US Earnings Season Update

Week: 12–16 January 2026 Summary

US earnings season opened with the major banks. Reported results were generally strong, but share-price reactions were mostly negative, indicating limited tolerance for uncertainty around forward earnings, costs, and policy exposure. Headline beats alone were insufficient to drive performance. Sentiment improved later in the week, led by semiconductors and capital-markets-exposed franchises, where earnings momentum and operating leverage were clearer. Overall, market behaviour reflected selective risk-taking rather than broad re-engagement.

- Banks: Strong profitability was not rewarded. Market focus remained on forward visibility, expense discipline, and regulatory and consumer-credit considerations.

- Fee and flow businesses: Capital-markets and asset-management franchises saw positive share-price responses, reflecting improved activity and client engagement.

- Technology: Semiconductor results reinforced confidence in the technology cycle and supported broader risk sentiment late in the week.

- Macro: Inflation and rates expectations were broadly unchanged, keeping investor positioning selective.

Early earnings season signals suggest markets are prioritising earnings quality, durability, and forward confidence over near-term delivery. Sector leadership is skewed toward areas with clearer demand drivers and operating leverage, while policy- and consumer-exposed financials remain under scrutiny.

Key Metrics

- Earnings scorecard: With 7% of S&P 500 constituents having reported Q4 2025 results, 79% have delivered earnings per share above consensus expectations, while 67% have exceeded revenue forecasts.

- Earnings growth: The S&P 500 is currently on track for blended year-on-year earnings growth of 8.2% in Q4 2025. Should this rate be realised, it would represent the tenth consecutive quarter of earnings expansion for the index.

- Earnings revisions: At the end of December (December 31), consensus estimates pointed to 3% year-on-year earnings growth for Q4 2025. Since then, six sectors have seen earnings expectations revised lower, reflecting a combination of downward EPS estimate revisions and negative earnings surprises.

- Earnings guidance: Early corporate guidance for Q1 2026 remains mixed but limited in scope, with two S&P 500 companies issuing negative EPS guidance and three companies providing positive guidance.

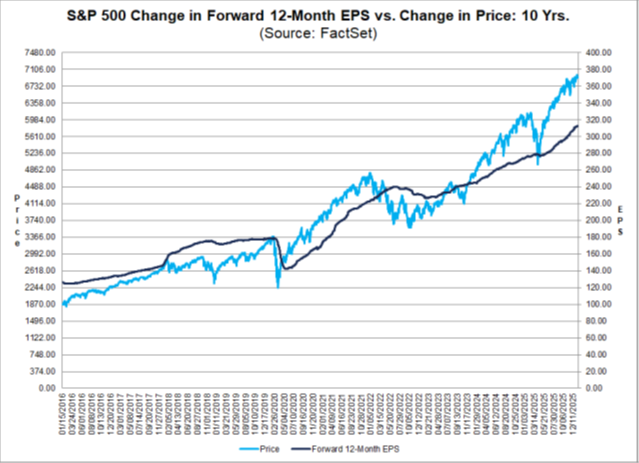

- Valuation: The S&P 500 is trading on a forward 12-month price-to-earnings ratio of 22.2, a valuation multiple that stands above both its five-year average of 20.0 and its ten-year average of 18.8, underscoring a continued premium to historical norms.

| Company | Ticker | Sector | Reported Results | Share Price Reaction |

|---|---|---|---|---|

| JPMorgan Chase | JPM | Banking | Q4 net income $13bn; EPS $4.63. FY net income $57.5bn; EPS $20.18 | -4.19% |

| Bank of America | BAC | Banking | Q4 net income $7.6bn (+12% YoY); EPS $0.98 (+18% YoY) | -3.78% |

| Citigroup | C | Banking | Q4 adjusted EPS $1.81; FY adjusted net income >$16bn (+27% YoY) | -3.34% |

| Wells Fargo | WFC | Banking | Q4 net income $5.4bn (+6% YoY); diluted EPS $1.62 (+13% YoY) | -4.61% |

| BNY Mellon | BK | Asset Servicing | FY 2025 net income $5.3bn (record); revenue $20.1bn (+8% YoY) | +1.88% |

| Goldman Sachs | GS | Investment Banking | Q4 EPS $14.01 | +4.63% |

| Morgan Stanley | MS | Investment Banking / Wealth | FY revenue $70.6bn (record); EPS $10.21 | +5.78% |

| BlackRock | BLK | Asset Management | FY net inflows $698bn; Q4 inflows $342bn | +5.93% |

| Delta Air Lines | DAL | Airlines | FY revenue $58.3bn (record); operating margin 10%; EPS $5.82 | -2.39% |

| Taiwan Semiconductor | TSM | Semiconductors | Results supported expectations of continued technology-cycle and AI-related demand | +4.44% |

If you are interested in discussing further, please contact the desk on 0207 466 5665.

Important Disclaimer

This article is intended for general information purposes only and reflects the market environment at the time of writing. It does not constitute investment advice, a personal recommendation, or an offer to engage in any trading activity. The content does not take into account individual objectives or circumstances and should not be relied upon as the basis for any investment decision. Past performance is not a reliable indicator of future results.

Content may have been created by persons who have, have previously had, or may in future have personal interests in securities or other financial products referred to therein. All conflicts, and potential conflicts, relating to our business are managed in accordance with our conflicts of interest policy. For more information, please refer to our Summary of Conflicts of Interest Policy

For more information and important risk disclosures, please see our Trading Notes and Privacy Policy. AMT Futures Limited is authorised and regulated by the Financial Conduct Authority.