A Call To Arms In Cyber Security

18/06/2025

Cybersecurity has moved from the server room to the boardroom.

Earmarked to be one of the fastest growing sectors over the next decade, digital security is at the frontline of business resilience. What was once a niche concern has become a critical investment area in the face of relentless and increasingly sophisticated digital threats.

Many of you will have seen news of ransomware attacks on well-known businesses in the press over the past months as a wave of cyberattacks swept through the UK retail sector. Marks and Spencer are expected to face a £300 million reduction in operating profits this year, following an attack which shut down its online clothing store for more than three weeks, disrupted product deliveries to its food stores, and slashed nearly £750 million from its market valuation.

Co-op Group later confirmed they had also been targeted in a similar attack but had managed to contain the threat more effectively, despite the hackers gaining access to sensitive information linked to 20 million members, including names, addresses, phone numbers, emails, and Co-op membership card details.

Cybersecurity experts note that these are far from being isolated incidents, with 45% of organisations reporting business disruptions linked to third parties as hackers broaden their horizons and begin attacking third-party businesses such as Peter Green Chilled, whose role in critical supply chains for UK supermarkets makes them an attractive target for disrupting larger retail operations and extorting ransoms.

Beyond the game of cat and mouse, it appears that even a whiff of a suspected cyberattack can lead governments and businesses alike to invest heavily in bolstering operational security.

Following the collapse of the Iberian power grid on April 28th, Spanish grid operator Red Electrica claimed there was no evidence of a cyber-attack on its own facilities, however the Spanish government later announced a 1.1bn EUR investment to reinforce cyber security nationally after Spain’s National Cybersecurity Institute (INCIBE) probed businesses far and wide and claimed that Spain had suffered 100,000 cyber-attacks across all sectors last year.

As digital threats escalate, cybersecurity has become increasingly central to business stability, shareholder value, and national security. Rising attack frequency and sophistication is driving record investment from both the private and public sector, yet as the threat landscape evolves, so too does the industry — creating a fragmented and specialised market defined by divergent technologies and expertise.

So, how should investors navigate this increasingly complex sector?

Advanced technology first developed in the military often forms the seed of commercial products, and these connections are often what enables companies to maintain a leading edge in the industry. Given the inherent secrecy and limited information sharing of cybersecurity developments, it is crucial to identify companies with direct ties to military intelligence.

The Role of Unit 8200

Unit 8200, Israel’s elite military intelligence unit, has earned global recognition as a breeding ground for cybersecurity innovation, consistently producing some of the world’s most successful tech entrepreneurs. Operating at the forefront of cyber defence and intelligence collection, its members gain unparalleled expertise in areas such as offensive cyber operations, vulnerability research, encryption, and large-scale data analytics. This intense, hands-on experience — combined with early leadership responsibility and exposure to sophisticated threat actors — equips alumni with both the technical and strategic skills to identify emerging security gaps and develop cutting-edge commercial solutions.

As a result, many Unit 8200 veterans go on to found or lead influential cybersecurity companies that attract significant global investment and frequently become acquisition targets for major technology firms.

Last Autumn for example, Alphabet, the parent company of Google, announced its largest acquisition to date: a $32 billion all-cash deal to acquire Wiz, a cloud security startup founded in Israel. All four founders of Wiz — Assaf Rappaport, Ami Luttwak, Yinon Costica, and Roy Reznik — previously served in Israel’s Unit 8200. After completing their military service, they founded Adallom in 2012, a cloud security company that was acquired by Microsoft in 2015 for $320 million. Following the acquisition, they went on to lead Microsoft’s R&D centre in Israel, before founding Wiz in 2020.

The Role of the NSA, and GCHQ

The US National Security Agency, and UK’s Government Communications Headquarters have long served as incubators for cybersecurity expertise, but with a distinctly different commercialisation model compared to Israel’s Unit 8200. Rather than producing large volumes of early-stage entrepreneurs, these agencies often cultivate highly specialised technical leaders who transition into the private sector after years of government service, bringing with them deep experience in counterintelligence, nation-state threats, and advanced cryptographic systems.

A leading example of this alternative pathway to market is L3Harris Technologies – one of the largest U.S. defence technology providers with significant operations in cyber, electronic warfare, and military intelligence support. The company employs a large workforce of former NSA, US Cyber Command, and DoD intelligence professionals who support some of the most sensitive government cybersecurity and intelligence programs globally. In addition to its extensive government work, L3Harris has expanded cybersecurity offerings in the private sector, providing advanced security technologies to critical infrastructure operators, telecommunications providers, aerospace companies, and commercial enterprises operating in highly contested threat environments. The company’s expertise allows private sector clients to access government-grade cybersecurity capabilities to protect themselves against sophisticated nation-state cyber threats that increasingly target private industry.

Unlike Unit 8200’s more open transition into venture-backed entrepreneurship, much of the NSA, and GCHQ’s most advanced cybersecurity research remains classified. As a result, private sector spinouts from these agencies tend to emerge less frequently.

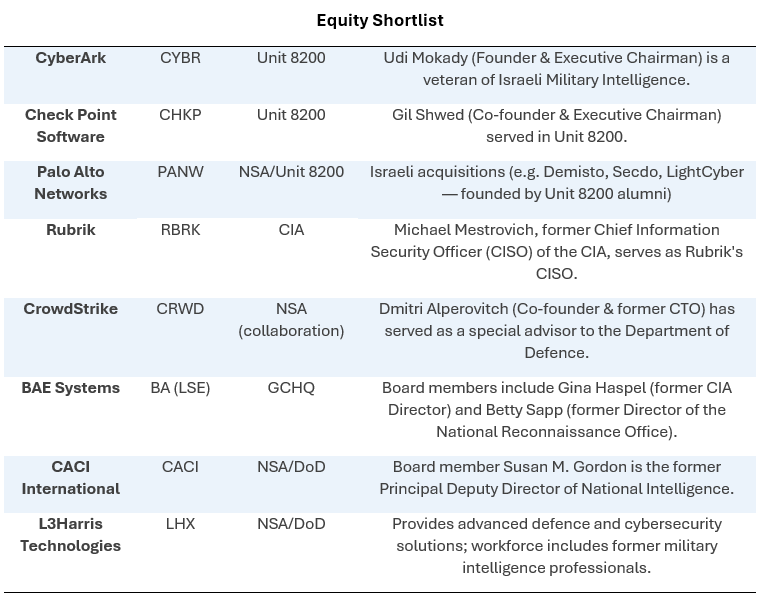

If you are interested in this sector, you may wish to consider the companies in the following table. Please don’t hesitate to call our desk if you’d like to discuss any of these in further detail.

The contents of this article are for general information purposes only. Nothing in this article constitutes advice to any person and any investments and/or investment services referred to therein may not be suitable for all investors. If you’re unsure whether any investment is right for you, you should contact an independent financial adviser. For more information, please see IMPORTANT DERIVATIVE PRODUCT TRADING NOTES.