2025 Year in Review

YEAR-DEFINING THEMES IN 2025

Trade policy caused major volatility in Q1-Q2

January opened with improved risk sentiment as President Trump delayed aggressive trade tariffs and initiated a review of U.S. trade policy, supporting a strong start for UK equities.

By March, markets were increasingly dominated by “Liberation Day” tariff anxiety, with a notable risk-off rotation and sharp weakness in U.S. mega-cap technology.

April was the stress point: the UK faced a 10% base tariff and both UK and U.S. equities sold off sharply after the April 2nd announcements, before rebounding on a 90-day pause.

A recovery rally broadened, extending through mid-year, led by AI and defence exposure

From June to August, both the FTSE 100 and S&P 500 repeatedly set new highs, supported in the UK by defence-linked strength and a strong pound sterling, and in the U.S. by tech earnings resilience and enormous AI-led capital expenditure into data centres.

Monetary policy gradually shifted to an easing cycle from “higher for longer”

The Federal Reserve kept interest rates on hold through the middle of the year, even as weakening labour market signals increased the perceived probability of autumn rate cuts.

In September the Fed delivered a jumbo 50bps cut, its first of the year (bringing the range to 4.00%-4.25%), reinforcing the market’s “gentler policy path” narrative into autumn.

Gold was the consistent cross-asset story; crude was dominated by supply and geopolitics

Gold rose from record highs in Q1, stabilised mid-year, and then accelerated again into September (a mammoth 12% monthly gain) and record-highs in October.

Oil moved on event risk (notably June’s Middle East spike) and then drifted under the weight of rising supply and surplus expectations later in the year.

Equity Markets

2025 was a great year for stock markets all around the world, with many delivering strong double-digit returns and reaching new all-time highs. Even if the journey was far from smooth in April, as tariffs briefly sent investors into a panic sell-off. The S&P 500 crossed 6,900 on December 11th, FTSE100 reached 9,940 points on December 30st, just shy of the 10,000 level, which was broken in the new year.

Artificial intelligence continued to dominate throughout 2025. From massive infrastructure investments in data centres to concerns about market concentration, AI has grown as an important source of economic growth and market returns.

Indices quickly bounced back after Trump walked back his steepest tariffs, easing Wall Street’s fears of an economic slowdown. The tariff policy created uncertainty but has turned out to have less of an economic impact than expected. Levies on imported goods have risen sharply for many trading partners, yet the feared economic consequences largely failed to materialise.

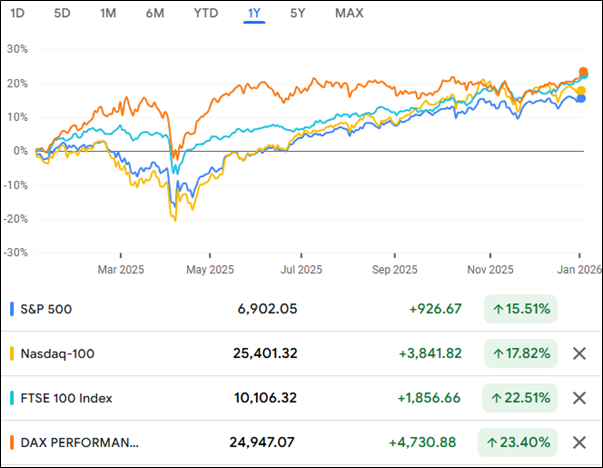

In the United States, the S&P 500 rose approximately 15% over the calendar year, while the technology-heavy Nasdaq Composite gained just over 17%. In the UK, the FTSE 100 soared by over 22%.

Google Finance – 1Y Major Index Comparison

Comparison of major indices performance 2025

The advance in U.S. equities was once again led by large-cap technology stocks, particularly those exposed to artificial intelligence infrastructure, cloud computing and data centre investment. Companies such as Nvidia, Microsoft, Amazon, Alphabet, and Apple now make up almost 30% of the overall S&P 500 index.

