UK Gilts: A Strategic Haven in Today's Inflationary Market

Buying Gilts as an Alternative to Cash

Given the current economic climate and the evolving market dynamics, sophisticated investors are considering the benefits of moving into UK government bonds, known as gilts, rather than cash, which suffers from depreciation at the hands of inflation. Despite the current allure of cash as an alternative to riskier assets, the growing attractiveness of gilts, bolstered by various market factors, presents a compelling case for investors looking to optimise their portfolios and combat inflation for the following reasons: Rising Demand and Favourable Yields:

The recent surge in interest rates has contributed to the growing appeal of gilts, with yields reaching levels not seen since 2007 (pre- Global Financial Crisis). Notably, some gilts are now offering yields exceeding 5%, a stark contrast to the lower rates witnessed in recent years. For instance, a UK gilt with a maturity date in 2025 provided an annual equivalent yield of 5.1% as of 24 October 2023, making them a competitive option for investors seeking substantial returns.

Tax Advantages:

Another key advantage lies in the tax benefits associated with investing in gilts. While income tax applies to the interest earned from gilts, investors are fully exempt from capital gains tax (CGT) if held to maturity; and there are different types of gilts that have varying rates. This exemption is particularly beneficial for higher-rate UK taxpayers who would otherwise face a higher rate of CGT. Moreover, holding gilts within tax-efficient wrappers such as ISAs or Self-Invested Personal Pensions (SIPPs) can further amplify these tax advantages by way of paying no CGT or tax on interest earned.

Below are two examples of gilt trades with varying coupons (prices correct as of October,24, 2023):

- T24 – 2 3/4% Treasury Gilt 2024: has a total yield of 4.834% including a coupon of 2.75%

- TN24 – 0 1/8% Treasury Gilt 2024: has a total yield of 4.742% including a coupon of 0.125%

In the above two examples T24 overall pays a higher yield, however it is subject to tax on a higher coupon of 2.75% compared to 0.125% on the TN24.

If the investment is made within a tax-free environment (eg an ISA or SIPP), then the T24 may be the better instrument as it pays the higher rate, and there would be no tax to pay on it.

However, for the retail investor looking to invest for their personal account they might be more inclined to buy the TN24 with a significantly lower coupon to take advantage of the CGT tax exemption.

Impact of Increased Gilt Supply:

Despite the record issuance of gilts by the UK government, the amplified supply hasn’t dampened their appeal. While an increase in supply could theoretically lead to downward pressure on prices, driving yields higher, various market experts emphasise the resilience of gilts, particularly those with shorter maturities.

Notably, gilts with longer maturity dates have shown a decline in prices due to reflecting older, lower interest rates. However, gilts with shorter maturities offer a preferable alternative to cash, especially when considering the tax benefits associated with certain low coupon issues as demonstrated above.

Diversification and Risk Mitigation:

Gilts serve as a valuable addition to a diversified portfolio, acting as a safeguard during times of market uncertainty. Their low correlation with stock markets makes them an excellent diversifier, allowing investors to balance their exposure to different asset classes. By strategically incorporating gilts with varying durations, investors can effectively manage risk and taking full advantage of the stability and security that gilts offer.

Strategic Considerations:

The current macroeconomic landscape emphasises the importance of considering wider market factors. High inflation remains a primary driver of gilt yields, with potential fluctuations anticipated in the near term. Despite challenges posed by the market, the current valuation of gilts presents an opportunity for investors to enter the market at a favourable point, potentially benefiting from future capital gains.

In conclusion, considering the benefits of increased yields, tax advantages, and the role of gilts in diversification and risk mitigation, investors are considering gilts as a robust investment option, particularly in the face of current market dynamics.

With careful consideration of the market climate and the strategic integration of gilts within a diversified portfolio, investors can optimise their investment strategies while maximising returns.

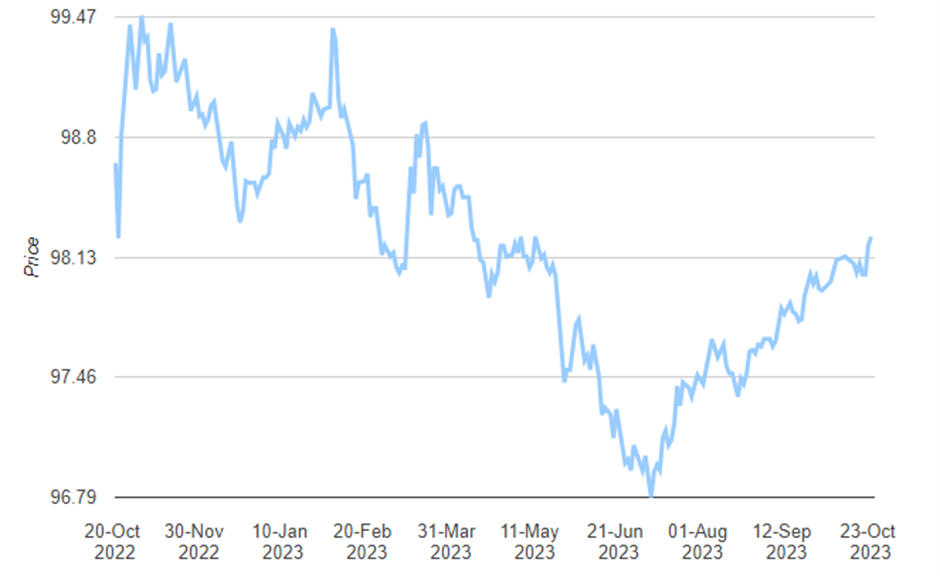

TN24 PRICE HISTORY:

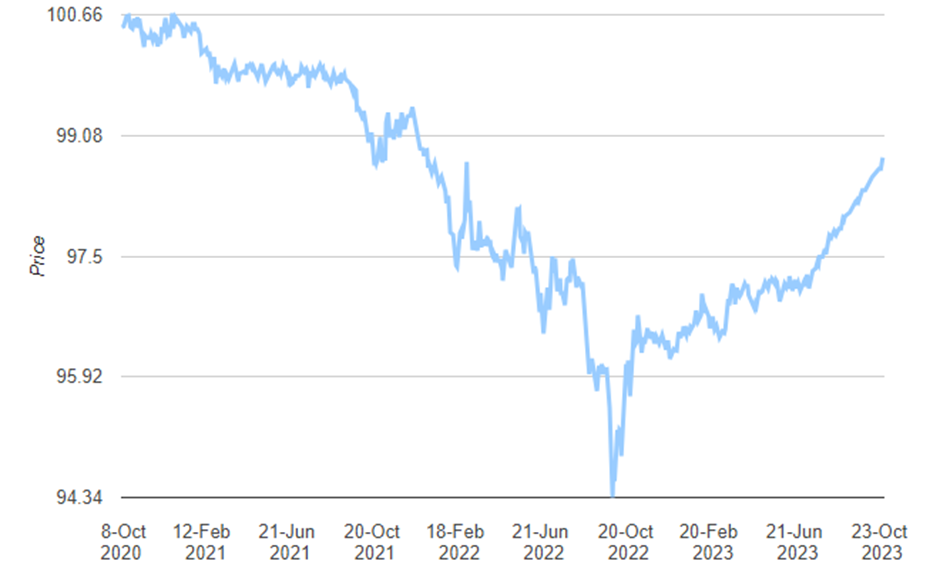

T24 PRICE HISTORY: