UK Gilt Market Report - September 2025

04/09/25

The UK gilt market has entered a period of renewed volatility, with long-term borrowing costs surging to levels last seen in the late 1990s. Thirty-year gilt yields have risen to approximately 5.6–5.7%, marking their highest level since 1998. This sharp repricing has been driven by sticky inflation, tighter global monetary policy, and renewed concerns around UK fiscal credibility. At the same time, elevated issuance and reduced appetite from traditional long-term investors have amplified the move in yields.

From a historical perspective, the increase in yields highlights the sensitivity of the UK to global shifts in monetary conditions. With the US Federal Reserve and the European Central Bank also keeping rates higher for longer, the cost of capital across developed markets has adjusted sharply upward. For the UK, the domestic overlay of high debt levels and political scrutiny of fiscal policy has intensified the impact, leaving gilts underperforming relative to some international peers.

Treasury Shake-up & Market Confidence

The reshaping of the Prime Minister’s economic team, with Darren Jones becoming Chief Secretary and Minouche Shafik appointed Chief Economic Adviser, was intended to restore confidence in the government’s fiscal stewardship. Shafik’s international standing and central banking background add credibility, but investors remain cautious. The legacy of the 2022 mini-budget crisis weighs on sentiment, and the government faces the challenge of proving that pro-investment strategies can coexist with debt sustainability.

Market participants have responded to the reshuffle with cautious optimism, but the credibility gap remains. Investors are demanding not just experienced personnel but also concrete evidence that the government is capable of long-term planning. Without credible fiscal rules and consistent execution, any recovery in confidence could prove short-lived. The Treasury’s history of risk aversion and short-term adjustments has left the market sceptical about its ability to manage structural challenges.

Gilt Supply Outlook

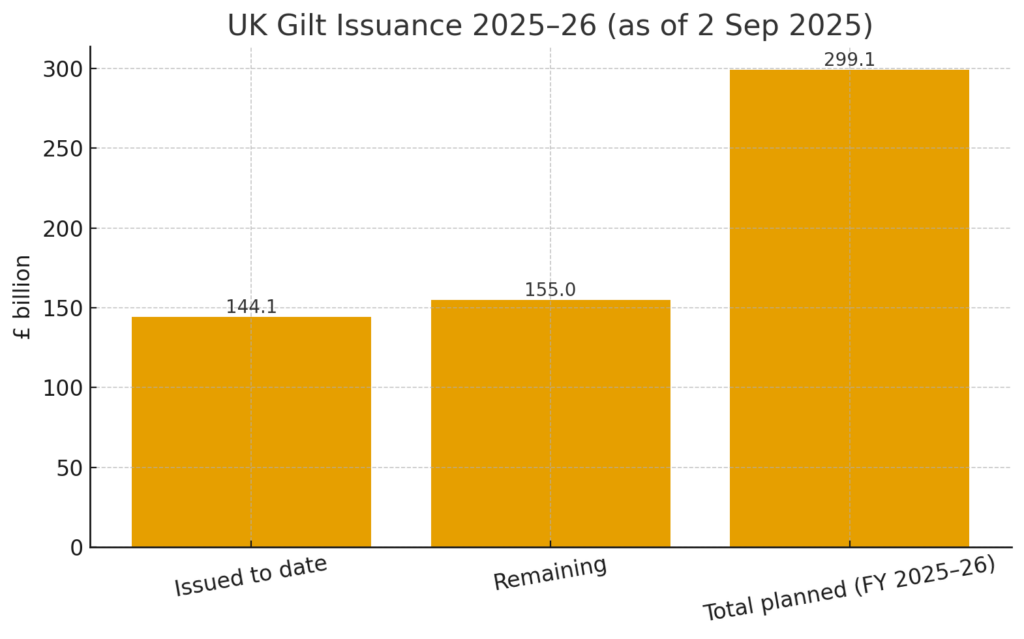

The Treasury plans to issue £299 billion in gilts during 2025/26, broadly consistent with the previous year. However, the composition of issuance has changed: long-dated supply has been cut to 10% of total issuance from 20% the year before. This shift is designed to ease pressure at the long end of the curve, where yields have risen most sharply. Looking ahead, the Office for Budget Responsibility projects over £50 billion of additional gilt sales over five years, embedding higher borrowing costs as older, lower-yielding debt matures and is refinanced at current elevated rates.

