gives the holder the right to sell the underlying asset at the strike price.

When buying a straddle, you are looking to profit if the stock moves more than the cost of your straddle in either direction. If the price of the underlying asset increases, the call option will increase in value, while the put option will decrease in value. If the price of the underlying asset decreases, the put option will increase in value, while the call option will decrease in value.

This strategy allows the holder to profit from both upward and downward price movements, making it a popular strategy for traders who expect a significant price movement but are uncertain of the direction.

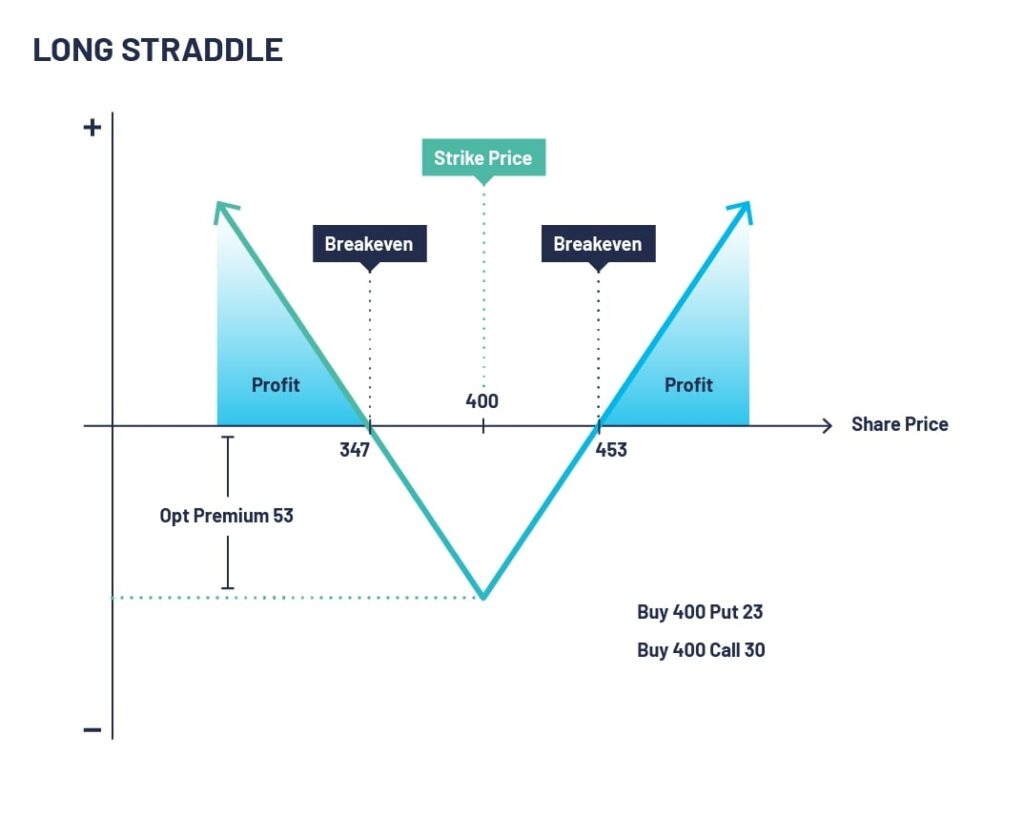

As you can see from the example below, the straddle break-even is the cost of the straddle itself. If the earnings results were to move more than the initial cost to establish the trade, you will be in profit. You also benefit from being able to profit from a move in either direction. Buying a straddle can be expensive so you will need the stock to move quite sharply.

Long Straddle Payoff

Where to Buy Straddles

Buying options is relatively easy, however, you must go through a few steps before you place your first trade. When it comes to buying straddles, one of the most important factors to consider is the brokerage firm you choose to work with. Not all brokers offer the same options trading capabilities or expertise. Choose a brokerage that will help guide you through not only the account opening process but also one that can help you to meet your investment objectives.

Another important factor to consider is the cost of trading. Look for a broker that offers competitive pricing for the service you require. At OptionsDesk we ensure what we charge you for our brokerage service is clear and transparent, with no hidden fees. We take our duty of best execution extremely seriously and do not make money from the difference (or ‘spread’) between the bid and offer. Unlike many firms in our industry, we do not, under any circumstance, receive payment for your order flow or trade against you. Be aware of firms offering futures or options contracts which are not exchange traded but bilateral swaps or Contracts for Differences. Swaps and CFDs carry much greater counterparty risk than regulated exchanges and clearing houses.

One of the most important aspects to consider is whether your broker is regulated. Choose a broker that is regulated by the Financial Conduct Authority (FCA) to ensure that you are protected and working with a reputable firm.

Options are leveraged products which allow you to speculate on the movement of a market without owning the underlying asset. This means your profits can be magnified as you would not have to pay the total cost to hold the underlying asset in your portfolio.

At OptionsDesk, we require that you complete an application form which asks various questions about your financial situation and investing experience. This information is the industry standard and very important as it allows us to see if option investing is appropriate for you as per the guidance of our financial regulator, the Financial Conduct Authority (FCA) and to get a better picture of how appropriate these instruments are for you. Be aware of any brokerage that does not conduct these checks.

Once your account is open, you can talk to a broker anytime during market hours about your investment objectives and the best ways to express them. OptionsDesk can talk through your trades and after you’ve selected the specific options contract that you’d like to trade, an OptionsDesk broker will do the rest for you.

At OptionsDesk, we execute orders on regulated stock markets and derivative exchanges. Because these trading venues are obligated to offer ‘best execution’, meaning, you get the best possible price for your order.