S&P 500 Dips Below Key Level, Erasing Summer Gains Ahead of Pivotal Earnings Week

23-10-2023

On Friday (20-10-23), the S&P 500 index concluded a tumultuous week in the U.S. stock markets, dipping beneath its 200-day moving average for the first time in over half a year. It also wiped out all its gains from a summertime rally that reached its peak towards the end of July.

The SPX index descended by 118 points, a 2.7% decrease, settling the week at 4,223 after experiencing a downturn for four consecutive days. This marked the lowest ending level for the index since June 1st, and it was also the first time it closed below its 200-day moving average, which was at 4,223, since March 17th. Over the week, the S&P 500 took a hit of 2.7% and has ended on a lower note in five of the past seven weeks.

Since its high on July 31st, the index has seen a reduction of 6.8%.

(Chart 1 – S&P 500 Index)

Approximately 16% of the market capitalisation of the S&P 500 is scheduled to release earnings reports in the upcoming week (23-10-23). Notable companies include Microsoft and Alphabet on Tuesday, Meta Platforms on Wednesday, and Amazon on Thursday. All the major players will be disclosing their financial outcomes for the September 2023 quarter after the market closes.

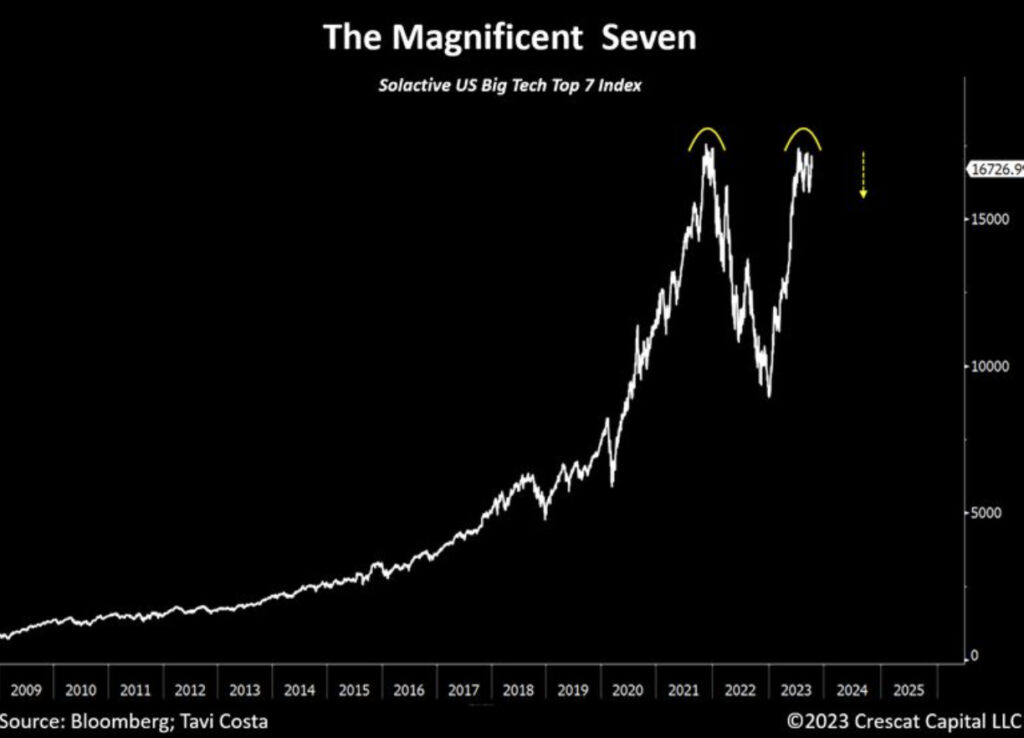

Pessimism and market sentiment have created a backdrop for the Q3 2023 earnings, especially for the mega-cap tech firms. This means that even slight negative results in earnings per share (EPS) and revenue could potentially lead to a further decrease in stock prices from their current loft valuations (see chart 2), and further decreases in broader market terms.

If you are concerned that growth stocks’ earnings may have peaked and that a correction could be brought on by the current geopolitical and macroeconomic outlook, then put options or put spreads are one way to stay invested whilst taking on some protection against short-to-medium term corrections.

(Chart 2 – The Magnificent Seven)

On the 03-10-23 we highlighted a potential trade idea that you could employ if you have a bearish sentiment for equities or wish to protect yourself against a falling market, you could still express your view with the following idea.

PROTECTIVE PUT SPREAD

Trade Idea

Bearish Trade

Current price: 4280

Net cost of trade: 161- 100 = 61 x $50 underlying: $3,050

Max Profit: 4200-3900 = 300 x $50 underling = $15,000 – $3,050 (initial debit) = $11,950

This put spread will protect you against a 9.7% drop on the S&P