Earning Additional Income With Covered Calls

Earning additional income is becoming increasingly important to many investors and their independent financial advisors as the economic climate changes.

As inflation rises, earning additional income is becoming increasingly important to many investors and their independent financial advisors.

For those with an existing portfolio of shares, there are a number of ways that options can help generate additional income within a set of well-defined risk parameters. Selling a covered call is a good example.

To illustrate how this might work in practice, we will consider how selling a covered call on shares that you own compares with just holding these shares passively, by looking at three scenarios:

Scenario 1 assumes the share price doesn’t fluctuate much, ends the year unchanged, and the options are not exercised

Scenario 2 sees the share price rise 30%, with the option being exercised.

Scenario 3 sees the share price fall 30% over the year, with the option expiring without being exercised.

The comparison starts with the assumption that the investor owns 100,000 shares, with a price of 100p and paying an annual dividend of 4p. The option premium for selling a 120p one year covered call (20% out of the money) is 7p.

Scenario 1

No Change In The Share Price

Without using an option, the investor starts the year with shares valued at £100,000 and finishes the year with a total value of £104,000, as a result of receiving dividend income of £4,000.

If the client writes a covered call option to generate passive income, at the end of year one, the total valuation is reflected in the adjacent image.

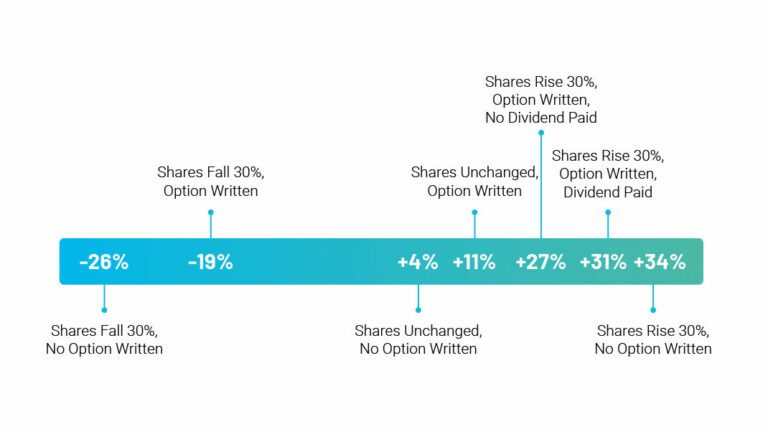

No option written -> yield = 4%

With option written -> yield = 11%

Scenario 2

Share Price Up 30%

Without using an option, the investor starts the year with a total value of £100,000 and finishes with a total value of £134,000. £30,000 of this comes from capital gain, with the remainder being the dividend income

If the client writes a covered call option to generate passive income, the price increase would see the option being exercised. If this happens before the dividend is paid, at the end of year one, the client’s total valuation is reflected in the image.

In the event the dividend is paid before the option is exercised, the total would advance to £131,000.

Whilst this is below the £134,000 realised without an option, the client has written the contract on the explicit understanding that they were always happy to exit that holding at 120p.

No option written -> total return = 34%

With option written and dividend -> total return = 31%

With option written and no dividend -> total return = 27%

Scenario 3

Share Price Down 30%

Without using an option, the investor starts the year with a total value of £100,000 and finishes with a total value of £74,000. The £30,000 loss comes from the fall in the underlying share price, with the £4,000 gain being the dividend income.

If the client writes a covered call option to generate passive income, in this instance they would collect the premium but not see the option being exercised so at the end of year one, the total valuation would be £81,000 reflected in the adjacent image.

No option written -> total return = -26%

With option written -> total return = -19%

Range of outcomes

The premiums received from writing the call option have helped insulate the position from some of the downside.

Use of options has also narrowed the possible range of outcomes for the portfolio. Without an option, we were looking at outcomes between -26% and +34%

The covered call strategy has narrowed that to -19% to +31%

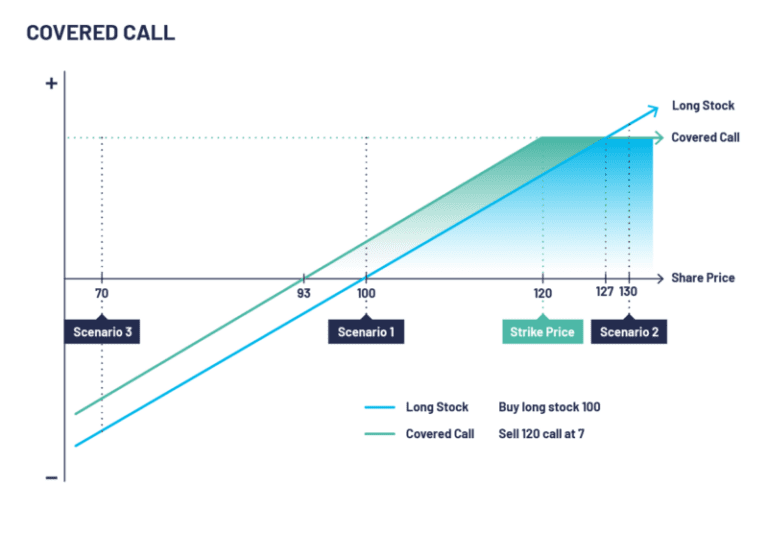

Covered Call

Illustrating the three scenarios using an options payoff chart provides another perspective of how covered calls can be used to improve financial returns. The blue line illustrates the outcomes without using an option, whilst the green line incorporates the value of the option premium.

So long as the share trades below 120p, the investor is always 7p better off by having collected the option premium.

Even once the share trade above 120p, until it reaches 127p the investor remains marginally better off having written the option. And beyond this, whilst the investor then risks missing out on further capital appreciation, the trade was entered into on the understanding that they were happy with a 120p exit price, plus the option premium.

It is worth noting that an adequate cash margin must be available on the account. A conservative approach would be to set this at 20% of the underlying value of the shares involved and in the vast majority of instances, those trading options have a suitable pot of uninvested capital available to meet those needs. With that in mind, these examples intentionally do not make any adjustment for the opportunity cost of capital. Note, once a client is actively running multiple covered options trades simultaneously, the resulting margin premium collected will likely make a significant contribution here.

Additionally, these examples are deliberately static assessments and do not consider how proceeds may be reinvested, how margins may be covered at a lower cost of capital or indeed the tax situation – which will be unique to each client.