The Silver Market in 2025

23/09/25

Silver has always occupied a unique place in global markets. It is both a precious metal sought by investors and a vital industrial material powering the modern economy. In 2025, silver is making headlines once again, with prices hitting multi-year highs, persistent deficits in supply, and strong demand across green technologies and traditional sectors alike.

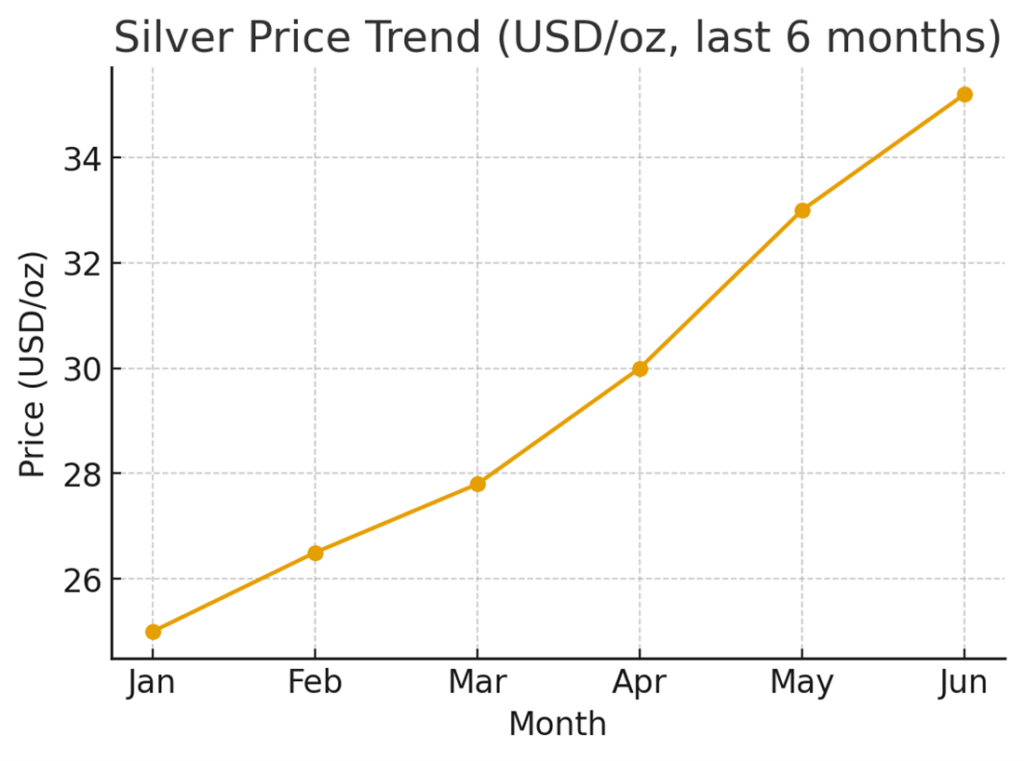

Price Trends Over the Last Six Months

Over the past six months, silver has staged a remarkable rally. Globally, the metal surged past US$35 per ounce in June 2025, its highest level in over 13 years. In the UK, prices climbed from around £22 per ounce in April to over £30 per ounce in September, representing a gain of nearly 20%. This run has been fueled by a weakening U.S. dollar, expectations that interest rates will fall, and strong investor flows into precious metals.

Analysts have taken notice: major banks, including HSBC, recently raised their silver price forecasts, citing ongoing supply deficits, supportive gold prices, and heightened geopolitical uncertainty.

Supply Profile: A By-Product Metal

Unlike gold, silver rarely comes from mines dedicated to silver alone. Instead, about three-quarters of global output arrives as a by-product of copper, lead, zinc, and gold mining. This makes silver supply relatively unresponsive to its own price. Even when silver rallies, miners won’t necessarily increase production unless it makes sense for the primary metal they are targeting.

