What To Do In 2022?

On the face of it 2022 looks to be as challenging as 2021 and we have some added issues to contend with. Inflation and interest rate increases are going to be major factors during what will probably be another difficult year.

So should we do what we normally do and wait for the top analysts’ stock picks for the year ahead? Should we put our faith in those who probably know better? Why not, as equities have generally provided a better return than traditional savings accounts. But will equities provide a real return in 2022 with inflation running north of 4%? Are you comfortable with holding equities and waiting for your next dividend to arrive? Is there an alternative, especially if you think the markets might not react well to rising inflation and rising interest rates?

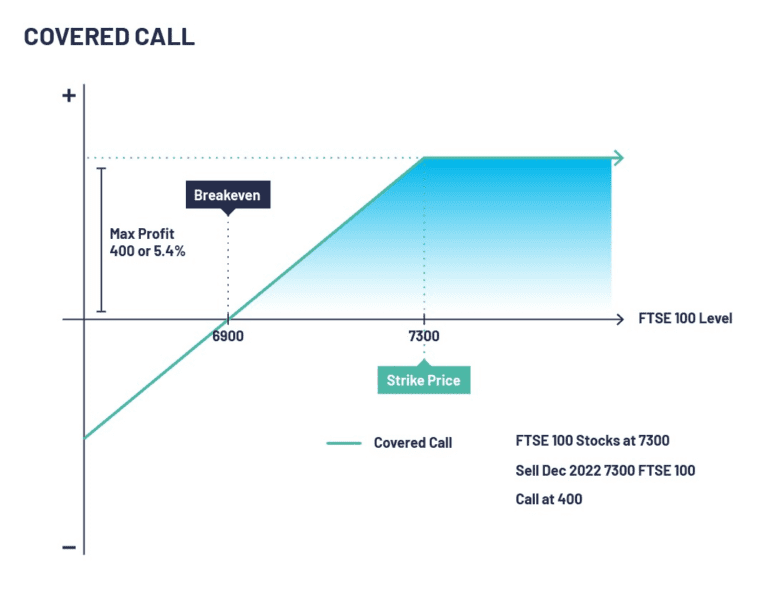

Can an equity and equity option overlay be a better way forward? If you think the markets are in for a tough year then selling covered calls may be the compromise you are looking for.

Let’s take the example of BP Plc. Today you can buy the shares for 356p and sell a Dec 2022 expiry 360 call option for 31p. If the shares are above 360 at expiry you will sell your shares at the strike price of 360p, making a 4p gain plus keeping the 31p premium so a total gain of 35p or 9.8%. You would also receive any dividends paid during the year, which if like 2021 could be another 4% or so.

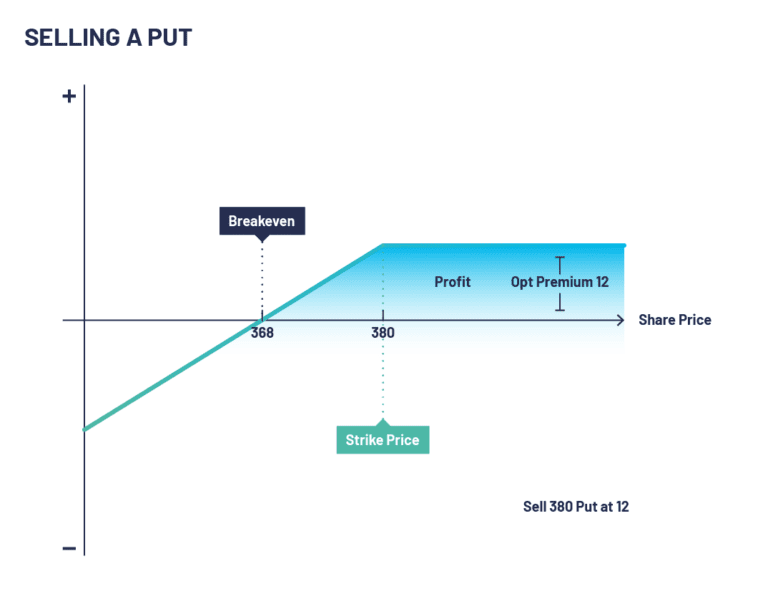

Don’t want to commit to buying shares at today’s price? Why not consider selling a put option with a strike price below the current level of 356p? You could sell a Dec 2022 330 put at 31p, which would mean you are committed to buy shares at 330p if the share price falls, but this would be at a discount of 7.3% to today’s price. If you did have to buy the shares at 330p you would also keep the premium of 31p which equates to 8.7% of today’s price, meaning you would effectively be buying shares at 299p (330p-31p). That’s a discount of 16% to today’s level.

On the flip side, if BP Plc shares stay above 330p then you won’t be committed to buying shares at 330p, but will still keep the premium of 31p, giving you a return of 8.7% for the year. A very reasonable outcome in my opinion.

Don’t fancy BP Plc? Then maybe one of the 1000s of options on individual shares, ETFs or indices listed on the following exchanges may be of interest:

https://www.theice.com/products/Futures-Options/Equity-Derivatives/Single-Stock-Options

https://www.cboe.com/us/options/symboldir/equity_index_options/

https://www.eurex.com/ex-en/markets/equ/opt

Learn more about what options can do for you in our Resources Hub

Check out our other articles

Take a look at our other articles where we discuss the importance of Options Trading.

Open an AccountNetflix Plummets On Poor Subscriber Growth

Netflix disappointed the market when it reported its 4th quarter results on 20th January 2022. It added 8.3m net

Covered Calls

This is a way to boost profits/earn income on a position that you already hold in your portfolio.