Trump’s Second Term: A Boost for U.S. Oil and Gas?

02-12-24

During Donald Trump’s presidency (2017–2021), the oil and gas industry experienced a marked expansion in drilling activity, spurred by policies designed to promote domestic energy production. Trump’s “America First Energy Plan” aimed to reduce the United States’ dependence on foreign energy and establish the country as a leading global producer. This vision, paired with favourable regulatory changes and tax policies, catalysed the rise of oil and gas rigs across the nation.

Pro-Energy Policies and Deregulation

Trump’s administration emphasised rolling back environmental regulations and opening up federal lands for energy development. Among the key moves:

- Opening Federal Lands: The administration expanded leasing opportunities for oil and gas drilling on federal lands and offshore areas, including parts of the Arctic National Wildlife Refuge (ANWR) and the Gulf of Mexico.

- Reducing Regulatory Barriers: Key regulations, such as methane emission rules and the Clean Power Plan, were relaxed or replaced, cutting costs for energy companies.

- Energy Independence Goals: Through these efforts, Trump sought to make the U.S. a net exporter of energy for the first time in decades, a milestone achieved during his term.

These initiatives made drilling more economically viable, even in areas previously considered less profitable due to regulatory costs.

Rising Rig Counts

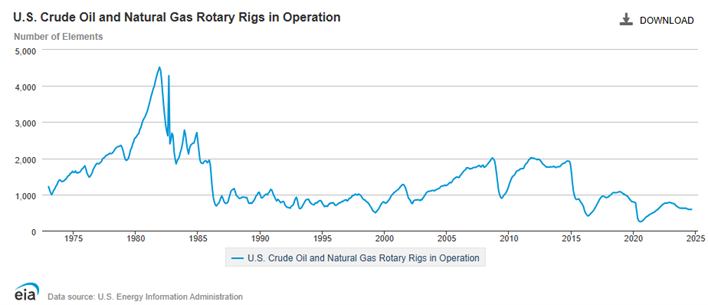

The number of active oil and gas rigs in the U.S. surged early in Trump’s first term, particularly during 2017 and 2018. This growth was driven by a combination of deregulation and favourable market conditions, including higher global oil prices. Texas’s Permian Basin, North Dakota’s Bakken Formation, and other shale-rich regions became hotspots for drilling activity.

According to Baker Hughes, a leading energy services company, the U.S. rig count rose from around 500 active rigs in late 2016 to over 1,000 by mid-2018. This growth reflected renewed investment confidence in the energy sector, bolstered by the administration’s consistent support.

Despite the initial surge, the oil and gas sector faced challenges toward the end of Trump’s presidency:

- Market Volatility: The COVID-19 pandemic in 2020 led to a sharp decline in global oil demand, causing rig counts to plummet.

- Environmental Concerns: Environmental advocates criticized the administration for prioritizing short-term economic gains over long-term sustainability, pointing to increased greenhouse gas emissions and risks to fragile ecosystems.

- Financial Struggles: Many energy companies faced financial strain due to fluctuating oil prices and high debt levels, even as production ramped up.

When Trump returns to the White House, his administration is likely to prioritize oil and gas development, which could lead to a measurable increase in rigs. However, the extent of this increase will depend on a confluence of policy, market conditions, and broader societal trends. While the U.S. energy sector might benefit from short-term growth, questions about long-term sustainability and the global transition to clean energy will remain pressing challenges.

Trump’s energy strategy, if similar to his first term, would aim to position the U.S. as a dominant force in global energy markets. Whether this aligns with future energy realities or faces significant obstacles will be a defining aspect of his second presidency.

Policy Incentives Favouring Fossil Fuels

Trump has consistently advocated for energy independence and an “all-of-the-above” energy strategy, heavily emphasizing fossil fuels. A second Trump presidency would likely prioritize:

- Deregulation: Efforts to rollback or eliminate environmental and emissions regulations that impact drilling, such as methane restrictions or permitting processes.

- Federal Leasing Expansion: Opening more federal lands and offshore areas for oil and gas exploration, including revisiting controversial regions like ANWR and deepwater drilling zones.

- Tax Incentives: Potential tax breaks or subsidies for oil and gas producers to stimulate domestic production.

These measures could make drilling more cost-effective and encourage companies to invest in new rigs and wells.

Market Drivers for Increased Rig Activity

While policy plays a significant role, market conditions are equally critical. Factors that could lead to a rise in oil and gas rigs include,

- High Global Energy Demand: Continued or growing global demand for oil and natural gas could incentivize U.S. producers to increase output.

- Geopolitical Tensions: Ongoing instability in major oil-producing regions, such as the Middle East or Russia, could elevate oil prices and make U.S. production more attractive.

- LNG Export Growth: Expanding liquefied natural gas (LNG) exports could drive demand for natural gas drilling, especially from U.S. shale basins.

If these factors align with a pro-drilling administration, rig counts could see a substantial rise.

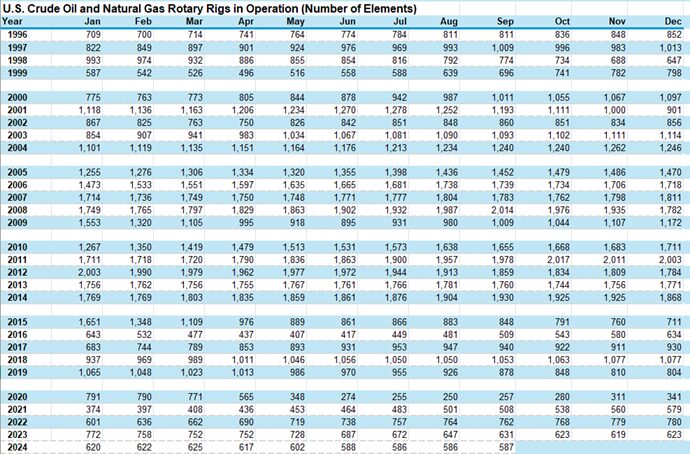

Please see table below for the history of oil rigs in operations

Data source: U.S Energy information administration

Halliburton Company, Valaris Limited, Schlumberger Limited and Baker Hughes Company are some of the biggest offshore oil rig companies in the U.S.

If you think there could be an increase in oil and gas rig productions, you may consider buying longer dated call options in companies above. Please call the desk if you would like to discuss any of the above in more detail.

The contents of this article are for general information purposes only. Nothing in this article constitutes advice to any person and any investments and/or investment services referred to therein may not be suitable for all investors. If you’re unsure whether any investment is right for you, you should contact an independent financial adviser. For more information, please see IMPORTANT DERIVATIVE PRODUCT TRADING NOTES.