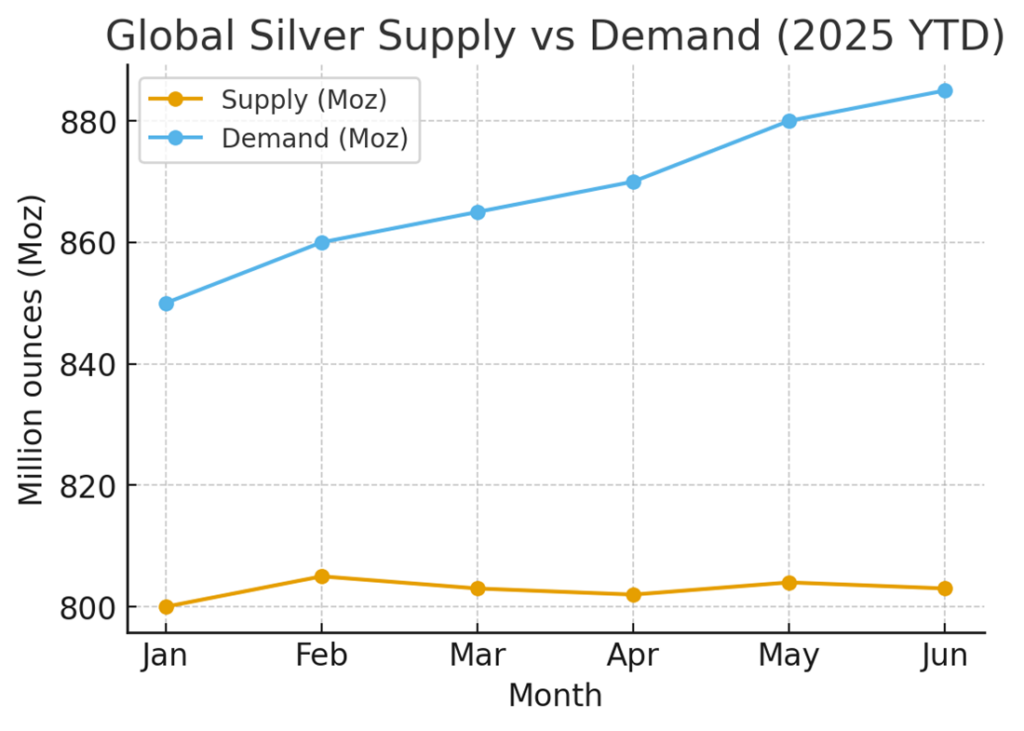

In 2024, global mine production totaled about 803 million ounces, with the top three producers — Mexico, Peru, and China — accounting for a large share. Recycling added additional supply, but not nearly enough to offset demand.

Demand Profile: Industrial Pull and Structural Deficits

Silver demand has been steadily rising, especially in industrial sectors. In 2024, industrial use hit a record 680 million ounces, with solar photovoltaics (PV) leading the way. Silver’s superior conductivity makes it irreplaceable in solar cells, electronics, and electric vehicles.

As a result, the silver market ran a 149-million-ounce deficit in 2024 — the fourth consecutive year of shortfall. Since 2021, cumulative deficits have drained almost 700 million ounces from above-ground stocks, tightening the market considerably.

Current Market Dynamics & Who Buys Silver

The present silver market is shaped by two forces: structurally strong demand and constrained supply. Together, they underpin today’s tight fundamentals and explain why prices have surged.

Industrial Users:

Solar PV manufacturers are the single most important growth driver.

Electronics and electric vehicles also consume large amounts of silver.

Infrastructure and telecoms are quietly becoming major consumers too.

Investors:

– Safe-haven demand has surged alongside gold, with coins, bars, and exchange-traded products gaining traction.

– Silver often benefits from gold’s strength, acting as a more volatile “cheaper cousin.”

Jewelry and Silverware:

– Countries like India remain major buyers, driven by cultural traditions and rising income.

Silver’s Role in the Modern Economy

Beyond its appeal as a store of value, silver is indispensable in today’s technology-driven world. It is the most conductive metal on Earth, making it essential for electronics, renewable energy, and advanced manufacturing. In electric vehicles, silver supports sensors, relays, and wiring. In healthcare, its antimicrobial properties are used in coatings and wound dressings. Even in everyday life, silver is found in mirrors, chemical catalysts, and batteries.

Silver’s dual identity — part precious metal, part industrial workhorse — is what makes its market so dynamic.

Listed Companies Affected by Silver’s Rise

Silver’s surge has meaningful implications for listed companies. Producers and streaming companies generally benefit from higher silver prices,

while industrial users often face margin pressure due to rising input costs.

Producers / Streamers (Beneficiaries)

- Fresnillo plc (LSE: FRES) — one of the largest primary silver producers, Mexico-focused.

- Pan American Silver (NYSE: PAAS; TSX: PAAS) — diversified silver/gold producer across the Americas.

- First Majestic Silver (NYSE: AG; TSX: FR) — Mexico-focused producer; expanded via the acquisition of Gatos Silver (2024/25).

- Hecla Mining (NYSE: HL) — U.S.-based precious metals miner with significant silver output.

- Wheaton Precious Metals (TSX/NYSE: WPM) — streaming company with exposure to silver revenues.

- KGHM Polska Miedź (WSE: KGH) — copper giant with substantial silver by-product output.

- Newmont (NYSE: NEM) — gold major with notable silver by-product production.

Major Users (Cost-Sensitive)

- Solar manufacturers: JinkoSolar (NYSE: JKS), Canadian Solar (NASDAQ: CSIQ), LONGi Green Energy (SSE: 601012) — dependent on silver pastes for PV cells.

- PV materials/pastes: DuPont™ (NYSE: DD) through Solamet®; Solamet Electronic Materials and Heraeus (PV paste division sold in 2025)

- Electronics & semiconductors: broad exposure across components, connectors, and solders.

- Jewelry demand: Titan Company (NSE: TITAN) and other listed retailers in India see cultural demand linked to silver.

UCITS-Compliant Silver Investment Products

For European and UK investors, several UCITS-eligible, physically backed silver exchange-traded commodities (ETCs) provide convenient exposure

to silver’s spot price performance:

- WisdomTree Physical Silver (LSE: PHAG / PHSP) — physically backed, allocated bars.

- iShares Physical Silver ETC (LSE: SSLN) — BlackRock’s physically-backed silver product.

- Xtrackers IE Physical Silver ETC (LSE: XSLR; ISIN DE000A2T0VS9) — DWS’s physically-backed ETC.

Conclusion

The silver market of 2025 is defined by tight fundamentals, surging industrial demand, and supportive macroeconomic trends. Prices have risen sharply in the past six months, reflecting both investor enthusiasm and genuine scarcity. With the energy transition, electrification, and global economic uncertainty all working in silver’s favor, the metal looks set to remain one of the most important commodities of our time.

This article is for informational purposes only and does not constitute investment advice, a personal recommendation, or an offer or solicitation to engage in any investment activity. The mention of any security, commodity or issuer should not be interpreted as a recommendation to buy or sell. Any views expressed are based on public information believed to be reliable at the time of writing, but no representation or warranty is given as to its accuracy or completeness.

AMT Futures Limited may trade in the instruments mentioned. For full disclosures, please refer to our Trading Notes.