Investing In Challenging Times – Know Your Options

The following article, written by our MD James Proudlock, appeared in MoneyWeek Magazine on 22-09-23

Introduction to Options

Ask any wealth manager, and they’ll tell you the key to building wealth is to stay invested throughout each market cycle and ignore short-term volatility. Yes, markets wax and wane, but they argue the way to cope with this is to diversify your assets and occasionally rotate by sector, geography or asset class (typically the weighting between stocks and bonds).

The accepted wisdom as you get older is to move away from equities and into bonds. Whilst you will forego the higher returns typically afforded by equities, you’ll sleep better at night knowing your money is in relatively less volatile instruments and will pay you a known income.

So is that it? Or is there anything else you can do with at least a part of your overall portfolio that can help achieve the investing trinity of wealth preservation, capital growth and income?

The answer could be to use derivatives as an overlay to your portfolio, but the very mention of this word often provokes a visceral reaction from investors because of their leverage and complexity.

Before deciding either way it’s worth making sure you have enough information to make an informed decision.

Derivatives is a catch-all phrase for any financial instrument that ‘derives’ its price from an underlying asset such as equities, bonds, foreign exchange or commodities. They can be either exchange traded or bilateral, and there are important distinctions between the two.

Exchange traded derivatives are typically known as Futures & Options, and are traded via a central price discovery system. They are highly regulated, and client money and assets are usually held in segregated accounts to keep counterparty risk to a minimum. Bilateral trades, which may include swaps, contracts for difference and other OTC contracts, can be more flexible in terms of contact size, but may carry greater counterparty risk and costs to trade. As with all of the content in this article, it is important to get independent financial advice from an expert in this field before deciding which type of derivative is best suited to your individual needs and risk tolerance.

Only exchange-traded options settle into the underlying asset, so we will focus on these for this article. More specifically, equity options give the holder the right but not the obligation to buy (call option) or sell (put option) a specific stock, ETF or index at a pre-agreed price on or before a specific date in the future.

The buyer can close out their position at any time, or if it’s a profitable position they can hold it to expiry and take up the underlying stock. Conversely, the seller of the call option can close the position at their discretion, but if they haven’t done so they must deliver the stock when required to do so.

In broad terms, the price of an option is a function of the current price of the underlying stock or index, how volatile that price is, and how long until the option expires.

Importantly, and unlike cash equities, it is just as easy to go short as it is long; and when you buy an option, your losses are limited to the premium you have paid.

So what are options good for? For professional investors with an existing portfolio, they are typically used for any combination of portfolio protection, income generation and trade entry, and tactical trading.

Options For Protection

Taking each in turn, protection (or insurance), is best bought when the cost of losing something is considerably greater that cost of insuring against that loss. You likely insure your most valuable assets such as your health, your house and your car, but what about your portfolio? As noted above, staying fully invested in equities is a proven way to build wealth over the long term, but the temptation to panic when markets become volatile can be irresistible – and very costly – for the following reasons: you will crystallise any capital gains for investments outside any tax-wrapped vehicle; you will forego the dividend income you would have received had you still held the stocks; the cash itself will lose its spending power in times of negative real interest rates; and finally, and likely most costly of all, you will almost certainly miss the bounce that follows the fall.

Options provide a great way to help manage this risk. Just like buying insurance, you could buy a put option, allowing you to stay fully invested but with a significant payout in the event of a steep market fall. Just as with your car insurance, if nothing bad happens your policy expires at the end of its term; but if something goes wrong your payout could be many multiples of the premium you paid.

