Microsoft: Is It Time To Excel?

20-09-22

Tech stocks saw a beating this year, which has seen major US indices enter bear market territory. With the removal of the COVID premium, geopolitical risk weighing on sentiment, and a squeeze on margins due to high inflation, have seen the US major tech stocks pull back rather considerably this year.

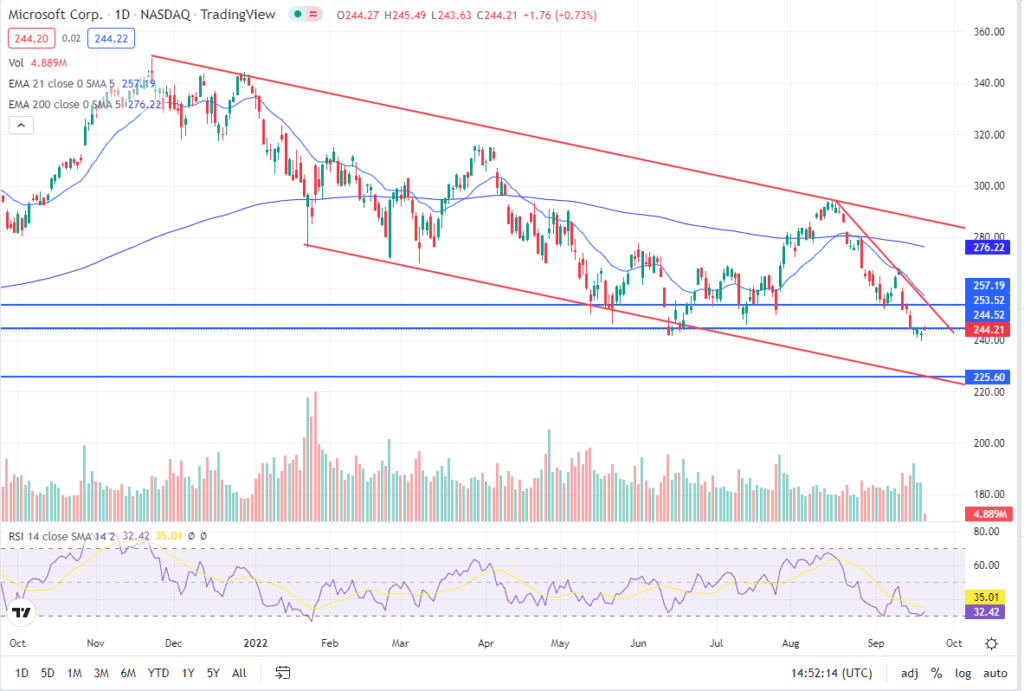

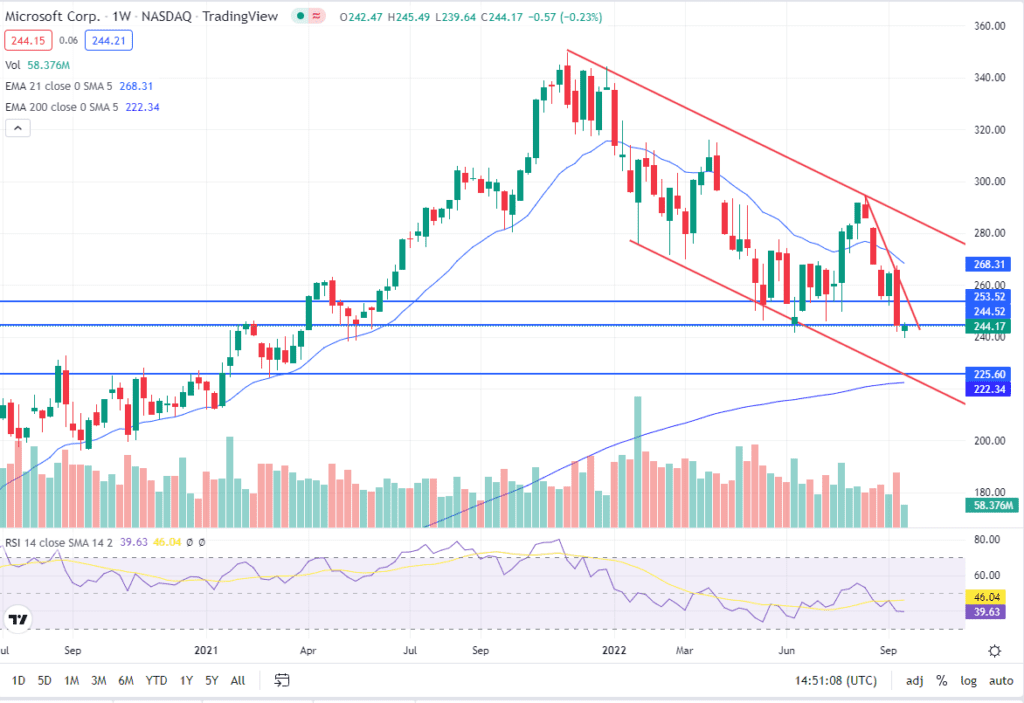

Focusing on Microsoft, from its peak of $349.67 (22/11/21) price has fallen 31.46% to a low of $239.64 (20/9/22) bringing this stock into bear market territory.

This 31.46% pull back has landed MSFT at a pivotal support at the $240 level. To highlight its importance, it was the initial reactionary highs of Feb 2021. It breached this level to make a high in April 2021 of $263.19, after which it retraced back to the $240 level. It found support at this level and continued its ascent to its peak of $349.67. Now that the stock has returned to its April 2021 levels, it presents a trading opportunity.

Now that this stock is sitting at a poignant support level, we want to see the validity of such support. Interestingly on both the weekly and daily chart we can see [tooltip tip=”A bullish divergence occurs when prices fall to a new low while an oscillator fails to reach a new low. This situation demonstrates that bears are losing power, and that bulls are ready to control the market again—often a bullish divergence marks the end of a downtrend.”]bullish divergence[/tooltip] on the [tooltip tip=” The relative strength index (RSI) is a momentum indicator used in technical analysis. RSI measures the speed and magnitude of a security’s recent price changes to evaluate overvalued or undervalued conditions in the price of that security. The RSI can do more than point to overbought and oversold securities” ]RSI[/tooltip], which suggests that the current down trend could be oversold and that a potential bounce could be expected. Couple this with resting at a major support, the bullish divergence, and a reluctance to hold below the $240 level, a trade could be;

Long Call Spread

Trade Summary

Buying a 21st Oct expiry $245 MSFT Call @ 8.77 and simultaneously selling a 21st Oct expiry $270 Call @ 1.25.

Paying $7.52 x 100 = $752 per lot

Should you view differ and feel there is further to go to the downside for the major tech stocks, the trade(s) could be.

Buy an at the money put

Buy 21stOct $242.5 Put @ 8.15

CHECK OUT OUR OTHER ARTICLES

There are many more option strategies available that can be tailored to you views.

ContactIs Gold Losing Its Shine?

The dollar has seen an impressive run in 2022 seeing the Dollar index (DX) rise as high as 16.8%.

S&P Long Straddle - Follow Up

Four weeks ago, we published a long straddle trade idea which was based upon taking advantage of lower than usual