This change in issuance strategy highlights the Treasury’s attempt to adapt to market conditions. By reducing long-end supply, it aims to stabilise yields and maintain investor participation across different maturities. However, this flexibility has limits: refinancing pressures will increase steadily, and the structural requirement for heavy gilt issuance will continue to weigh on markets. If demand weakens further, the Bank of England may face renewed pressure to intervene in secondary markets.

Fiscal Outlook

In the near term, fiscal performance has been stronger than expected. Borrowing in July undershot forecasts due to robust tax receipts and lower debt interest costs. However, structural vulnerabilities remain significant. Debt is expected to rise toward 98% of GDP by the end of the decade, and the Chancellor’s fiscal headroom is just £10 billion – a razor-thin margin in the face of potential shocks.

The decision to loosen fiscal rules to accommodate £113 billion of public investment over five years is a calculated gamble on growth. Success could lift productivity, expand the tax base, and improve debt sustainability. Failure would likely force tougher policy choices, such as higher taxes, deeper spending restraint, or additional borrowing. This dilemma reflects the UK’s broader fiscal bind: the need to invest to improve long-term competitiveness while simultaneously convincing markets of fiscal discipline.

In addition, long-term commitments such as pensions, healthcare, and climate transition spending are set to exert increasing pressure. Without structural reforms to either raise revenues or curb spending growth, the government’s ability to meet its fiscal rules is highly uncertain. The Treasury therefore faces a delicate balancing act – too much restraint risks choking growth, while too much stimulus risks undermining confidence.

Conclusion

The gilt market is serving as a barometer of fiscal credibility. The rise in long-term yields reflects both global dynamics and local fiscal anxieties. The Treasury reshuffle provides a signal of renewed commitment to stability, but markets require tangible evidence that pro-investment policies can be delivered without undermining debt sustainability.

With issuance heavy and fiscal buffers slim, the months ahead will be critical in determining whether the government can navigate its fiscal gamble successfully. If credibility is rebuilt and investment delivers productivity gains, the UK could gradually stabilise its debt trajectory. If not, the gilt market may face further volatility, and policymakers could be forced into more difficult decisions. The gilt curve and investor demand will remain the most immediate indicators of how this balancing act unfolds.

Investors should remain cautious at the long end of the curve, maintaining flexibility through option-based strategies or relative-value positioning rather than outright directional bets. For policymakers, the priority must be clarity: articulating a credible fiscal path and ensuring that investment-led growth is underpinned by reforms. Without this, the cost of capital will remain structurally higher, limiting the UK’s economic flexibility.

Sources & References

– The Guardian – UK long-term borrowing costs reach 27-year high (Sept 2025)

– The Guardian – More pain for Reeves as borrowing costs near 27-year high (Aug 2025)

– The Times – UK economy: Rachel Reeves has very small margins on fiscal rules (2025)

– Reuters – Sterling, gilts under pressure as spotlight falls on UK finances (Sept 2025)

– Office for Budget Responsibility (OBR) – Debt and issuance outlook (2025)

– Franklin Templeton – Market commentary on gilt issuance (2025)

– UK Parliament Commons Library – Long-term vulnerabilities in public finances (2025)

This article is intended for general information purposes only and reflects the market environment at the time of writing. It does not constitute investment advice, a personal recommendation, or an offer to engage in any trading activity. The content does not take into account individual objectives or circumstances and should not be relied upon as the basis for any investment decision. Past performance is not a reliable indicator of future results.

For more information and important risk disclosures, please see our Trading Notes and Privacy Policy. AMT Futures Limited is authorised and regulated by the Financial Conduct Authority.