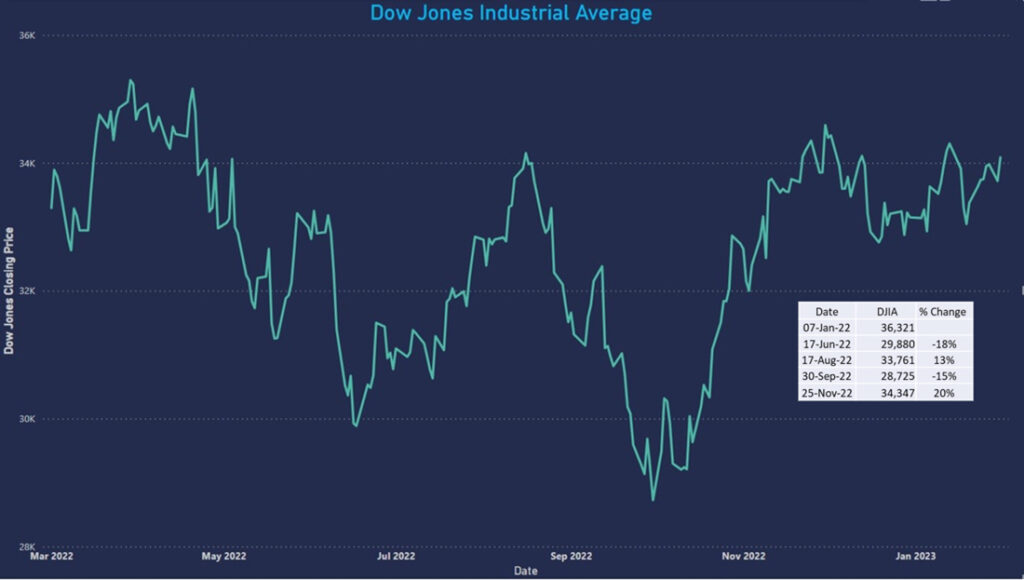

Take 2022 as an example. In the first half of the year the market dropped almost 20%. It then enjoyed a double digit rally before falling back 15%, only to finish the year up 20% from its September low. Unfortunately, most investors panic nearer the bottom of a downturn than the top, and pay a high price for doing so.

Chart 1 – Dow Jones Industrial Average closing price, Jan-Dec 2022

If you are worried about a falling market, or feel a stock or index is overvalued, you can simply buy a put option that gives you the right but not the obligation to sell the stock based on its current level and reap the profit should it fall in value.

Buying put options is also an effective way to place stop-loss orders. If you place a stop loss on the stock you hold there is a risk that the price will gap through your stop level and you will get out at a much worse position than you had planned for. By contrast, a put option allows you to exit your position at the option’s strike price, regardless of any gap move lower.

Options For Income Generation

Income generation is more complex and you should always seek independent financial advice from a knowledgeable expert before considering it. Whilst losses when buying options are limited to the premium you pay, the losses from selling options are potentially unlimited. But this does not mean that there aren’t sensible ways to incorporate options selling into your portfolio construction and management, for both position entry/exit and income generation. One example is ‘covered calls’, where you sell a call option on shares that you already own. In doing so, you are effectively giving someone else the right to buy your shares within a certain time period at a level you would be happy to take your profits, as well as keeping the income you received from granting the option in the first place. If the underlying share price stays below the option’s strike price until it expires, you get to keep the premium as a valuable source of additional income.

Options For Tactical Trading

Tactical trading is perhaps the most common, where investors and traders alike use the leverage inherent in options to try to boost their profits through tactical trading around time-specific company-related or macroeconomic events such as quarterly trading updates and interest rate decisions. In this instance the most common trades are short-dated options used to take advantage of an expected upside or downside surprise. Another benefit of using options for shorter-term, high conviction trades is that they require a much smaller capital commitment than equities to gain a meaningful exposure – because of their inherent leverage, you can gain a significant exposure to the underlying asset for a relatively small amount of money.

To conclude, before you consider using options as an overlay to protect, enhance and trade tactically around your core portfolio holdings it is worth considering the five questions the UK’s Financial Conduct Authority advises every retail investor to ask about any financial product or service:

- Am I comfortable with the level of risk? Can I afford to lose my money?

- Do I understand the investment and could I get my money out easily?

- Are my investments regulated?

- Am I protected if the investment provider or my adviser goes out of business?

- Should I get financial advice?

The FCA’s recently-introduced Consumer Duty, which requires financial services companies to ensure their clients ‘have a good outcome’, should give retail investors comfort that their best interests are protected, and allow them to objectively evaluate whether or not options have a role to play in the overall protection and management of their investment portfolios. The key is to know your options, be clear about what you want to use them for, and talk through your investment objectives with a specialist options broker or financial adviser.

Editorial by James Proudlock – OptionsDesk CEO – Moneyweek Magazine.