2023: Year In Review

02-01-2024

As we bid farewell to 2023, it is a timely opportunity to reflect on the economic events that shaped the world. During the year we saw the collapse of two key players in our financial system. Credit Suisse, one of Switzerland’s oldest financial institutions, succumbed to a crisis of confidence amongst their wealthiest clients with the resulting bank run spilling over to their retail division and across the shores. Despite numerous cash injections, their share price was locked in the doldrums and resulted in a regulator-led acquisition by their long-term rival UBS. In the US, further rising interest rates and the resulting fall in value of long-term bonds, caused a liquidity crisis at Silicon Valley Bank which led to its demise.

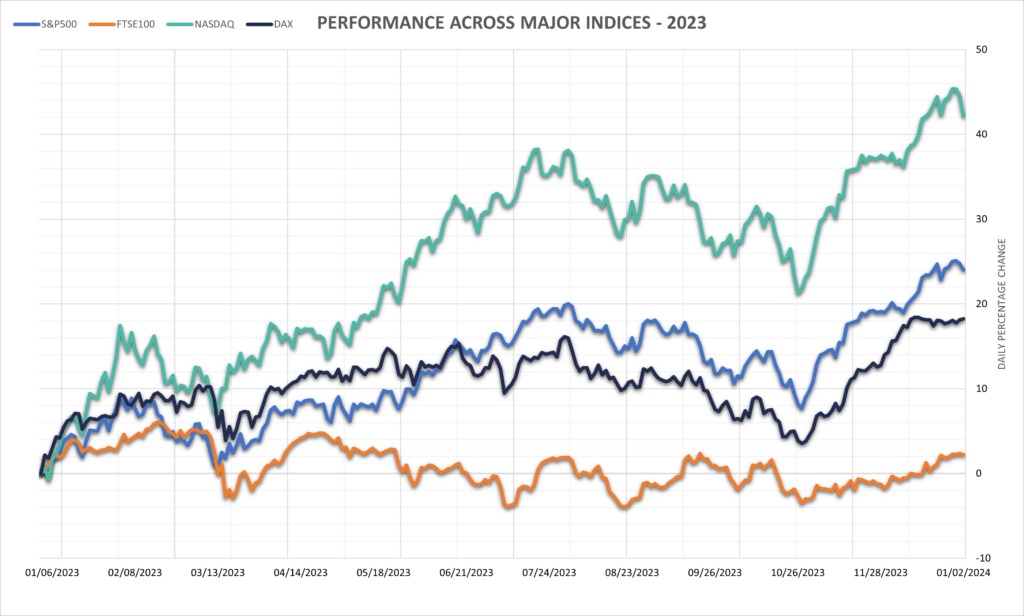

At face value the West was heading into a long-predicted recession. With a slump in the Chinese property market and two major global conflicts straining our financial system, it seemed unlikely that the prevailing tone would be a positive one; but an unexpected tech boom with the release of large-language models in what was a defining moment in the field of AI sent the S&P500 on a tear, posting an annual gain of 25%.

We have welcomed steady falls in inflation across the G3, in part thanks to a decreased reliance on OPEC to supply the West with oil. Following OPEC’s 1 million bpd production cuts in April, US petrol majors made big moves this past quarter, expanding their upstream portfolios to meet future demand, stabilising energy prices and giving governments and central bankers some relief in their fight against inflation.

With 2024 being an election year in both the US and the UK, and with central bank rate cuts on the horizon, the pressure now lies on those in government to please their voters. In the United Kingdom, Chancellor Jeremy Hunt’s Spring budget is set for the 6th of March, and following his signing of the Bern Financial Services Agreement there is a renewed sense of optimism that a proposed removal of inheritance tax amongst his other measures will draw a line in the sand and bring the Tories back into the race.

With Labour leading in the polls many are expecting a new year slump in Sterling which would present a prime opportunity for overseas M&A into undervalued FTSE listed companies, potentially bolstering investment in the UK economy.

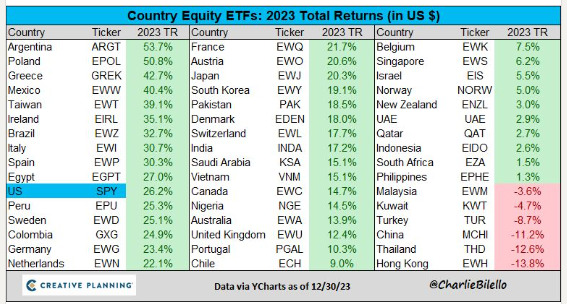

As the new year begins, many may find the US economy to be overvalued, and search for alternative investment opportunities overseas. China’s poor performance has weighed heavily on emerging market indices, but country, region-specific and thematic ETFs will likely continue to see ever-increasing volumes.

Source: https://x.com/charliebilello/status/1741093982602477975?s=20

Looking forward to 2024, the stage seems set for a continued equity rally as value and traditional economy stocks close the gap with the Magnificent Seven’s technology megacaps.