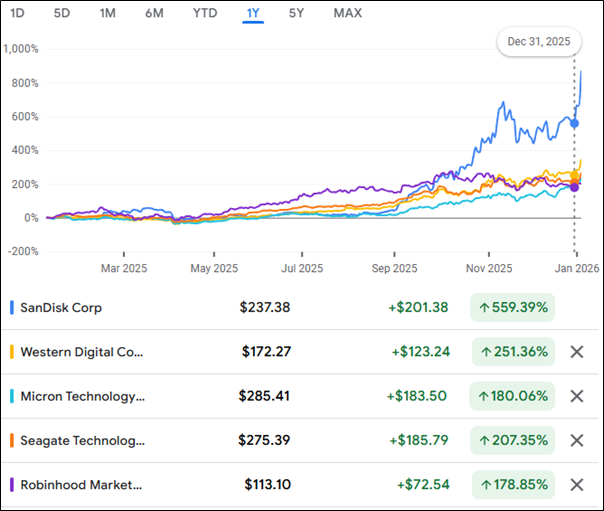

Within U.S. equities, some of the strongest individual stock performances in 2025 were concentrated in data storage, semiconductor memory and trading platforms, reflecting the scale of capital expenditure linked to artificial intelligence and data centre expansion.

Google Finance – Best-Performing S&P 500 Stocks in 2025

Best-performing S&P 500 stocks in 2025

- SanDisk was the #1 performer among large-cap names, rising by more than 550% over the year, as demand for high-performance storage solutions surged alongside investment in AI infrastructure.

- Western Digital rose by over 250%, while Micron Technology advanced approximately 180% during 2025. These moves were explained by tightening supply conditions in memory markets, improving pricing power for AI growing workload.

- Seagate Technology, another player in data storage hardware, gained more than 200% over the year, benefiting from global data growth and enterprise infrastructure spending.

Beyond hardware, Robinhood Markets is also among the 2025 best-performing stocks, rising close to 180%. The rally reflected a rebound in retail trading activity, improved profitability, and increased participation in equities and derivatives markets during periods of high volatility driven by geopolitical tensions.

Macro

Geopolitics and policy decisions were a persistent influence on markets throughout 2025. The return of President Donald Trump to the White House. President Trump’s trade policy in 2025 was dominated by aggressive use of tariffs. Under his administration, tariffs were expanded dramatically on imports from major trading partners, including Canada, Mexico, China, and the European Union, with broad base rates and country-specific duties. These measures were part of a declared national emergency to protect U.S. economic and national security interests. Global equity markets experienced their sharpest declines since the COVID-19 pandemic: the Dow Jones Industrial Average, S&P500, and Nasdaq Composite all fell sharply as investors reacted to the tariff package and concerns about trade wars and inflationary pressures.

A second major controversy was the enactment of the One Big Beautiful Bill Act, combining tax and spending measures while raising the borrowing limit – averting an immediate debt -ceiling crisis but intensifying longer-run concerns about deficits, entitlement reductions, and debt dynamics. Reuters reported projections that it would add materially to U.S. debt over the next decade, with investor focus on the implications for Treasury demand and borrowing costs.

From a market perspective, this kind of fiscal package tends to create a mixed impulse: supportive to near-term growth and earnings in parts of the market, but potentially negative for valuation multiples if it contributes to higher long-term rates.

Against this backdrop, 2025 marked a clear turning point in global monetary policy. After several years of aggressive interest rate increases aimed at curbing post-pandemic inflation, major central banks began to ease policy as inflation pressures moderated and economic growth showed signs of slowing.

In the United States, the Federal Reserve cut interest rates three times during the year, responding to a cooling labour market and easing inflation dynamics. While economic growth remained resilient for much of the year, softer employment data later in 2025 reinforced the case for policy easing.

In Europe, the European Central Bank delivered a series of rate cuts, supporting financial conditions and improving sentiment across equity and credit markets. Lower borrowing costs were widely seen as a stabilising force for the euro area economy as growth remained modest.

In contrast, the Bank of Japan continued its gradual normalisation of monetary policy, raising interest rates to 0.75% by year-end. This marked a significant departure from decades of ultra-loose policy and contributed to periods of volatility in global currency and equity markets.

Alongside monetary easing, corporate activity remained elevated. Share buybacks exceeded $1 trillion globally, while mergers and acquisitions activity approached record levels, reflecting strong corporate balance sheets and continued confidence among management teams despite the uncertain macroeconomic backdrop.

