The Short Index Strangle

Having trouble picking winning stocks? Why not take a tactical position on an index?

A short strangle is a market-neutral options strategy which seeks to take advantage of a drop in volatility, time decay and limited movement of the underlying within a defined range.

Selling a strangle profits when the underlying price stays between the two strike prices within a given period of time. This strategy also works well as volatility declines, so the best time to apply it is during a period of high implied volatility.

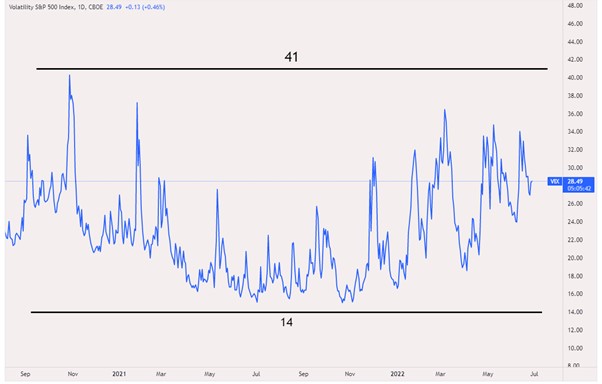

For example, if you think the FTSE is going to continue trading within a defined range, then granting options to receive income might be an effective way to profit from sideways price movements. The FTSE 100 Index has been trading within the same 1000-point range for the past 455 days (6700-7700) despite significant spikes in volatility (represented by the Volatility Index ranging between 14 and 40).

To take advantage of this historic data, you may consider placing the following trade:

Short Index Strangle

Summary

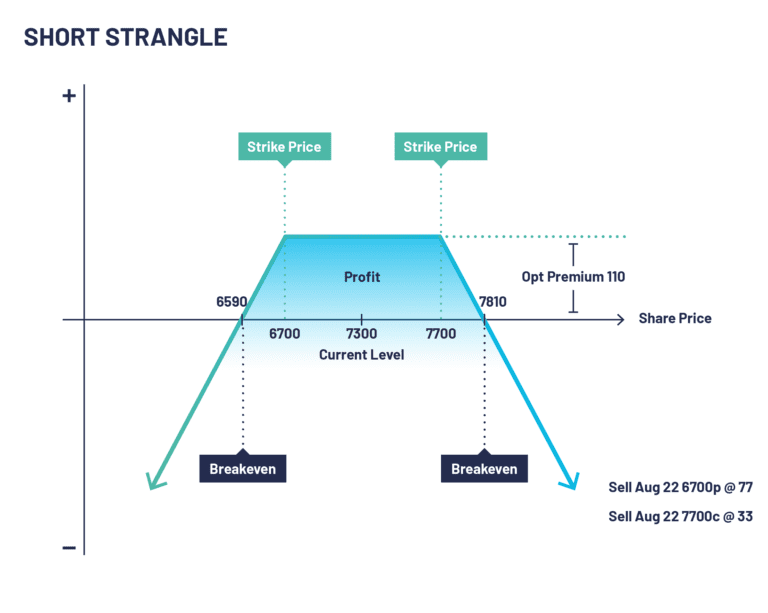

The Index is currently trading at 7300.

A short strangle is executed by selling an August 6700 Put at 77p and selling an August 2022 7700 Call at 33p.

The net credit taken to enter the trade is the maximum possible profit of 110p (£1100 on 1 Lot)*.

On expiration, if the Index is trading between 6700 and 7700, both the 6700 put and the 7700 call expire worthless and you retain the maximum profit of 110p (£1100 on 1 Lot) which is the initial credit they received when opening the position. Profit could be crystalised before expiration of the contract by closing the positions if the Index price is trading within the defined range. This would allow the trader to capitalise on time decay without holding possible downside risk for the remaining term of the option.

If FTSE 100 Index rises and is trading at say 8000 on expiry, the 6700 puts will expire worthless, but the 7700 calls expire in-the-money and have an intrinsic value of 300, thus creating a loss of 190p (300-110, -£1900 on 1 lot)

The trade would also lose money if, for example, the index was trading at 6400 but with the 6700 puts having an intrinsic value of 300p.)

The recommended initial margin required to place this trade would be £10,000, should the price of the index stay within the 1000-point range then £1100 profit will be realised on or before the August 2022 expiry (19th August 2022). Please note that additional margin may be required if the market has adverse price movements.

SHORT STRANGLE SUMMARY

CONFIGURATION:

- Sell a put with a strike price below the current market price of the underlying.

- Sell a call with a strike price above the current market price of the underlying.

OUTLOOK:

- Anticipates decreased volatility – You think a period of low volatility is coming and have a neutral view.

TARGET:

- Underlying price of the asset to be in the middle of the two strikes you have sold so that the options can expire worthless.

PROS

- Premiums can be very attractive.

- High time decay in a neutral market.

CONS

- Higher risk strategy

- Beware of high margins.

- Potential losses can accumulate very quickly.

- Assignment risks on both options if they are American style.

Check Out Our Other Articles

Take a look at our other articles where we discuss the importance of Options Trading.

Earning Additional Income With Covered Calls

Earning additional income is becoming increasingly important to many investors and their independent financial advisors as the economic climate changes.

Barclays Hit By £450m Loss Bond Blunder

Shares in Barclays have fallen as much as 6% as they grapple with a fresh compliance and risk slip-up.