Precious Metals

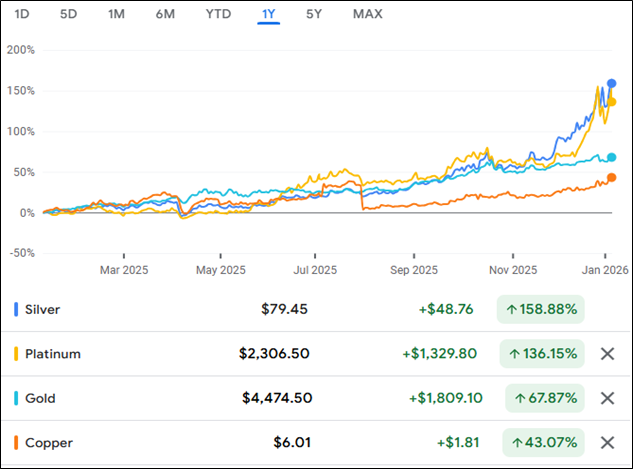

The precious metals in general were the standout asset class of 2025.

It is impossible to reflect on 2025 without mentioning Gold. The yellow metal dominated the headlines as international central banks continued to diversify their reserve holdings and gold exchange-traded funds saw strong inflows. Gold has hit 50 all-time highs this year and has surged by almost 70%.

The Bloomberg precious metals index returned 80.2% over the year. Silver outperformed with returns of 149.1%, due to a major supply deficit, explosive industrial demand (Solar panels, EVs, and AI tech), and its traditional role as a safe-haven asset.

Copper prices have surged to record highs due to a supply shortage, rallying by more than 20% since the start of 2025. Prices reached a record high of over $13,000/MT on the London Metal Exchange (LME) and broke above $6/lb on CME futures toward the end of the year.

Platinum’s 2025 performance was a massive surprise rally, with prices skyrocketing over 135% due to extreme supply deficits, strong industrial demand, and investors shifting from gold, making it one of the top-performing assets this year.

Strong performance from precious metals offset falling oil prices, lifting overall commodities returns to 15.8% in 2025.

Google Finance – Comparison of precious metals/green metals 2025

Conclusion

2025 proved that markets can deliver strong outcomes even when the year is dominated by policy risk, geopolitics and rapid structural change. The opening months were defined by shifting trade signals: January benefited from improved risk sentiment as aggressive tariffs were delayed and a review of U.S. trade policy began, while March and early April saw tariff anxiety culminate in a sharp drawdown before risk assets stabilised and rebounded after the steepest measures were walked back and a 90-day pause eased fears of an abrupt slowdown.

From mid-year, the narrative became one of resilience and re-acceleration. Equities repeatedly pushed to new highs through the summer as the recovery broadened, supported in the UK by defence-linked strength and a strong pound sterling, and in the U.S. by a robust summer earnings and the scale of AI-led capital expenditure into data centres. This outperformance again concentrated market leadership in mega-cap technology – now close to 30% of the S&P 500 by index weight – while some of the strongest individual gains were tied directly to AI infrastructure themes across data storage, semiconductor memory and trading platforms.

Macro conditions became more supportive as monetary policy expectations shifted from “higher for longer” to an easing cycle. The Fed held rates through the middle of the year as labour-market signals softened, then delivered a jumbo 50bp cut in September that reinforced expectations for a gentler policy path into autumn, while the broader backdrop reflected a turning point in global monetary policy and an active corporate landscape (buybacks and M&A) despite uncertainty.

Commodities were a crucial diversifier and return driver throughout the year. Precious metals were the standout asset class – gold notched repeated record highs and surged by almost 70% as central banks diversified reserves and ETF inflows strengthened, while silver, copper and platinum also delivered outsized moves on supply/demand dynamics—helping lift overall commodity returns even as oil drifted lower under surplus expectations after being periodically jolted by geopolitical event risk.

By year-end, the message from the month-by-month progression is clear: policy shocks can still create sharp, fast drawdowns, but 2025’s experience showed how quickly markets can reprice once uncertainty stabilises – particularly when earnings remain resilient, liquidity expectations improve, and structural growth themes like AI continue to attract capital. Against that backdrop, the year reinforced the importance of diversification across regions and asset classes, an awareness of concentration risk in headline indices, and the role of real assets – especially gold – as both hedge and source of returns.

Month-by-Month Recap

January: Strong start, with tariff delay easing risk appetite

- UK equities: FTSE 100 rose 6.1% to 8,674, supported by eased trade-tension concerns linked to delayed tariffs and a policy review; sector support included energy, mining, and aerospace/defence.

- U.S. equities: S&P 500 gained 3% amid broadly constructive earnings tone; the report flags optimism following Trump executive orders but also warns on valuation and policy uncertainty weighing on tech.

- Macro and gold: U.S. CPI (Dec) referenced at 2.9% y/y; the report frames gold as supported by geopolitics, rate-cut uncertainty and sanctions threats, citing a 44% rise over one year.

February: Defence leadership in the UK; tariff & “government cuts” in the U.S.; China tech surge

- UK equities: FTSE 100 rose 3.5%, led by European defence momentum; BAE Systems and Rolls-Royce posted strong share performance and supportive earnings/guidance details are highlighted.

- U.S. equities: despite strong Nvidia growth, the month ended softer as tariff uncertainty and “government cuts” concerns were cited; S&P 500 closed down 0.67% at 5,955, and Palantir weakness was linked to defence budget-cut headlines and company-specific factors.

- China tech: DeepSeek is cited as a catalyst for renewed interest; Hang Seng rose 17% in February, boosted by Alibaba (+35%+) and an Apple partnership reference.

- Macro: the report focuses on European security tensions, Munich Security Conference dynamics and U.S.–Russia/Ukraine diplomacy developments.

March: Tariff fears intensify; U.S. tech sells off; gold and copper surge

- UK equities: FTSE hit a record closing high early month (8,871.31) then fell back as “Liberation Day” tariff fears rose; the UK Spring Budget and downgraded growth outlook are also discussed.

- U.S. equities: S&P 500 fell 6% (Nasdaq-100 also -6%), with the report attributing leadership of the drawdown to major technology names and a tariff-driven “flight to quality.”

- Commodities: gold buying pushed prices above $3,100/oz (best quarter since 1986 per the report); copper rallied on tariff speculation and then reversed after April 2.

- Central banks: Fed and BoE held; ECB cut 25 bps (March 6).

April: “Liberation Day” shock and rebound; gold hits new records

- UK equities: U.S. applied a 10% base tariff to the UK (April 2). FTSE fell 11% to a 12-month low before rebounding after the April 10 90-day pause.

- U.S. equities: S&P 500 fell 12.5% in the week after the announcements and recovered 12.5% after the pause, ending the month flat.

- Gold: spot peaked at $3,501.27/oz on April 22 (28th record high of the year, per the report).

- Policy: ECB cut again (April 17); the report notes Powell signalling he would not cut in May despite pressure.

May: Risk assets rebound; UK-US and UK-EU trade deals in focus

- UK equities: FTSE rose 3.3% to 8,786; supported by a BoE cut, improved IMF growth forecast, and delayed U.S. tariffs on EU imports.

- Policy and trade: the report details the UK–US “Economic Prosperity Deal” (autos, metals, agriculture) and a UK–EU “Brexit reset” (border checks, carbon markets, mobility, defence/security).

- U.S. equities: S&P 500 gained 5.5%, described as the best month since November 2023 and a recovery from April’s drawdown.

- Gold: stabilised between ~$3,200–$3,440 after April’s peak.

June: New highs; Middle East oil spike; policy remains on hold in the U.S. and UK

- UK equities: FTSE reached 8,884.92 (June 12) before ending the month unchanged versus May (8,785), with defence strength and a weaker pound cited among drivers.

- U.S. equities: S&P 500 climbed 4.5% to a new high (6,215), with easing U.S.–China trade tensions and strong tech earnings noted.

- Oil: volatility followed Israeli military action against Iran (June 13), with prices spiking to $77.60 before settling as OPEC confirmed increased output for July.

- Rates: Fed and BoE held; ECB cut 25 bps (June 5).

July: Continued highs; labour-market revisions strengthen September-cut expectations

- UK equities: FTSE rose 3.7% to 9,132; the report points to EU defence spending, GBP weakness, and relative trade positioning.

- U.S. equities: S&P 500 rose 2% to 6,427.02; big-tech earnings and ongoing AI capex appetite remained central supports.

- Rates: Fed held at 4.25%–4.50% (July 30); weak payrolls and large downward revisions increased the odds of a September cut.

- Commodities: gold stayed firm (range around $3,316–$3,330) with central-bank demand; oil commentary centred on OPEC+ output increases and forward guidance.

August: New highs; gold rally resumes after Jackson Hole; sentiment more cautious into autumn

- UK equities: FTSE rose 0.7% to 9,196; defence spending and a UK–Norway frigate contract are noted, alongside rising jitters ahead of the Autumn Budget.

- U.S. equities: S&P 500 rose 2.85% to 6,501.86, supported by earnings and stronger conviction around September easing.

- Gold: after a steady start, gold rallied and closed up 4.5% at ~$3,475/oz; the report attributes demand to Fed-cut expectations and heightened Trump–Powell friction.

- Oil: the month highlights rising OPEC+ output and oversupply concerns, keeping crude under pressure.

September: Strong month; Fed’s first cut; gold delivers best 1M performance since 1979

- U.S. equities: S&P 500 rose 4.5% and logged another all-time high (6,615).

- UK equities: FTSE rose 3.5% to a new all-time high (9,446), with miners supported by gold strength.

- Gold: surged 12% for the month; safe-haven allocations and expectations of an easing cycle are emphasised.

- Monetary policy: Fed delivered its first cut of the year on 17 September (to 4.00%–4.25%), supporting the “easing-cycle” narrative.

October: Record-setting equities and gold; policy easing accelerates

- S. equities: S&P 500 rose 2.5% to an all-time high of 6,920; Nasdaq gained 4.8% amid renewed AI enthusiasm and upbeat large-cap technology earnings, with improved sentiment as Trump signalled a softer stance on China trade and the Fed delivered its second cut.

- UK equities: FTSE 100 rose by close to 4% to a record 9,787, supported by easing rate expectations and strength in energy and financials; the report cites support from a weaker pound and notes UK AI investment reaching £2.9bn in early September.

- Gold: reached an all-time high of $4,381.98/oz (October 20) before retracing to around $4,000/oz, with rate-cut bets, central-bank buying and safe-haven demand cited.

- Oil: remained rangebound in the mid-$60s, dipping to around $61.50 and rebounding; the report highlights U.S. sanctions on Russian oil and resulting shipment declines.

- Policy and inflation: Fed cut to 3.75%–4.00% on October 29 and signalled an end to balance-sheet runoff from December 1; UK CPI cited at 3.8% vs 4.0% forecast; ECB kept rates unchanged.

November: Rally pauses; UK budget volatility; data disruption from U.S. shutdown

- U.S. equities: the rally stalled; S&P 500 up ~0.3% while Nasdaq fell ~1.5%, with valuation caution (particularly tech/AI-linked) highlighted.

- UK equities: October’s rise was retraced in a sharp move ahead of the budget; FTSE ended flat at 9,720 after volatility.

- Commodities: gold finished November about 5% higher near $4,220/oz; crude averaged ~$63–$64/bbl with oversupply concerns persisting.

- Macro/data: a 43-day U.S. federal government shutdown (1 Oct–12 Nov) suspended key economic data releases and delayed October/November figures.

- Policy: BoE held at 4% on 6 Nov; ECB did not meet in Nov and kept key rates unchanged.

If you are interested in discussing further, please contact the desk on 0207 466 5665.

Important Disclaimer

This article is intended for general information purposes only and reflects the market environment at the time of writing. It does not constitute investment advice, a personal recommendation, or an offer to engage in any trading activity. The content does not take into account individual objectives or circumstances and should not be relied upon as the basis for any investment decision. Past performance is not a reliable indicator of future results.

Content may have been created by persons who have, have previously had, or may in future have personal interests in securities or other financial products referred to therein. All conflicts, and potential conflicts, relating to our business are managed in accordance with our conflicts of interest policy. For more information, please refer to our Summary of Conflicts of Interest Policy

For more information and important risk disclosures, please see our Trading Notes and Privacy Policy. AMT Futures Limited is authorised and regulated by the Financial Conduct Authority.